Africa’s Logistics & Transport startups have attracted $1.8 billion in funding over the last five years, solidifying the sector’s role as the connective tissue for the continent’s digital economy. As a vital lever connecting operations across retail, e-commerce, fintech and agriculture, these companies have solved complex, real-world problems in transport, warehousing, and cross-border trade, making them essential for the continent’s progress.

However, this journey has not been easy. Investment in the sector peaked at $623 million in 2022, followed by a sharp drop during the global “VC winter” in 2023. Far from stabilizing, the market remains unpredictable. Funding surged to $220.6 million in the first half of 2024 before falling again to just $113.7 million in the first half of 2025. This fluctuation shows that while the sector remains critical, the investment landscape is still cautious and uncertain.

How the funding was raised

Most of the capital ($1.43 billion) came from 286 equity deals, where investors buy a stake in a company. This was the main fuel for growth. However, a sign of the sector’s growing maturity was the $422 million raised through just 41 debt financing deals. Debt is usually for more stable companies with reliable income, showing that many Logistics & Transport startups are now seen as stable businesses. Grants provided a smaller but vital $11.5 million across 48 deals for new and innovative ideas.

Where the funding went

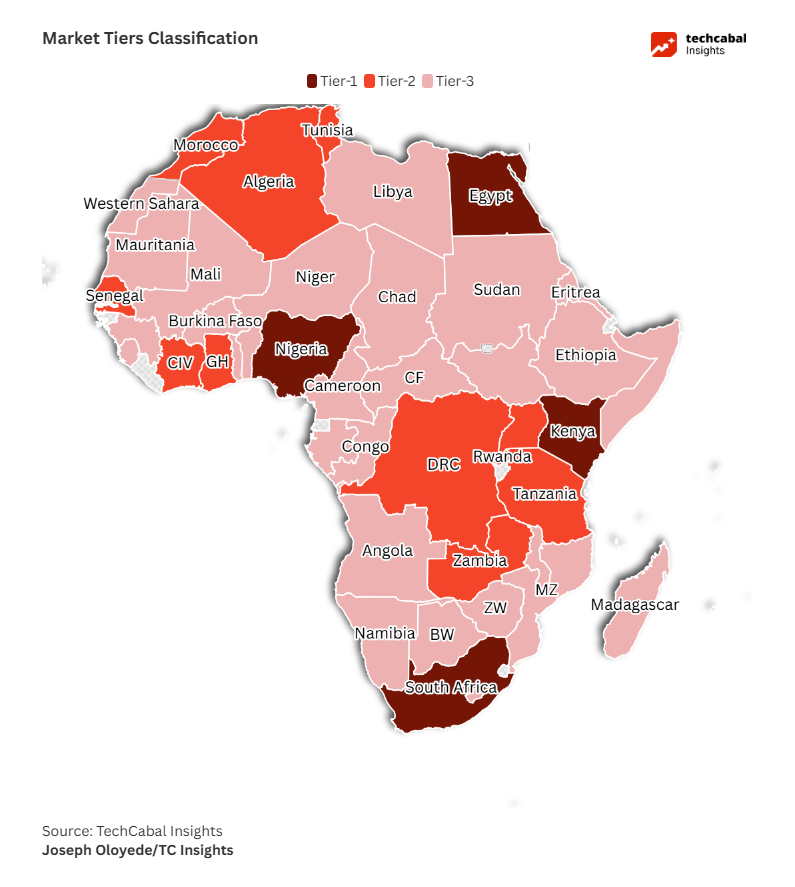

The funding was not spread evenly, with investors concentrating on a few key markets. The “Big Four” tech hubs, Nigeria, Egypt, Kenya, and South Africa, along with Algeria, attracted the most capital. Nigeria led the way with $676 million, followed by Egypt ($409 million), Algeria ($182 million), and Kenya ($181 million). Beyond these leaders, other emerging ecosystems showed significant activity, including Benin ($113 million), Togo ($46 million), Rwanda ($50 million), Ghana ($44 million), and Namibia ($18 million).

