On Friday, January 23 2026, TechCabal Insights released its State of Tech in Africa 2025 in Review Report at a physical launch in Lagos. The report offered a data-driven look at the continent’s technology ecosystem, followed by a candid panel discussion titled “After Capital: What Defines Success Today.” The session moved beyond headline numbers to explore the gritty reality of building businesses in 2026, characterised by a definitive shift toward profitability, strategic consolidation, and applied innovation.

An overview of the numbers that defined African tech in 2025

The event opened with a presentation by Fikayo Idowu, a Senior Consultant at TechCabal Insights, who outlined the ecosystem’s financial health. Despite global economic headwinds, the African tech sector demonstrated significant resilience, seeing funding levels return to the benchmarks set in 2022.

Over $1.4 billion was raised in the first half of the year. The second half surpassed it, with funding reaching $2 billion. This capital was deployed across approximately 502 deals, signalling that while money is available, it is becoming more concentrated. A notable trend highlighted in the report was the surge in debt financing, which accounted for 27% of total funding.

Fikayo noted the strategic importance of this shift: “It signifies to the ecosystem that these companies that are getting this funding have passed through the fire of experimenting. This is scale money.” The ecosystem also crossed the $1 billion mark for debt raised, a milestone last achieved in 2023, indicating a maturing market where founders are opting to leverage revenue for growth rather than diluting ownership through equity.

While fintech continued to dominate, raising $1.3 billion, the energy and water sector emerged as a critical area of interest, with founders stepping in to fill gaps left by government infrastructure projects that have lagged.

However, the report did not shy away from the harsher realities of the market. Layoffs impacted over 2,400 people as companies attempted to restrategize, with “a focus on making money.”

Furthermore, the ecosystem saw 18 startup shutdowns—a 50% increase from previous levels. Fikayo framed this pragmatically, arguing that “startups shutting down is not the end of the world,” and that faster failure cycles prevent funding from being trapped in non-viable ventures.

