New research quantifies the ongoing transformation and reveals why technology adoption has become urgent for food security.

When we last examined AI-driven solutions for African agriculture, precision farming applications were emerging. A comprehensive DHL-GIBS African Agritech study now provides some data on agricultural transformation across the continent, illustrating the promise of how technological approaches could contribute to addressing food security challenges.

The productivity gap and its implications

Sub-Saharan Africa has increased cereal output over time. Still, this growth came primarily through expanding farmland from 48 million to 112 million hectares, while average yields improved only marginally from 1.1 to 1.5 tonnes per hectare.

India achieved different results over the same period: yields increased by over 280% since the 1960s without significant land expansion. This data highlights, in clear contrast, the difference in agricultural development approaches between regions.

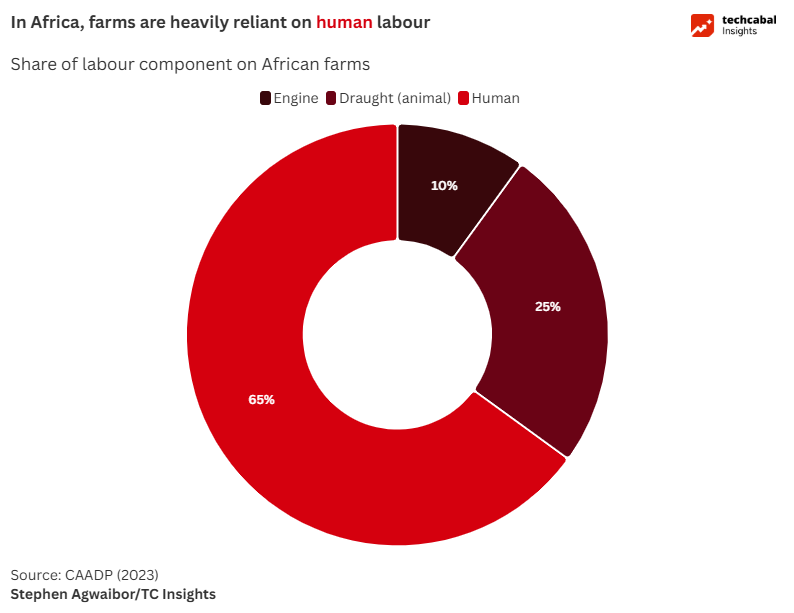

The implications are significant given demographic projections. Over half of the projected global population increase of 2 billion people between 2020 and 2050 will occur in sub-Saharan Africa, making continued land expansion increasingly unsustainable. In Africa, human labour is still relied on heavily to boost yields, whereas mechanised farming remains far more efficient for productivity.

