Nigeria stands at a defining moment in its healthcare trajectory. With a population exceeding 237 million and a health system stretched far beyond its installed capacity, the country faces a widening gap between healthcare demand and the traditional infrastructure’s ability to respond. Access to quality care remains uneven, expensive, and deeply inequitable. Yet embedded within this challenge lies a transformative opportunity: the rise of digital health.

For decades, the narrative of Nigerian healthcare has been defined by scarcity, insufficient facilities, chronic underfunding, limited personnel, and fragmented delivery systems. Today, however, an alternative future is emerging, powered by data, connectivity, and digital innovation. Digital health is no longer a fringe concept; it represents an estimated $1.5 billion market opportunity and, more importantly, the only scalable bridge to expand access to the last mile.

From telemedicine and electronic medical records (EMRs) to AI-enabled diagnostics and mobile health platforms, digital tools offer a pathway to rebuild the health system around accessibility, efficiency, and equity. But this future is not guaranteed. Nigeria will only unlock the promise of digital health if it is treated not as a cluster of innovative products, but as a foundational reform of the entire healthcare system.

The anatomy of the crisis: Why digital is the only bridge

To understand the urgency of digital adoption, one must first look at the structural deficit. Nigeria currently operates with roughly 40,184 health facilities, according to the Federal Ministry of Health and Social Welfare, serving over 220 million people. This translates to one health facility for every 5,475 people.

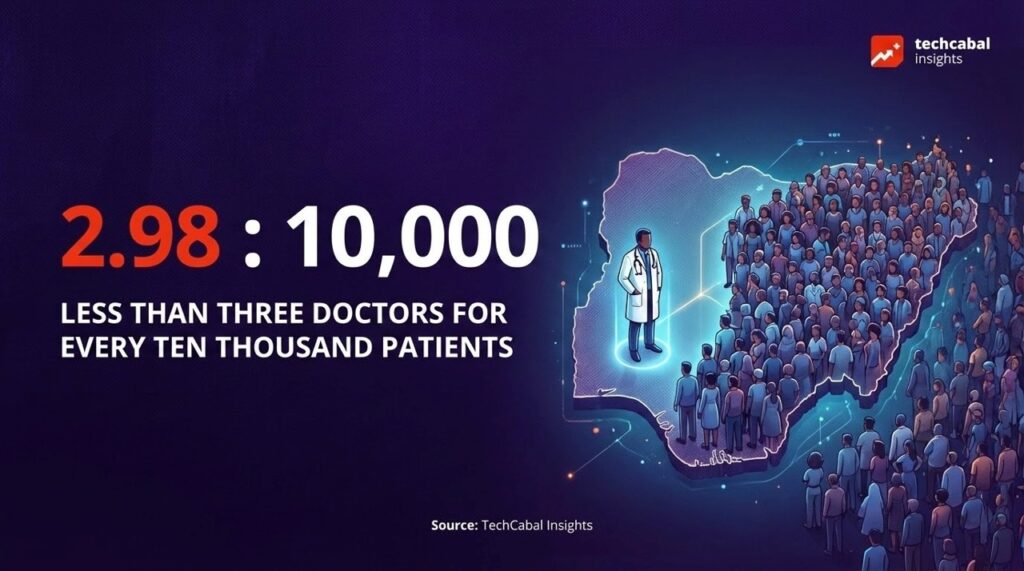

The human capital deficit is even more stark. While the World Health Organisation recommends a doctor-to-patient ratio of 1:600, Nigeria struggles with a doctor-to-patient ratio of approximately 1:3,474, with some estimates suggesting fewer than three doctors for every 10,000 patients.

No amount of conventional brick-and-mortar expansion can keep pace with population growth, epidemiological transitions, and the high burden of both infectious and chronic diseases. As the population grows, the gap widens. Digital health is therefore not optional; it is the only infrastructure that can scale fast enough to meet national needs.

ALSO READ: Bridging the funding gap: Inside Helium Health’s innovative healthcare financing model