The profitability mandate

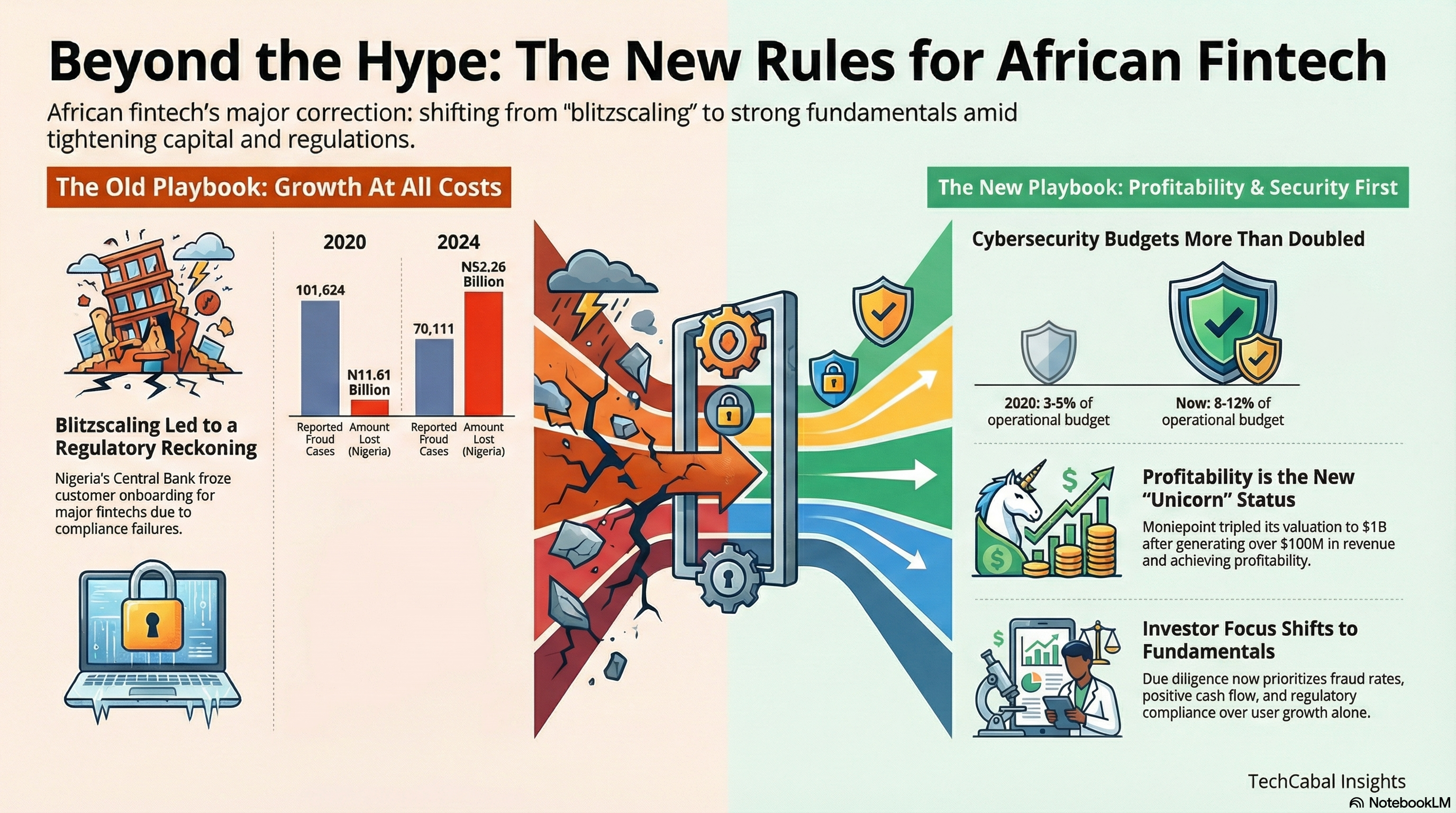

Following the presentation, the conversation shifted to a panel discussion moderated by Ganiu Oloruntade, Senior Editor at TechCabal, featuring Segun Cole (CEO, Masai VC), Lola Masha (Partner, Antler), and Dieko Ojo (Investment Associate, Novastar). The central theme was the ecosystem’s pivot from “growth at all costs” to “profitability at all costs.”

Segun opened the panel with an uncompromising stance on the current market reality.

“The debate on growth versus profitability is settled in 2026,” he asserted. “Profitability is the only permission to play,” he added.

Lola offered a nuanced perspective, acknowledging that early-stage companies cannot be profitable on day one. However, she emphasised that the era of raising money on a mere idea is over. “You can’t simply walk to an investor today and say I have a pitch deck, give me a million dollars. I think that age is way past,” she explained. Investors now demand a clear understanding of unit economics and a disciplined path to positive cash flow.

Dieko added that this focus on the bottom line doesn’t hinder creativity. “Profitability is not anti-innovation,” she said. Instead, it ensures that innovation happens within reasonable guardrails so companies are not “overshooting runway in the pursuit of innovation.”

The discussion took an interesting turn when addressing the mental toll this new financial discipline takes on founders. The panellists were unanimous: high pressure is a feature, not a bug, of entrepreneurship.

“If you’re afraid of pressure, please don’t start a business. If you’re afraid of pressure, please get a job,” Lola remarked. She described pressure as the force that “converts coal to diamond.” Segun reinforced this by reminding the audience of the fiduciary duty investors hold: “One of the things I tell founders every time is investors are loyal to their LPs. Their first priority is return on investment”.