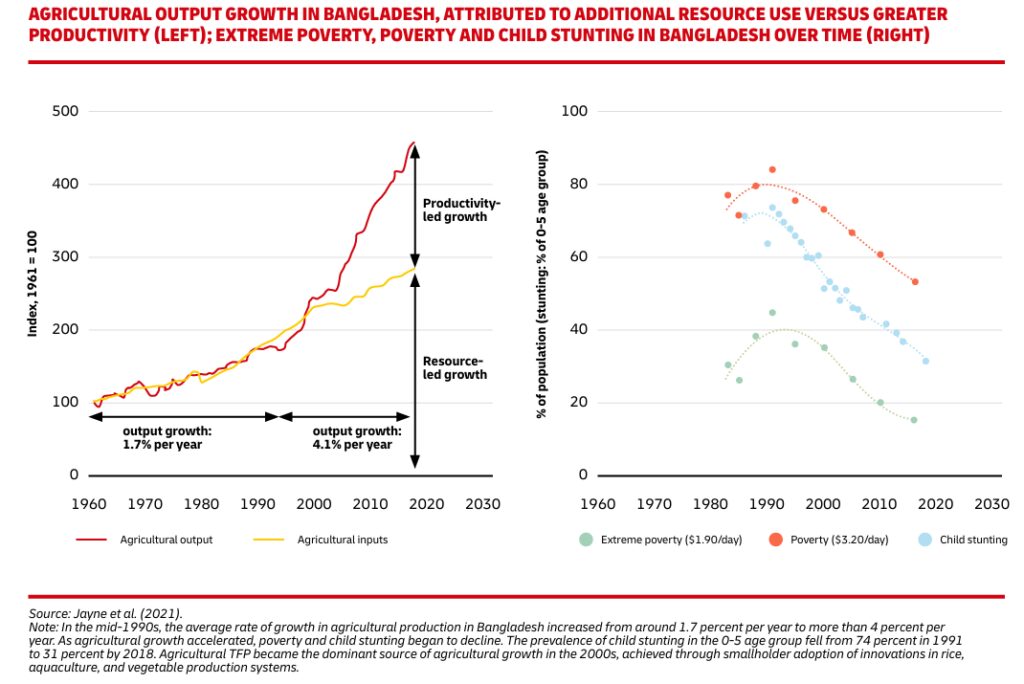

Research confirms that agricultural growth remains 2-3 times more effective at reducing poverty than equivalent growth in other sectors. The World Bank notes that productivity-led growth in agriculture has the largest impact on poverty reduction, roughly twice that of manufacturing.

Bangladesh provides documented evidence of this relationship. The DHL-GIBS report notes that following agricultural technology adoption in the mid-1990s, the country more than doubled its agrarian growth rate. According to the report, between 1991 and 2016, the share of the population living on less than $3.20 per day fell from 84% to 53%, and between 1991 and 2018, the share of children under five years old suffering from stunting declined from 74% to 31%. The World Bank separately confirms continued progress, with stunting declining from 63.4% in 1990 to 24% in 2022. Similar technology-driven transformations are now emerging across Africa, though at earlier stages of development.

Current technology applications

Across Africa, interventions show how technology and policy alignment can raise productivity, including:

- Kenya’s cage aquaculture increased output by 80% between 2021 and 2023, reducing Chinese fish imports from 8.6% to 1.8% of the national supply whilst generating $31 million in gross value.

- Tanzania’s policy interventions, including tax exemptions on processing equipment, attracted over 200,000 tonnes of private investment in sunflower processing capacity.

- Zambia’s electronic voucher system for input subsidies reached 1.2 million smallholders and contributed to 10-15% production increases in 2019.

- Nigeria’s seed trials with 250 smallholder farms yielded 452kg more grain per hectare when farmers received high-yielding rice varieties.

- Digital tractor-leasing platforms (Hello Tractor, ETC Agro, TROTRO Tractor) now operate across nine African countries, making mechanisation accessible to smallholders.

AI and precision agriculture development

The report notes that the global market for AI will double its 2023 valuation by 2026. Some applications of this technology are already being piloted on the continent in areas such as pest detection, soil diagnostics, irrigation scheduling, and crop monitoring.

Researchers at the University of Pretoria and the South African Council for Scientific and Industrial Research (CSIR) have developed satellite imagery systems that distinguish maize plants from weeds, with varying reports measuring accuracy between 85% and 95%. This level of precision could significantly reduce herbicide costs and improve crop yields for smallholder farmers who currently rely on manual weeding. The system has potential applications in biodiversity monitoring, wildfire detection, and climate impact assessment.

Platforms like FruitLook and moisture sensors help farmers optimise irrigation and reduce water waste in water-stressed regions. Farmonaut’s work in South Africa and Namibia adds to this by using remote sensing and analytics to improve crop health.

However, the biggest challenge is scaling. Many smallholders cannot afford the tools or lack reliable connectivity, and many pilots remain confined to favourable geographies and high-value crops rather than staple food systems.

ALSO READ: Exploring AI-driven solutions for African agriculture

Adoption, finance, and scale

Technology, while demonstrably efficient, cannot, by itself, transform agriculture. Widespread adoption depends on infrastructure, finance, and market access, all of which intersect with how agritech is funded.

- Connectivity: Coverage is wide, but usage is limited.

- Capital: Smallholders often lack financing to adopt proven technologies.