Market maturity: Nigeria’s healthtech investment trends

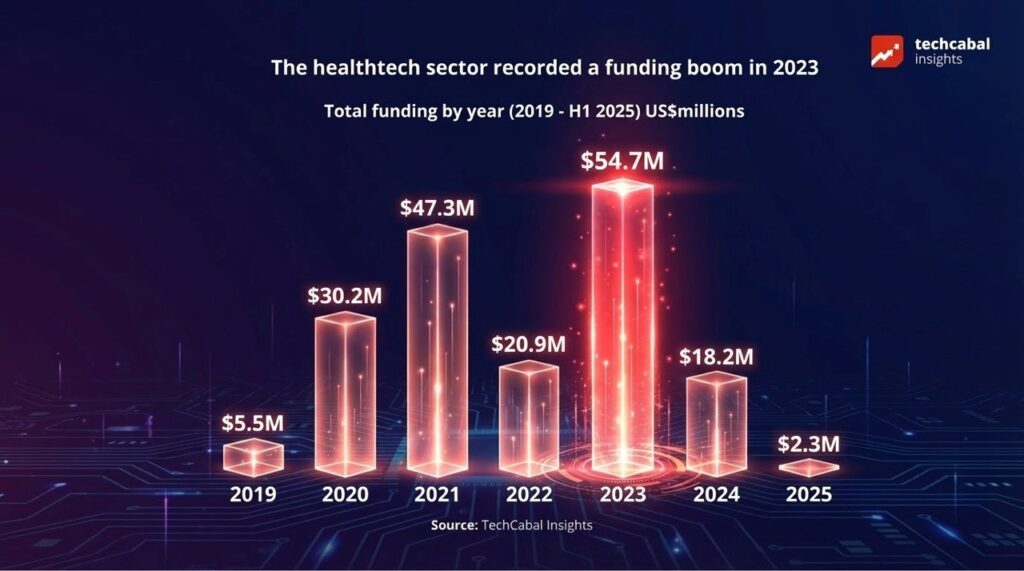

Despite macro-economic headwinds, the healthtech sector has shown resilience. Between 2019 and 2023, the sector witnessed a funding boom, with capital inflows rising from $5.5 million in 2019 to a peak of $54.67 million in 2023.

While 2024 saw a correction to $18.23 million, the long-term trajectory points toward maturity. We are moving beyond simple “telemedicine” apps into deep-tier infrastructure plays.

Investment trends within Nigeria’s healthtech sector

Sector specialisation is accelerating

Health infrastructure & EMRs: Startups like Helium Health have proved that digitisation can scale, digitising records for over 1 million patients and disbursing over $10 million in loans to facilities.

Supply chain & authenticity: Companies like DrugStoc and RxAll are using data-driven logistics and AI to fight the 30% counterfeit medicine problem. Notably, RxAll’s AI-powered scanner can detect counterfeit drugs with an impressive 95% accuracy rate.

Insurance & access: Reliance Health, Casava, and Curacel are leveraging digital rails to reduce out-of-pocket spending, which remains a crushing burden for millions of Nigerians.

ALSO READ: 7 African startups transforming health records, human resource, and home care

The “offline-first” reality and the persistent equity gap

The distribution of Nigeria’s medical talent is heavily skewed: Urban areas command 80% of the workforce, leaving just 20% to serve the massive rural population. To truly capture the Nigerian market, innovators must build for the reality of the rural majority. This means adopting an “offline-first” strategy to close the gap.

A 2025 study utilising the Global Digital Health Index across 10 Nigerian states finds uneven “digital health maturity” across governance, infrastructure, and service delivery. While Lagos leads in digital readiness, states like Gombe, Niger, Bauchi, Sokoto, Borno, Nasarawa and Yobe were the least mature.

To capture the $1.5 billion market opportunity, strategic scaling requires building low-bandwidth, off-grid platforms. We cannot design Silicon Valley solutions for a market where power is intermittent and internet connectivity is a luxury. Inclusion must be a design criterion, not an afterthought.

Data: The backbone of a modern health system

Perhaps the most underutilised asset in Nigerian healthcare is data. Currently, fewer than 18% of Nigerian hospitals utilise Electronic Medical Records (EMRs), despite evidence that EMRs reduce medical errors and enhance care coordination. This analogue reality makes longitudinal care and population health management nearly impossible. However, where data is available, the impact is profound. AI models are now detecting tuberculosis from X-rays with over 98% accuracy, outperforming human specialists in high-volume settings.

The path forward: What must change?

Healthcare is shifting from physical buildings to digital ecosystems. With over 49% broadband penetration and 140 million internet users, the clinic is effectively moving into the patient’s pocket. For Nigeria to transition from “market potential” to “systemic impact,” four synchronisations must occur:

Policy reforms: The Nigeria Digital in Health Initiative (NDHI) must move from framework to enforcement. Ensuring standards are met, mandating interoperability, and defining incentives for EMR adoption and data quality.

Infrastructure investments: Scaling digital health Investments requires strategic investments in power and broadband in rural clusters, as well as blended care models (virtual + facility-based care).

Data interoperability: Systems must communicate. Patient data cannot remain trapped within individual hospitals or private platforms. A national health information exchange and unified standards are essential.

Human capital development: We must train the 30% of healthcare workers currently using digital tools to become evangelists for the other 70%. Digital health only works when the people delivering care are empowered to use it.

Conclusion: From innovation to infrastructure

Nigeria possesses the innovators, the demand, and the demographic scale to build one of Africa’s most advanced digital health ecosystems. What the country lacks is systemic alignment, consistent policy, interoperable data systems, equitable infrastructure, and a digitally empowered workforce.

Digital health must now evolve from experimentation into a national infrastructure. Nigeria has the urgency and the opportunity. The defining question is whether policymakers, providers, investors, and innovators can converge around a coherent, equitable, data-driven system that prioritises outcomes over optics.

The future of healthcare in Nigeria will not be shaped by technology alone, but by the governance structures, standards, incentives, and values that determine how technology is deployed. The path forward is clear: digital must become the default, not the exception.

Explore how Africa’s digital infrastructure is reshaping commerce. Download the Future of Commerce 2025 report.