ALSO READ: What’s next for African tech: 5 key predictions for 2026

M&A as a strategic growth lever

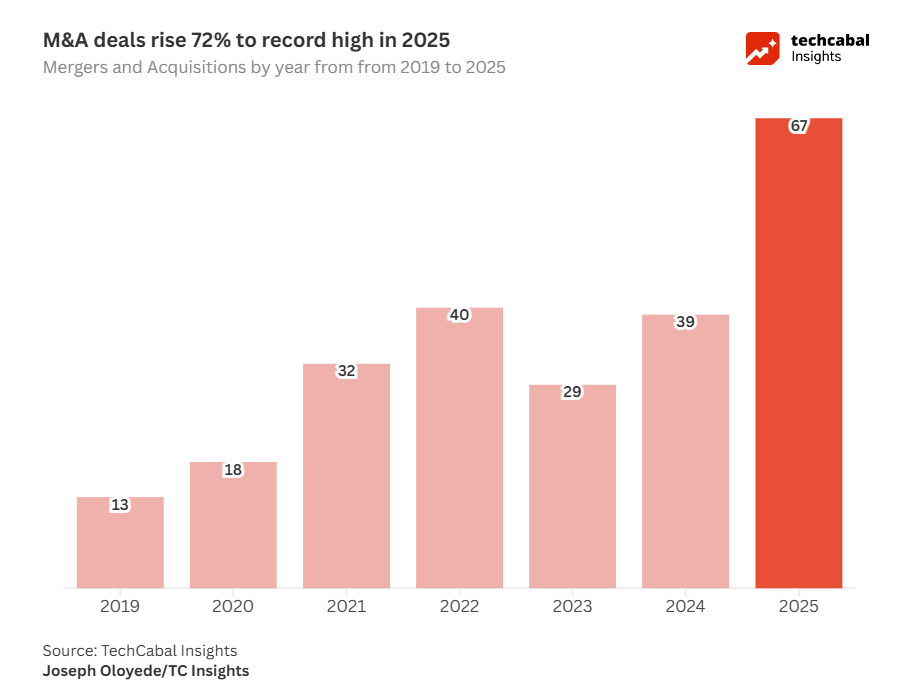

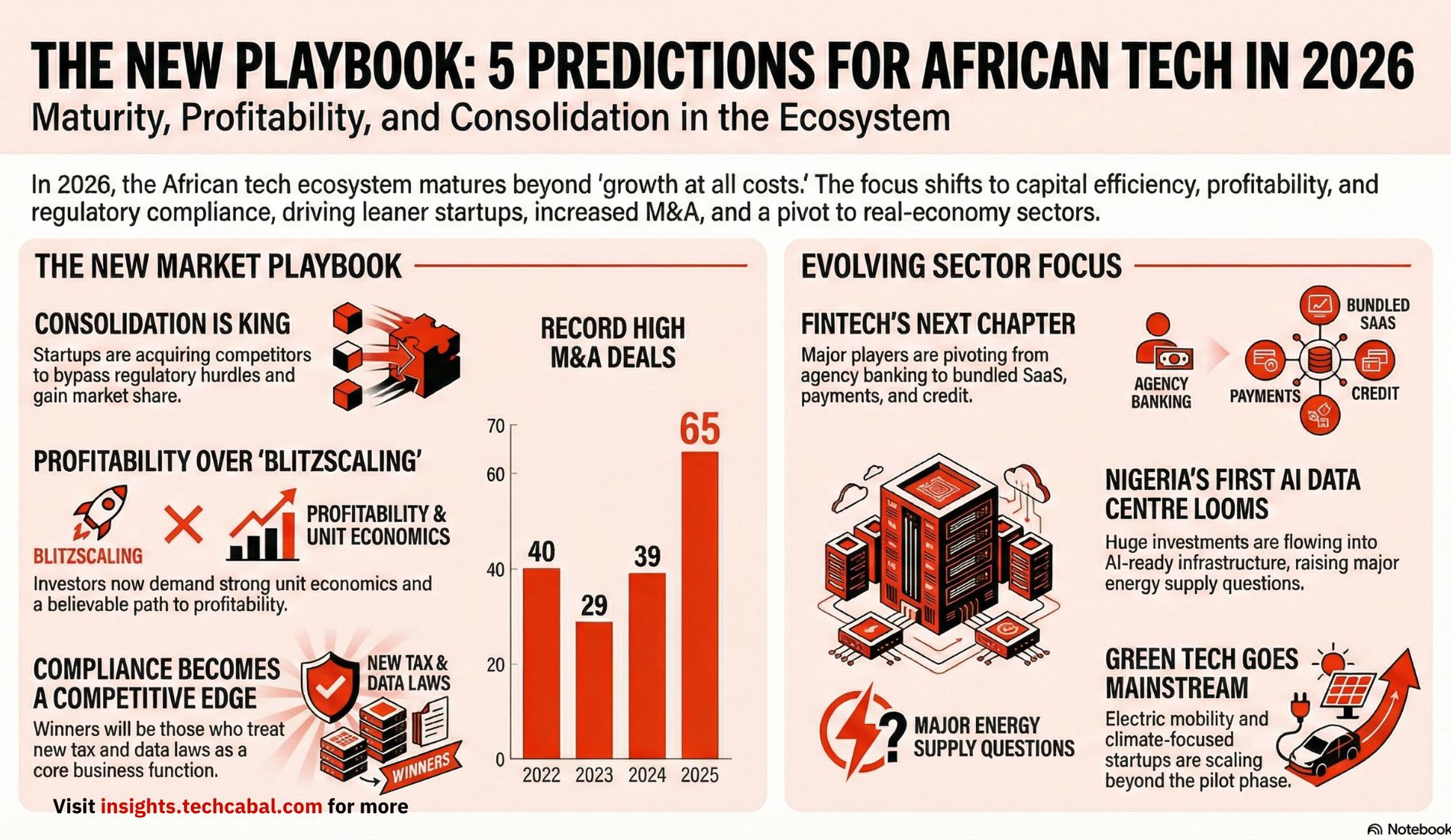

The panel also dissected the surge in Mergers and Acquisitions (M&A), which saw 67 deals tracked by TechCabal Insights—a 72% increase. Ganiu questioned whether this trend represented desperate consolidation or strategic growth.

Segun argued that M&A has evolved. “M&A is no longer a distress signal. M&A has moved to a primary growth lever,” he said, describing a trend of regional primes using acquisitions to quickly obtain regulatory licences and expand into new markets. He predicted that in 2026, we will see “African giants acquiring smaller companies to add specific product market fit to their existing scale”.

