In Africa, the notion of artificial intelligence (AI) accelerating growth is often met with an equal dose of excitement and scepticism. Depending on what side of the divide you fall on, you will find arguments to advance your stance. However, almost everyone agrees that AI is accelerating at a breathtaking pace, finding applications that cut across all walks of life.

A recent global Work Trend Report from Microsoft and LinkedIn (which curiously excluded Africa) revealed that generative AI use nearly doubled in the last six months, with 75% of knowledge workers using it—up from 46%. Eighty-five percent of workers said it helped them focus on important work, while 90% reported time savings, a statistic that will only climb as more startups hop on the AI train.

In May, Afrilabs, a network of research and innovation hubs, released a report mapping AI startups on the continent. The report highlighted the status, challenges, and opportunities for African AI startups and their ecosystem. Here are key takeaways.

African AI startups are still in their early stages

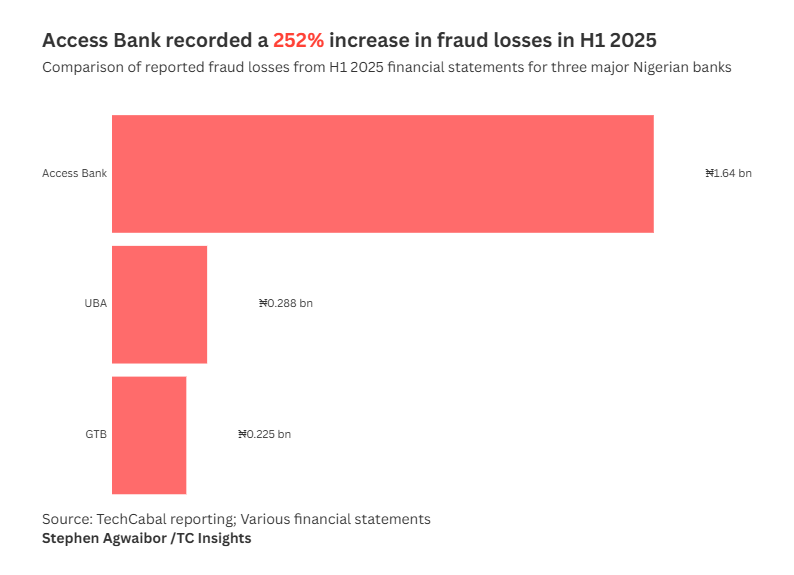

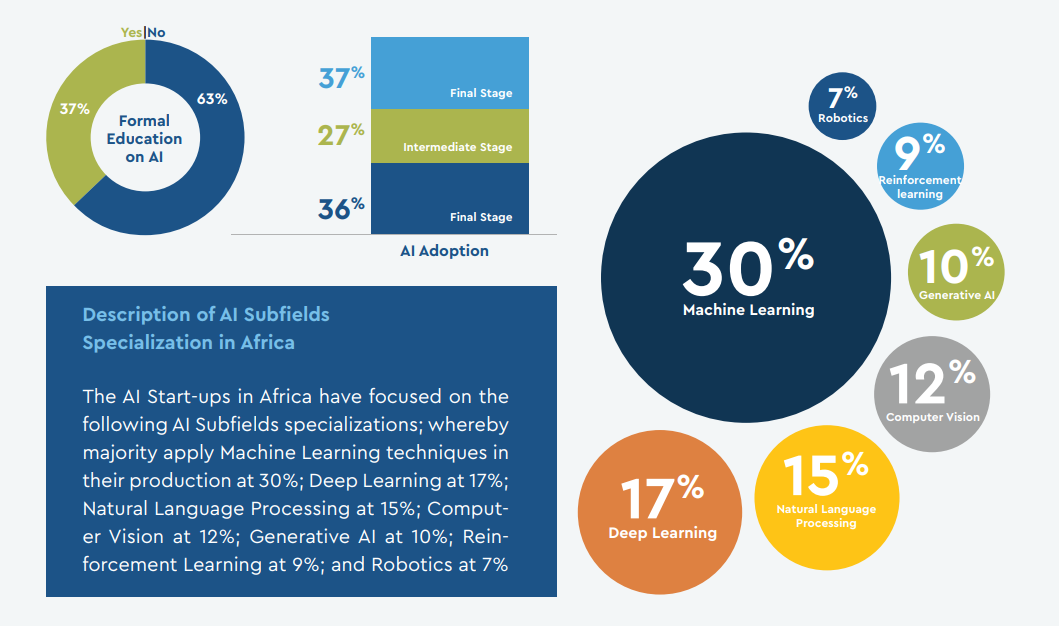

According to the report, over 2,400 companies in Africa specialise in AI, with 41% being startups. Approximately $2.02 billion has been invested in promoting AI activities on the continent. However, 63% of African AI startups are in the initial and intermediate stages (beginners and experimenters) of growth, suggesting these investments may take time to materialise. AI could potentially contribute $1.2 billion to the continent’s GDP by 2030 if it captures just 10% of the fast-growing global AI market.

[Description of AI formal education and AI subfields specialization / Afrilabs]

