Africa’s retail tech sector is grappling with a tough new reality. While the market’s potential is undeniable, the path to building a lasting, profitable business has been filled with challenges. Retail startups on the continent raised over $1.07 billion between 2019 and July 2025, but this investment boom has been met with a harsh market correction, forcing a shift from rapid expansion to a focus on sustainability. This difficult environment exists alongside incredible underlying growth, which is largely driven by structural factors such as a young, tech-savvy population, rapid urbanisation, and the increasing penetration of mobile devices.

Fueled by these drivers, the number of e-commerce users in Africa grew from around 233 million in 2019 and is expected to cross 518 million by 2025. This user boom is set to push the market’s value from about $17.9 billion in 2019 to $39.4 billion in 2025, creating a clear tension between market opportunity and operational challenges.

The investment boom and the inevitable correction

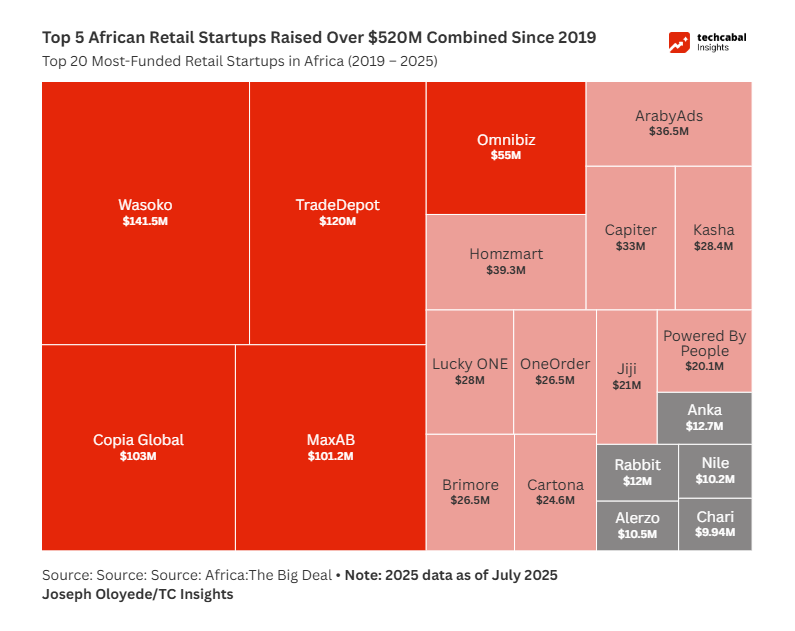

Although African retail tech startups raised over $1.07 billion between 2019 and July 2025, the investment was highly concentrated rather than evenly spread. The majority of this capital was equity, while a smaller but significant amount of debt financing signaled growing maturity in the sector.

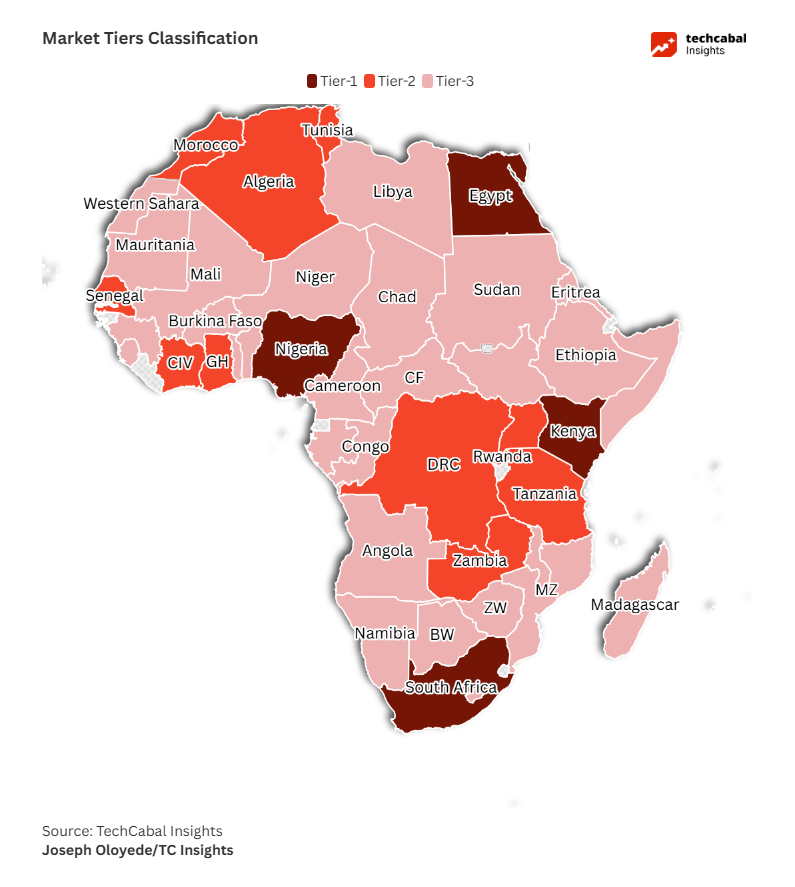

Geographically, over 75% of all funding went to just three countries (Egypt, Kenya, and Nigeria), establishing them as the continent’s primary hubs for e-commerce innovation.