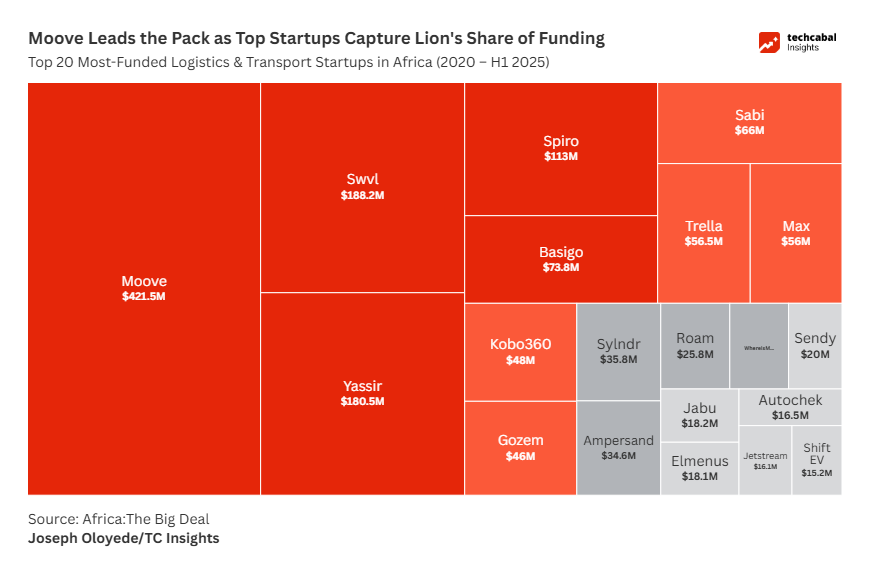

The sector’s heavyweights

A closer look at the data reveals that a huge portion of the capital was concentrated in a handful of high-growth companies. Nigeria’s mobility startup Moove stands in a league of its own, having raised a massive $421.5 million. It is followed by transport marketplace Swvl with $188.2 million and super app Yassir with $180.5 million.

The treemap chart of top-funded startups shows investor interest across various models, from EV-focused players like Spiro ($113 million) and Basigo ($73.85 million) to digital freight platforms like Trella ($56.5 million) and Kobo360 ($48 million). However, raising significant capital did not always guarantee success; the list also includes WhereIsMyTransport ($22 million) and Sendy ($20 million), both of which shut down during the market correction, proving how tough the operating environment has been.

Expansion and consolidation

With billions in funding, top startups began to expand and acquire competitors to build continent-wide networks. For example, Kenya’s BuuPass bought QuickBus to enter Nigeria and South Africa. The biggest news was when African startups started buying companies outside the continent. Nigeria’s Moove acquiring Brazil’s Kovi was a major signal that African companies could now compete on the global stage. This trend of buying other companies and expanding into new territories shows the sector is maturing, with the strongest players solidifying their positions.

The market correction

The investment boom was followed by a tough but necessary market correction, forcing companies to prioritise survival over rapid growth. This new reality led to significant layoffs across the ecosystem for various reasons. In 2024, Kobo360 laid off 30 employees amid struggles to raise new funding. Other cuts were more strategic; MAX let go of 150 staff in early 2025 as part of its pivot to electric vehicles. Chowdeck reduced its contract staff by 68% after operational improvements as it entered Ghana, a new market.

For some startups, the pressure was too intense. Between 2023 and the first half of 2025, at least six notable startups in the ecosystem shut down. These included high-profile names like Kenya’s Sendy, South Africa’s WhereIsMyTransport, and Nigerian players Metro Africa Xpress (MAX), Heroshe, HerRyde and Hytch. These closures and cuts, while difficult, were part of a market adjustment that has left behind a field of stronger, more efficient companies.

ALSO READ: Africa Investor Guide

What could the future look like?

Today, the African logistics & transport startup ecosystem is emerging from this cycle tougher and smarter. Renewed investor confidence is a crucial signal, best shown by Moove’s reported $300 million fundraise, a move that could push its value past $1 billion and raises a key question: is Moove’s success a repeatable blueprint, or a unique outlier? And what will this new level of market consolidation mean for competition and scalability across the sector?

Beyond headline-grabbing valuations, the sector’s future will be shaped by more than just capital. Growth will increasingly come from technology, as startups use AI and data to create more efficient and cost-effective supply chains. At the same time, the push towards green energy is accelerating, with a notable shift to electric vehicle fleets to combat high fuel costs and meet new environmental standards. Perhaps the biggest driver, however, will be supportive government policies that ease trade between African countries. As these barriers fall, the demand for startups that can simplify customs and connect the continent will surge.

The capital invested over the last five years has built the foundation. The future of African logistics will be about building on it to move goods smarter, greener, and across a more integrated and prosperous continent.

Want deeper insights or a custom report on this topic? Fill out our quick form, and the TechCabal Insights team will get in touch with you.