Welcome to 2026, a new year and another reason to be hopeful.

African tech experienced significant maturation in 2025, though perhaps not in the ways headlines suggested. While funding crossed $3 billion, a welcome 44% increase from 2024, the story beneath the numbers reveals a shift in how capital flows into the ecosystem. A sizable portion of some of the largest funding rounds consisted of debt facilities, securitisations, and receivables financing, rather than traditional venture equity. This signals that African startups have grown to the point where they can access diversified capital structures.

An interesting moment from last year occurred in Q3, when clean energy surpassed fintech as the continent’s top-funded sector, capturing 53% of the investment. Corporate venture capital surged, with strategic investors backing B2B infrastructure, including regtech, embedded finance, and trade platforms, rather than consumer-facing apps.

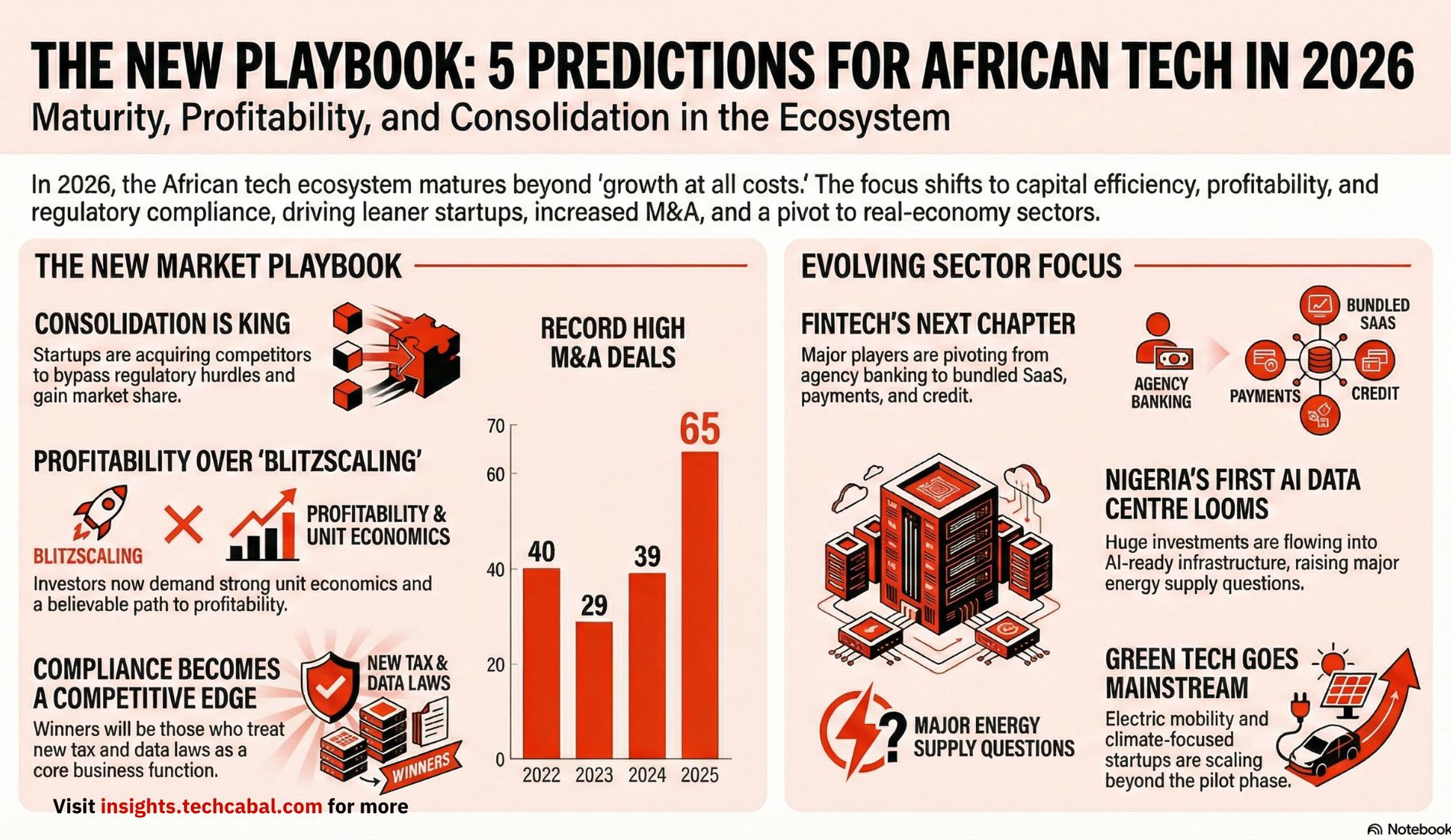

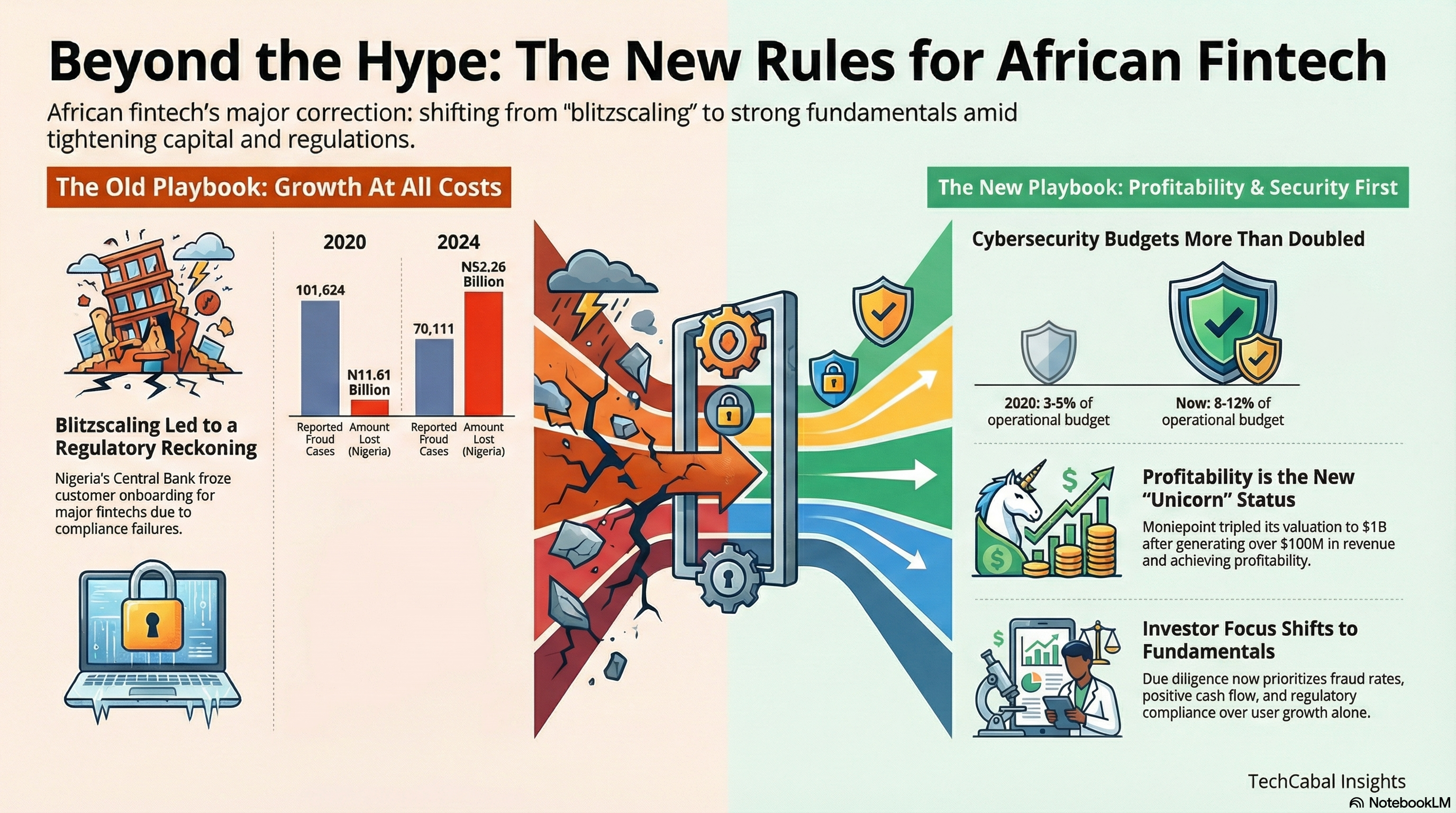

The emphasis has shifted away from blitzscaling (rapid growth at any cost) to maximising unit economics, meaning every single dollar invested must now be accounted for. The result is leaner but more efficient startups, which explains why 2025 was a great year for mergers and acquisitions.