- Markets: Even productive farmers struggle to reach buyers and secure fair prices.

Financial innovation is filling part of the gap. In South Africa, SV Capital allows investors to buy fractional livestock stakes for as little as R500 (~$28), generating annual returns of 14.5% while funding real farm operations. Zambia’s e-voucher scheme scaled because it plugged into existing distribution networks, while Kenya’s aquaculture succeeded by pairing policy support with private investment.

Yet, the broader funding environment is fragile. African agritech and foodtech startups have raised just over $1 billion over the last decade. Annual funding peaked near $500 million in 2022 but has since fallen to around $200 million. In agritech, funding is often collaborative. Agbase reports that the number of funders per agritech deal has been declining, which may point to a reduction in faith in the sector’s ability to provide a return on capital. This creates a concerning cycle: fewer investors mean less competition for deals, potentially leading to less favourable terms for startups and slower innovation.

Much of the sector depends on donor and concessional capital, which is under pressure as official development assistance budgets tighten. Early-stage risk capital is scarce, leaving high-impact innovations such as climate-resilient seeds or alternative proteins underfunded.

Some ventures, including Kenya’s SunCulture (solar irrigation), Victory Farms (aquaculture), and Pula (agri-insurance), show how blended finance can deliver results. But without more resilient and diverse capital flows, agritech risks stalling just as the need for productivity gains grows.

The road ahead

Africa’s agricultural transformation is already visible, from internet-enabled fish farms in Ghana to satellite crop monitoring in South Africa. But isolated pilots are insufficient.

The next step is scale: closing the mobile usage gap, ensuring tools are usable by farmers with limited literacy or connectivity, and aligning policy with private investment in processing and finance. Just as critically, the agritech ecosystem must attract sustainable funding to carry innovations from pilot to mainstream.

As the world’s fastest-growing population, fixing agricultural productivity must become a priority, or Africa may face an existential crisis. The question isn’t whether technology can help, as the examples above prove it can. The question is whether Africa can build the infrastructure, financing, and policy frameworks needed to scale these solutions quickly.