Education and healthcare lead AI adoption

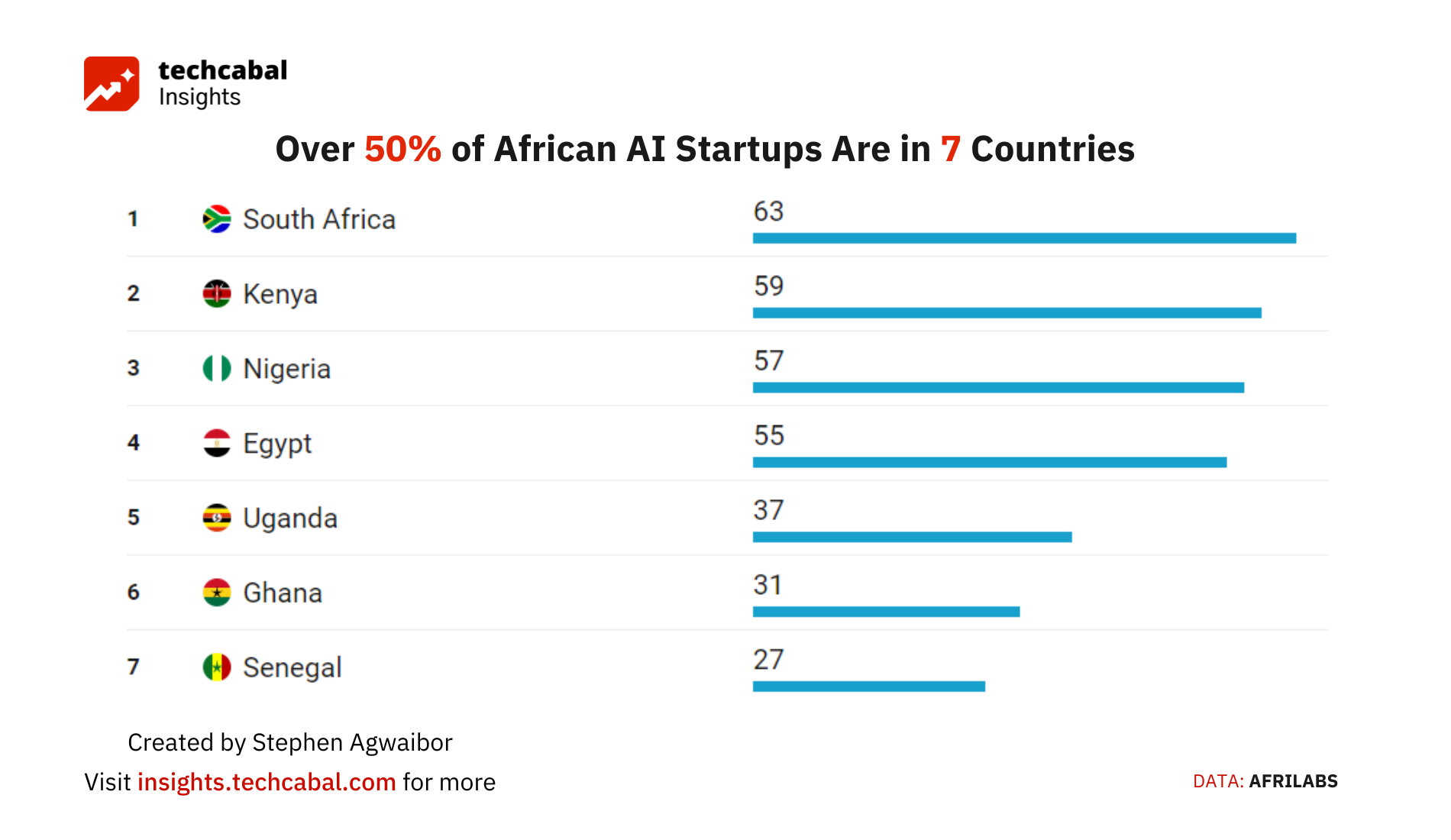

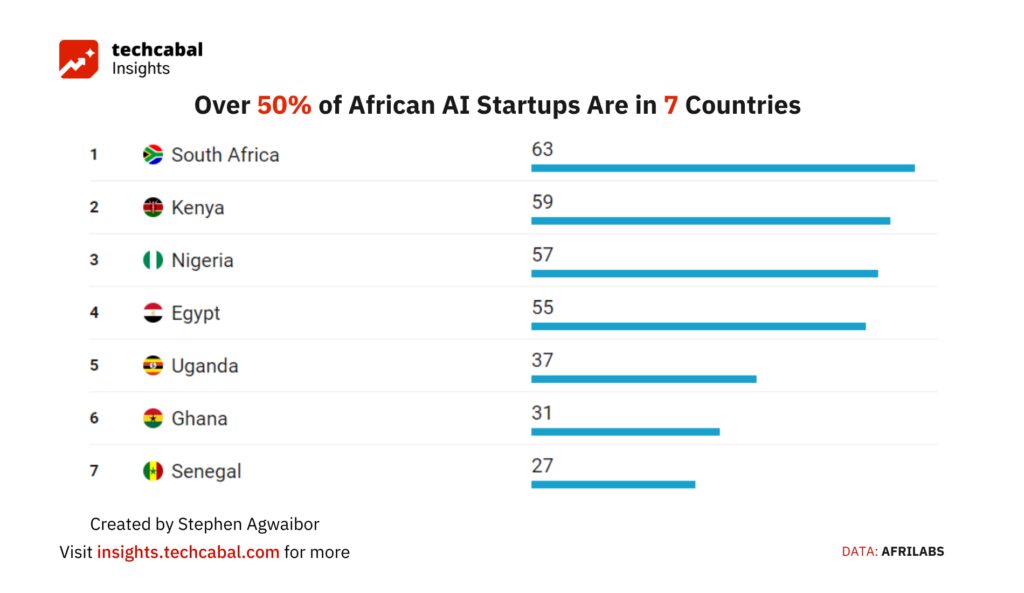

The survey covered over 660 AI startups across various sectors. Seven out of 46 countries account for more than 54% of all AI startups. Education recorded the highest impact with 216 entities, followed by healthcare with 114. Agriculture and manufacturing showed the lowest impacts, with approximately 53 entities each. However, more data is needed from some West, Central, and East African countries to draw definitive conclusions about these sectors.

[For data requests or research services, reach out to TC Insights via this link]