So, what might we expect for African tech in 2026? We received feedback from analysts within the TechCabal Insights team, as well as a few from our sister publication, TechCabal. Here’s what they had to say.

The rise of super-conglomerates through aggressive M&A

Adedayo Ojo, Associate Consultant, TC Insights

The era of the “Pan-African expansion team” hiring local country managers is drawing to a close. In 2026, dominant players in Tier 1 markets (Nigeria, Kenya, South Africa, and perhaps Egypt) will continue to form regional oligopolies by aggressively acquiring their competitors in neighbouring markets to bypass regulatory hurdles. We will likely see the formation of maybe 3-4 massive super-conglomerates that dominate fintech and logistics across many African countries.

This is because in 2025, we reported a 42% surge in expansions alongside a 72% spike in M&A. We are witnessing a shift from building from scratch, which is slow and heavily regulated, to acquiring licenses and market share. Think Moniepoint acquiring a bank for a licence, or Stitch acquiring ExiPay.

We will also see a wave of hybrid companies that use tech to optimise physical infrastructure. Fintechs will likely start financing or owning solar grids, similar to Payhippo’s pivot to clean energy financing, and logistics fleets, such as Jumia and Takealot, by opening their delivery networks. In 2025, we witnessed a massive capital flight toward tangible assets, with energy and water funding nearly doubling, while asset-light sectors such as retail and e-commerce struggled.

Nigerian fintechs will pivot away from agency banking

Muktar Oladunmade, Reporter, TechCabal

Nigeria’s biggest fintechs, which made their name through agency banking or reached massive scale with it (Moniepoint, OPay, PalmPay, and Paga), will deprioritise the sector and continue to diversify their product offerings. I’m calling this because last year, the Central Bank introduced several policies that effectively limit the activities of agents by restricting their geographical presence, the number of fintechs they can work with, and the daily withdrawal limit.

My other prediction is that many non-banking fintechs will acquire Microfinance Bank (MFB) licences to start holding deposits. Most fintechs that deal solely with payments will conclude that adding a banking licence to their arsenal will deepen their product offering and protect them from regulatory shocks.

ALSO READ: Six things we learned about African tech in 2025

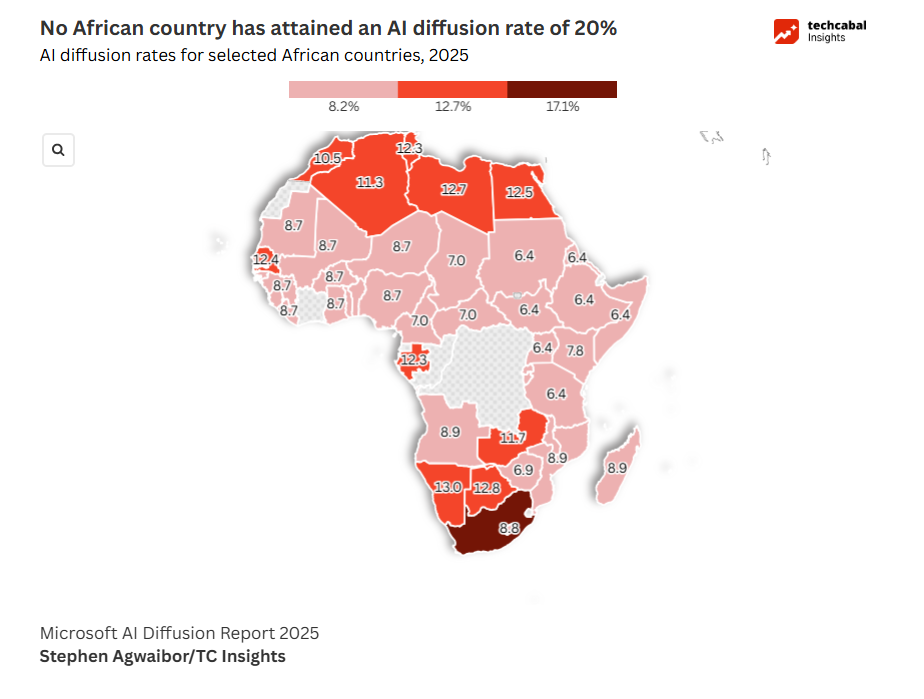

Nigeria’s first AI data centre is coming

Stephen Agwaibor, Senior Associate, TC Insights

2026 will likely be the year Nigeria gets its first AI data centre—provided power holds. Over the course of the last year, we covered the economics of data centres, touring and mapping at least 26 of them, both operational and planned, across Nigeria. Three observations stood out.

