2025 marked a turning point for Africa’s climatetech ecosystem. Far from a quiet year, it was a period of robust recovery, with funding rebounding from a 2024 slump where funding dipped to $754M according to TechCabal Insight’s funding tracker. By November 2025, funding had surged back to $1.1 billion, seeing climate and energy startups start to rival fintech for funding relevance.

Against the backdrop of a cautious global venture environment, the sector proved its maturity, attracting strategic mega-rounds into models with proven unit economics and strong links to climate adaptation on the ground. This shift is evident in the numbers: African startups raised $1.42 billion in H1 2025 alone, with Climate & Energy solidifying its position as a critical pillar of the ecosystem, securing over $219M and consistently ranking as the second-most funded sector.

Most funding in the sector still relies on conventional tools like equity, debt, and grants. But to truly unlock scale, the market needs to embrace innovative blended finance structures. We saw powerful examples of this in 2025, such as Spiro’s $100 million asset-backed expansion and Sun King’s dual approach, combining a $40 million Series D with a massive $156 million securitisation of its solar assets. Even Ampersand’s recent raise utilised ‘catalytic junior debt’ to crowd in senior lenders. From Special Purpose Vehicles (SPVs) for carbon credits to first-loss guarantees that de-risk commercial capital, these models are currently the exception, not the rule, and that needs to change. This maturity is most visible in how capital was deployed in 2025.

ALSO READ: Six things we learned about African tech in 2025

Capital flows shift toward infrastructure-grade climate solutions

While total African startup funding rebounded modestly in 2025, climatetech stood out for a different reason: intentional capital allocation rather than volume alone.

Climatetech attracted an estimated $300 million incremental surge in funding in 2025, according to aggregated reporting by Axcel Africa and ecosystem trackers. This growth did not come from speculative bets, but from investors doubling down on solutions tied to core structural needs: energy access, food systems, and climate resilience.

This shift was exemplified by large raises into proven operators across energy access and electric mobility, including companies such as M-KOPA ($160M), Sun King ($196M), and Spiro ($100M). These ventures attracted growth capital on the back of asset-backed models, clear unit economics, and demand anchored in everyday infrastructure rather than discretionary consumption.

Key signal: Investors are increasingly treating climatetech not as a thematic overlay, but as critical infrastructure for African economies. We saw definitive proof of this in 2025, as Bbox Nigeria tapped a $300 million World Bank fund for solar access outside VC circles.

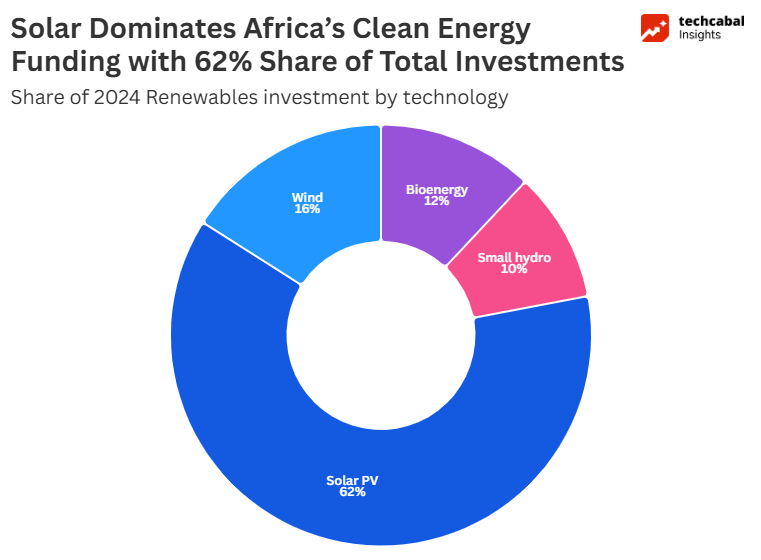

This reinforces a longer-term pattern identified within the sector. Over the past decade, Africa’s climatetech growth has been overwhelmingly anchored in renewable energy and climate-smart agrifood systems, sectors where demand is structural rather than cyclical. As capital became more selective, it also became more geographically intentional.