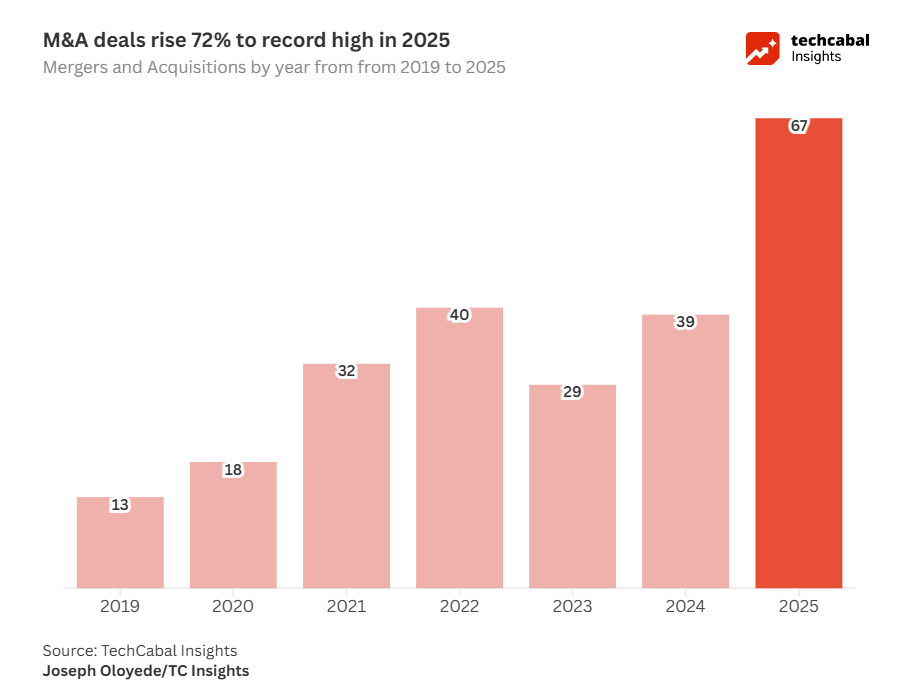

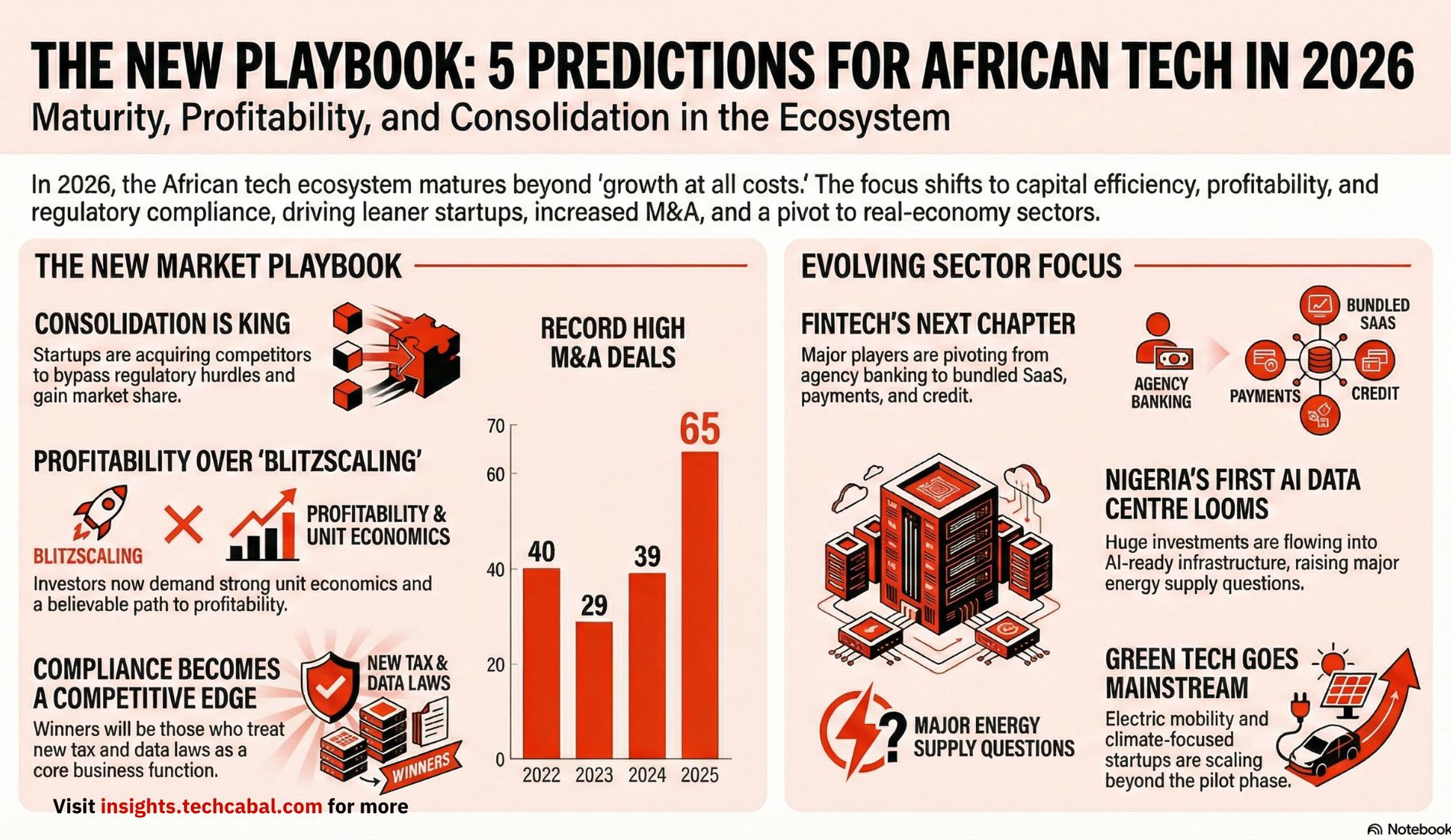

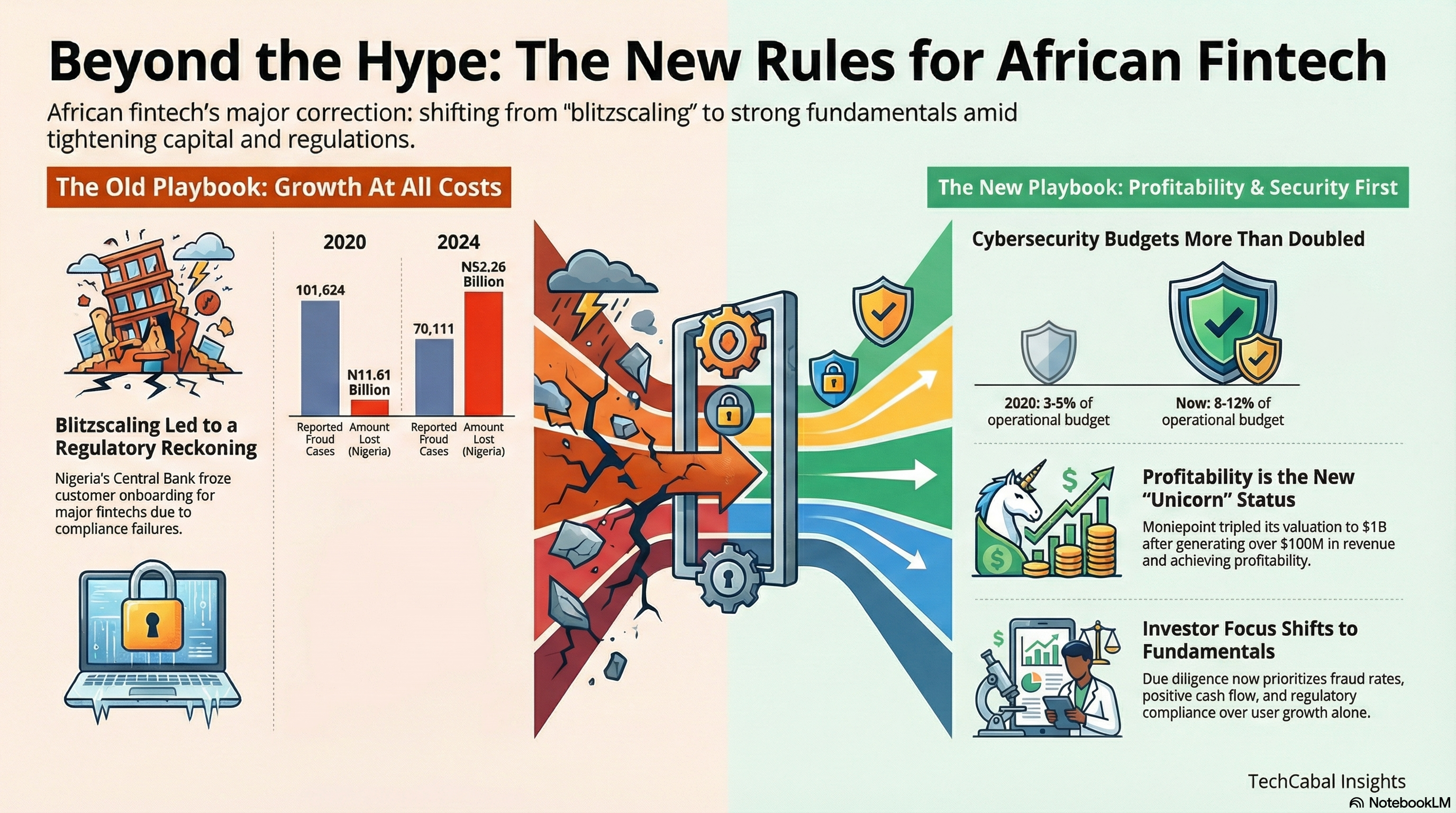

The State of Tech in Africa Report H1 2025 gives a robust assessment of what is happening in African tech and projections for the future. Download it here.