First, almost all of them were owned by telecoms (Airtel, MTN) or independent data centre operators, such as Equinix, Digital Realty, and Rack Centre. This makes sense because these facilities double as colocation centres for hosting cloud infrastructure, which telcos rely on for data storage and transmission. Second, none of them were retrofitted for AI at the time, only for cloud operations. Third, a majority of them, about 70%, were clustered in Lagos.

My conversations with leading industry players and reporting from TechCabal suggest that things may change soon, as companies like Airtel and Kasi Cloud, based in Lekki, are looking to commission AI-ready data centres later in the year. These facilities, if they do go live, will be unlike any infrastructure we’ve ever seen. By scale and design, AI data centres are behemoths, requiring enormous amounts of energy, compute, and time to be fully functional.

The commitments made towards these projects are running into hundreds of millions of dollars, and the question of how they will sustain themselves, given Nigeria’s energy conundrum, remains unanswered. The installed capacity of current data centres is around 85MW and is expected to balloon to 400MW within the next four years, a number that is roughly 7% of Nigeria’s entire electricity generation capacity.

Compliance will become a competitive advantage

Joseph Oloyede, Data Analyst, TC Insights

The “growth at all costs” era is officially over. 2026 will be defined by strict adherence to new rules. As tax reforms and stricter data laws take effect across key markets, such as Nigeria and Kenya, compliance will become a major differentiator. Winners will be those who treat regulation as a design constraint rather than an afterthought. Open banking and instant payment rails will increase interoperability, but they will also raise the compliance bar for SME fintechs seeking to integrate with these regional systems.

While I expect a resurgence in “real economy” sectors like agritech, logistics, and mobility, where software optimises physical assets, fintech will continue to dominate funding. It remains the sector raising the largest capital from investors, but the model is evolving. We will see a shift from standalone lending to “SaaS plus payments plus credit” bundles, as well as increased financial unlocking for electric vehicle (EV) infrastructure driven by bold players and flexible banking conditions.

Profitability, green tech, and smarter exits will define the new playbook

Adonijah Ndege, Senior Reporter, TechCabal

Raising money on a bold vision alone is no longer enough. Only the most resilient businesses are able to survive. Investors are now obsessed with the basics: unit economics, margins, and a believable path to profitability. Growth still matters, but not at any cost. Startups like Workpay and Turaco have become reference points because they’ve shown that you can scale across Africa without endlessly burning through resources.

Electric mobility has crossed the experimentation phase. Companies like BasiGo and Spiro are no longer running pilots. Kenyan roads could carry thousands of electric buses and nearly half a million electric boda bodas, supported by extensive battery-swapping networks. Beyond transport, climate-focused startups are tapping into Kenya’s geothermal advantage.

Many startups are also shifting from being simple platforms to becoming intelligent agents that make decisions. In agritech, companies like Apollo Agriculture are setting the pace. Using satellite data, AI, and climate models, they’re moving past basic credit and inputs. In 2026, farmers receive precise guidance on when to plant, fertilise, or harvest, based on real-time weather patterns and soil conditions.

The dream of ringing a bell in New York or London has faded. In its place are more practical, local exit paths. Regional consolidation is accelerating. Large players, such as KCB Group’s tech arm, are acquiring smaller startups to quickly add new features, including niche credit products and wealth management tools. Secondary sales are also becoming more common. As the Nairobi International Financial Centre matures, early investors are increasingly selling their stakes to private equity firms or later-stage funds, without waiting for an IPO.

Conclusion

2026 will separate survivors from scalers. The fundamentals, such as unit economics, regulatory compliance, and capital efficiency, are no longer nice-to-haves. They’re requirements. Consolidation will accelerate. Infrastructure will deepen. And somewhere between the M&A headlines and data centre launches, African tech will prove whether it can build businesses that last, not just ones that raise.

Discover how digital infrastructure is shaping Kenya’s economy. Download our Kenya Digital Economy Report 2025