ALSO READ: Kofa raises $8.1 million to expand battery-swapping energy network

Where Africa’s Climatetech startups are scaling

Geographically, Africa’s climate tech activity in 2025 remained anchored in Kenya, Nigeria, and South Africa, countries with deeper capital markets, stronger regulatory institutions, and established innovation ecosystems.

As highlighted in the CATAL1.5°C report, these markets continue to attract the majority of venture formation and funding due to greater policy clarity (especially in energy and data regulation), higher investor density and stronger startup support infrastructure.

However, 2025 also surfaced early signals of decentralisation. Countries such as Ghana, Tanzania, and Zambia showed increasing climatetech activity, driven by a combination of targeted policy reforms, donor-backed acceleration programmes, and highly localised climate challenges creating demand for bespoke solutions.

Why this matters: A broader geographic spread increases the likelihood that solutions are context-specific, rather than being simply exported from regional hubs.

What changed in African Climatetech in 2025

Three shifts defined the year:

- From mitigation-only to resilience-first

Ventures increasingly frame value propositions around adaptation, reliability, and cost savings, not just emissions reduction. This shift is evident in companies such as M-KOPA and Sun King, whose solar home systems are increasingly marketed around reliability, predictable energy costs, and reduced exposure to fuel price volatility for households and small businesses. In mobility, platforms like Moove and BasiGo emphasise lower operating costs and higher vehicle uptime for commercial fleets, positioning electric vehicles as productivity-enhancing infrastructure rather than purely green alternatives. - Greater scrutiny on scalability

Funders became more selective in 2025, favouring models with clear pathways to regional expansion and revenue durability. Preference increasingly tilted toward asset-backed, repeatable models that can scale across markets with similar infrastructure and demand conditions. This is reflected in sustained investor interest in companies such as Sun King, which has scaled pay-as-you-go energy systems across multiple African markets using a standardised distribution and financing model. These models reduce execution risk by combining predictable demand with modular, repeatable deployment structures. - A widening capital gap at growth stage

Early-stage capital remains relatively accessible, but Series B+ funding continues to lag, creating a bottleneck for companies seeking to scale beyond a handful of core markets. As a result, many mid-stage climatetech firms increasingly rely on Development Finance Institutions (DFIs), strategic corporates, and structured finance vehicles to bridge the gap between venture-scale pilots and continent-wide expansion. For example, companies like M-KOPA and d.light have historically combined venture funding with debt facilities and DFI-backed instruments to finance asset deployment at scale, while electric mobility players increasingly explore asset-level financing structures to support fleet growth without excessive equity dilution.

ALSO READ: After years of financing solar, Sun King turns to smartphones in Nigeria

What’s next for Africa’s Climatetech ecosystem

2025 affirms that Africa’s Climatetech sector is a high-impact, high-potential investment destination. The next phase of growth, however, will require a concerted effort to address two key challenges:

- Scaling the Nascent Sectors: To achieve comprehensive climate resilience, greater investment must be channelled into the nascent areas of Circular Economy (Waste Management) and Sustainable Cities (Building, Cities, & Appliances). These sectors, currently representing only 10% of the venture landscape, offer immense potential for systemic change.

- Bridging the growth-capital Gap: The persistent shortage of later-stage capital remains the sector’s most pressing challenge. DFIs, blended finance vehicles, and large-scale private equity funds will play a critical role in mobilising the capital required to help successful ventures scale across borders—transforming local champions into pan-African infrastructure players..

The foundation has been laid. With continued strategic investment and supportive policy frameworks, Africa’s Climatetech ecosystem is poised to deliver not only significant returns but also the climate resilience the continent urgently needs.

Discover how digital infrastructure is shaping Kenya’s economy. Download our Kenya Digital Economy Report 2025