Challenges and opportunities for growth

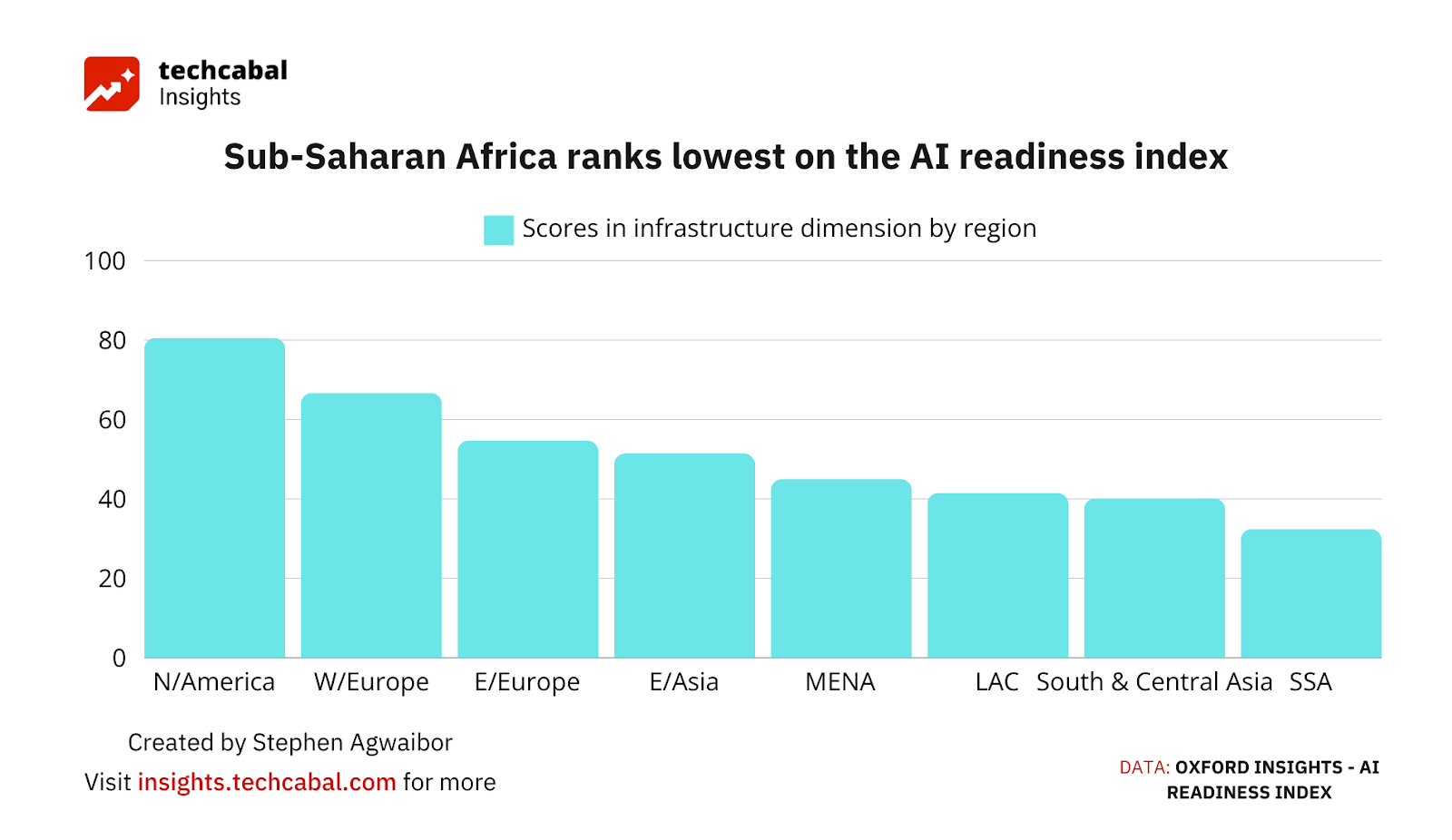

AI is powered by a vast degree of computing power, which in turn relies heavily on massive datasets. The study notes that a lack of data access, inadequate cloud infrastructure, limited funding, and regulatory barriers still pose challenges for African AI startups. The average AI readiness index for all African countries stood at 26.9, which is very low compared to other regions globally.

However, some progress is being made. Until recently, Mauritius was the only African country with an AI strategy. That is now changing, with Rwanda, Benin, and Senegal being the first Sub-Saharan countries to adopt an AI strategy. Nigeria is currently developing one.

Promising findings from the study show that some African countries, like Tanzania, have adapted well to broadband technologies to provide high-speed internet services. Others have taken concrete steps in building data centres.

Over the next five years, growth and investment rates for AI startups on the continent are predicted to reach 77% and 62%, respectively. Despite low adoption rates, African AI startups have avenues to enhance various socioeconomic activities. For example, South Africa’s health department is exploring AI-powered computer-aided detection to combat tuberculosis, presenting opportunities for AI-integrated health startups.

In conclusion, while African AI startups face significant challenges, they also stand on the brink of immense potential, provided there are concerted efforts by stakeholders towards bridging the digital and infrastructural gaps.

*****To gain more insights into the report, download via this link.*****