Investors placed their biggest bets on B2B marketplaces and platforms solving complex supply chain issues. This focus is clear from the top recipients, where companies like Wasoko ($141.5 million), TradeDepot ($120 million), Copia Global ($103 million), and MaxAB ($101.2 million) each secured over $100 million. While other models received funding, the largest checks were reserved for startups tackling these foundational business challenges.

A time of tough decisions: shutdowns, layoffs, and strategic shifts

The end of easy money triggered a difficult but necessary market correction, forcing retail tech companies to downsize, shut down, or completely rethink their business models to survive.

The most severe outcome was the closure of several startups. The story of Copia Global is a stark example; despite having raised over $123 million, the company shut down its Ugandan operations in 2023 before facing a potential shutdown in its home market of Kenya a year later. Other players like the B2B platform Zumi, which laid off 150 employees upon closing, and the South African retailer Snatcher, which cited internal fraud, also ceased operations.

For the companies that continued, survival often came at a high cost. Widespread layoffs became a common strategy to cut costs, with even the most well-funded startups making deep cuts. Copia Global laid off over 1,000 employees through multiple rounds, and Twiga Foods reduced its workforce by over 850 people through several restructurings aimed at achieving long-term sustainability. Other major B2B players like Alerzo and Wasoko also conducted significant layoffs to navigate the tough business environment.

In response to these pressures, many survivors made bold strategic pivots to find new paths to profitability. E-commerce giant Jumia began offering its established delivery network as a separate logistics service for other businesses. In a major strategic shift, Twiga Foods pivoted from an expensive model of owning all its warehouses and trucks to a more flexible, lower-cost asset-light approach. Nigerian B2B e-commerce startup Sabi laid off about 20% of its workforce, in a broad restructuring as it pivots to the minerals and agricultural commodities market. These decisions represent a clear industry-wide shift from the previous growth-at-all-costs mindset toward building more resilient and efficient business models.

Building bigger and smarter: expansions and mergers

Even in a tough market, strong startups are still finding ways to grow. Consolidation has become a key strategy, with companies merging to create larger, more powerful networks. The merger of B2B giants MaxAB and Wasoko was a major move, which led to them acquiring Fatura, as were acquisitions made by Twiga Foods and Jumia. Ghanaian retail-tech startup Tendo acquires counterpart Shopa to boost supply chain infrastructure.

Expansion into new territories also continues. The biggest headline was Amazon’s official launch in South Africa, a move that brings global competition right to the doorstep of local players. At the same time, African startups are expanding on their terms. Social commerce platform Chpter used a partnership with Flutterwave to enter 11 new African markets at once, while others like OmniRetail are expanding across West Africa. The end-to-end digital commerce startup Tappi expanded its services to Côte d’Ivoire, its third African country after Kenya and Nigeria. Some are even looking beyond the continent, with Egyptian startups Rabbit and Kemitt expanding to Saudi Arabia. Showing that African startups can now compete on the world stage.

The engines of e-commerce: fintech and logistics

The success of e-commerce depends entirely on two key pillars: the ability to pay and the ability to deliver. Fintech is the engine that makes digital commerce possible. The rise of mobile money, especially in Sub-Saharan Africa, has been the foundation. Today, companies are building on this by embedding financial services directly into their platforms. JumiaPay and OmniPay are just two examples of e-commerce platforms offering their own payment and credit solutions.

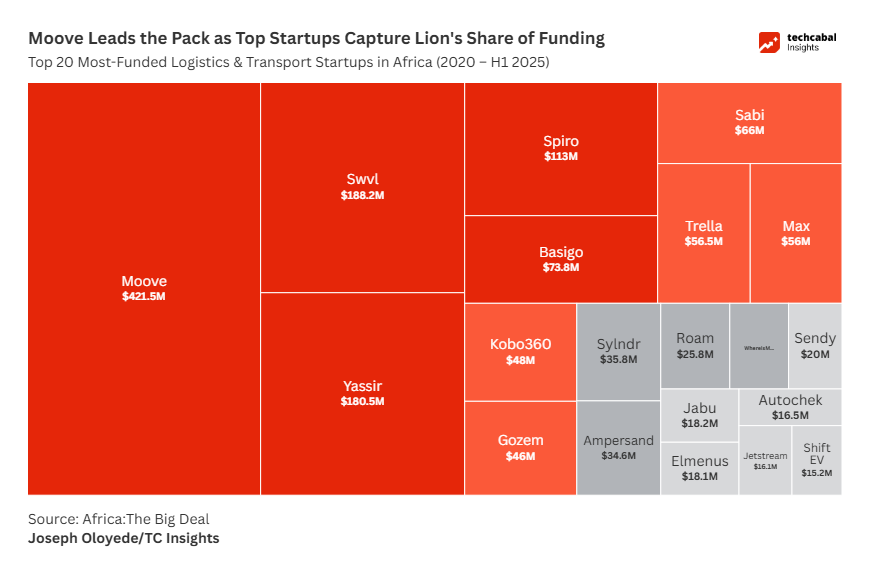

Logistics remains the industry’s biggest challenge but also its greatest area of innovation. Logistics and transport startups in Africa have raised an impressive $1.8 billion over the last five years, showing how critical this sector is. The future of logistics will be driven by technology, as companies use AI and data to make supply chains more efficient. There is also a strong push towards “green logistics,” with a shift to electric vehicle fleets to cut down on high fuel costs and reduce environmental impact.