Dieko supported this, referencing a concept she termed “licence hunters.” She noted that merging with a larger entity allows businesses to evolve and innovate while still guaranteeing their sustainability.

Lola provided context for why this consolidation is necessary to circumvent fragmentation in the African market. “Africa is not one market just yet. Getting from one country to the other, just physically moving, is still quite challenging,” she noted. Because regulations (such as GDPR equivalents and tax laws) vary by country, organic expansion is incredibly difficult. Therefore, acquiring a company already operating in a target market is a logical, risk-reducing strategy.

The innovation landscape and AI

During the Q&A session, the conversation turned to technology itself, specifically Artificial Intelligence. An audience member asked whether Africa was merely playing “catch-up” with the West in AI and whether local startups would attract funding in this sector.

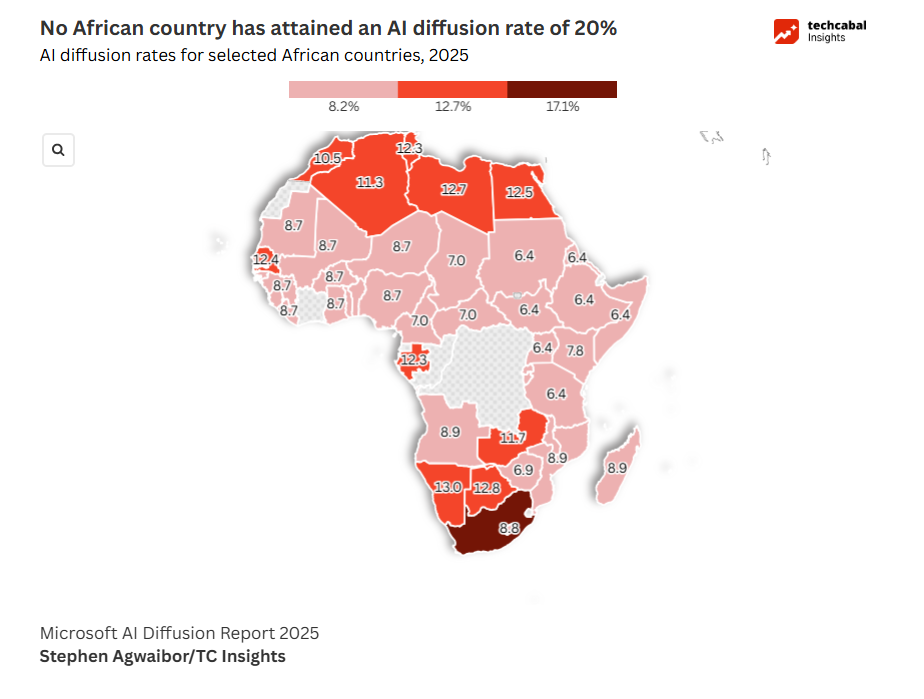

Segun provided a reality check regarding the infrastructure required for frontier AI (like building Large Language Models). “Africa is ready for applied AI, not frontier AI,” he stated, citing that less than 5% of African talent has access to the necessary GPU power. Instead of building the next ChatGPT, successful African startups will be those using AI to solve specific operational inefficiencies.

“The kinds of AI companies that you’re going to see winning in 2026 in Africa are the guys that are using AI to solve and reduce operational problems and time lags by 30%,” Segun predicted. He emphasised applications in credit underwriting and healthcare triage rather than generative chat interfaces.

Lola agreed, highlighting that innovation in Africa is defined by local relevance. “The challenges that we face in our markets are quite different from the challenges faced in the Western world. So there’s a lot of room for us to innovate,” she said.

Future outlook

In his closing thoughts on the year ahead, Segun reiterated the need for the ecosystem to prove it can return capital, not just raise it. “One very important thing that has to be the focus—front, back, and centre—is exit velocity,” he said. “We also need to move away from celebrating the raise and start having conversations around distribution”.

Dieko tempered the optimism with a note on selectivity. While funding is returning, the bar is higher. “Not everybody is going to get money this year. It’s compounding growth towards profitability that investors are going to be on the lookout for”.

Fu’ad Lawal, Editor-in-Chief of TechCabal, closed the session by reflecting on the report. He noted that it would have a “network effect,” with the product gaining value as more stakeholders provide data and strong opinions. He urged the audience to continue sharing feedback to refine future insights.

Consensus from the “State of Tech in Africa” session was clear: The ecosystem is maturing. Gone are the days of easy money and growth at all costs. In its place is a disciplined focus on unit economics, strategic consolidation through M&A, and technology specifically applied to solve African infrastructure problems. As Segun summarised effectively: “Profitability is the only permission to play”.

Get informed about African tech and where it is headed. Download the State of Tech in Africa 2025: Year in Review Report.