ALSO READ: How African transport & logistics startups attracted $1.8 billion in 5 years

Looking ahead: building a smarter, greener, and more connected future

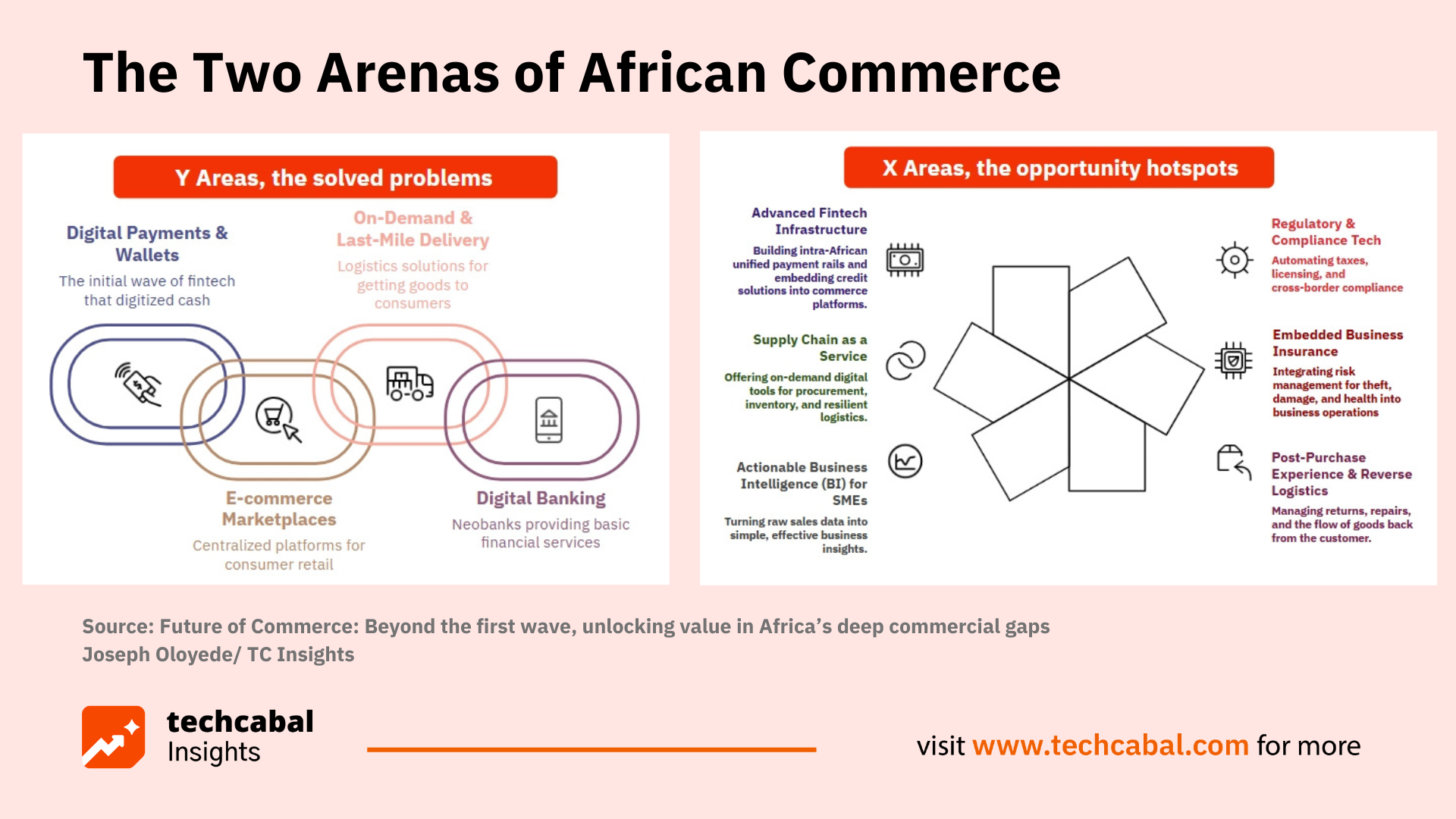

The African e-commerce industry is emerging from this market correction tougher and smarter. The “funding winter” has forced a necessary focus on real business fundamentals over hype. The future will be defined by a few key trends. The continued rise of social commerce will empower millions of small merchants, while a focus on sustainability and AI-driven efficiency will separate the winners from the losers. The most important driver of all, however, will be supportive government policies that make it easier to trade across African borders. As these trade barriers fall, the demand for tech platforms that can connect the continent will only grow. The capital invested over the last five years has built the foundation. The next five will be about building on it to move goods smarter, greener, and across a more integrated Africa.

Want deeper insights or a custom report on this topic? Fill out our quick form, and the TechCabal Insights team will get in touch with you.