Africa’s fintech sector is experiencing a critical inflexion point. While 71% of limited partners cite weak exit environments as their primary concern when investing across the continent, and exit transaction values declined 26% annually between 2021 and 2023, according to Boston Consulting Group, a couple of strategic transactions may be rewriting the playbook for value creation and liquidity generation.

Recent high-profile deals, including Silverbacks’ 5x return on OmniRetail and dLocal’s proposed $150 million acquisition of AZA Finance, provide insights into the current state of play for M&A deals on the continent. These transactions reveal pathways emerging for scaling fintech operations and unlocking investor value across Africa’s fragmented but rapidly digitising economy.

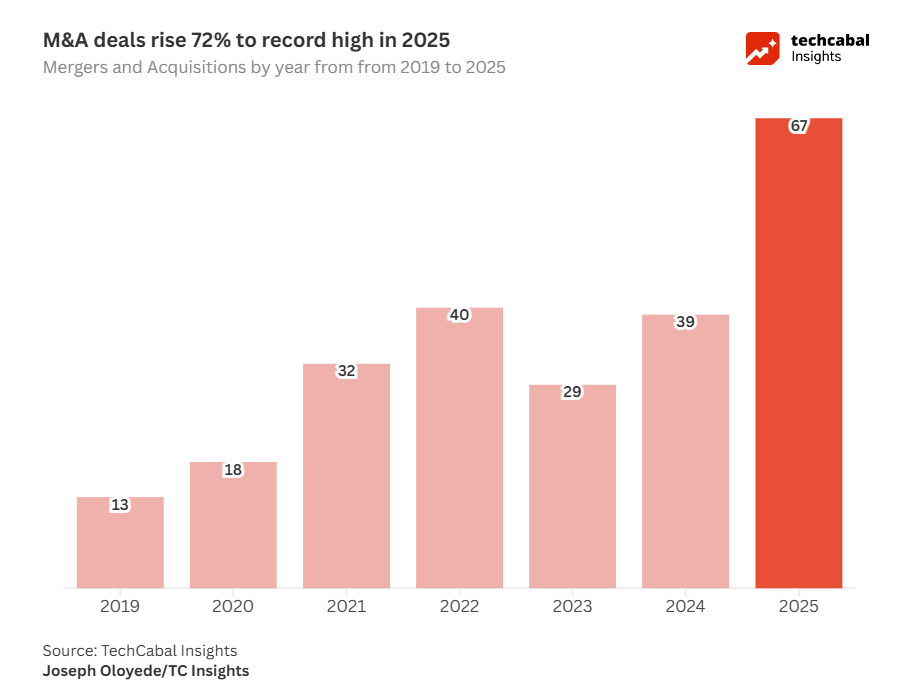

Image source: Techcabal

Secondary market momentum

The most striking development is the maturation of secondary markets. Private equity-to-private equity transactions have doubled from 15% to 30% of total exits over the past decade, providing crucial liquidity for early-stage investors while enabling growth capital deployment. This evolution addresses a fundamental challenge: the 48% decline in traditional PE exits since 2022, as reported by the African Private Equity and Venture Capital Association (AVCA).

Silverback Holdings exemplifies this trend. Following their 29x return from LemFi in May 2025, their 5x OmniRetail partial exit demonstrates how sophisticated investors generate consistent returns despite challenging market conditions. OmniRetail, which has maintained its position as Africa’s fastest-growing company for three consecutive years according to the Financial Times, achieved this through systematic digitisation of informal retail supply chains.

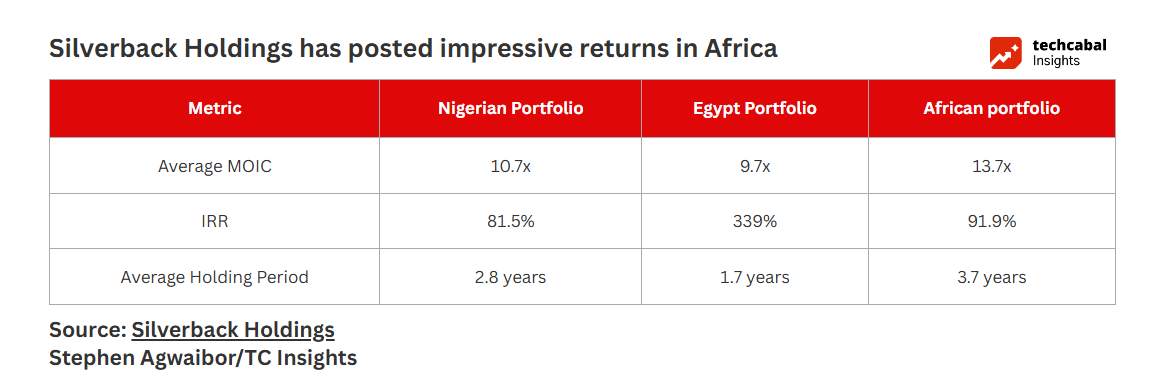

The numbers point to fintech’s dominance: Silverback reports a 13.7x multiple on invested capital (MOIC) from fintech investments across Africa, significantly outperforming other sectors and reflecting its ability to address fundamental infrastructure gaps while generating scalable revenue streams.

ALSO READ: How can African tech deliver more exits?

Corporate acquisition

Traditional corporates are increasingly viewing fintech acquisitions as digital transformation accelerators. Flour Mills of Nigeria’s $20 million investment in OmniRetail mirrors the successful Stripe-Paystack model, where acquirers gain technology capabilities and market access through strategic partnerships.

The OmniRetail case study reveals the power of vertical integration. The platform now connects 150,000 retailers with 145 manufacturers and 5,800 distributors across 12 Nigerian cities. Through its Traction Apps acquisition, OmniRetail processes ₦1.8 trillion ($1.08 billion) annually while facilitating access to ₦200 billion ($120 million) in merchant financing. This creates a compelling value proposition: reduced distribution costs, enhanced payment infrastructure, and expanded credit access within a single ecosystem.

Cross-border infrastructure: The dLocal-AZA paradigm

The proposed dLocal-AZA Finance acquisition represents a sophisticated approach to cross-border payments infrastructure. The merged entity would create the first truly scalable LatAm-Africa payments corridor by combining dLocal’s Latin American expertise with AZA’s 17-country African presence.

The acquisition partly hinges on regulatory efficiency. The combined entity would, subject to regulatory approval, streamline compliance across multiple jurisdictions. This matters significantly in a continent where cross-border payment costs average 8.9% of transaction value, higher than the 6.8% global average.

Technology stack integration

The technical integration promises substantial operational improvements. dLocal’s API-driven settlement infrastructure, which processed $25.6 billion in transaction volume in 2024 (up 45% year-over-year), would merge with AZA’s hybrid fiat-crypto rails serving traditional banking and digital asset corridors.

Early projections suggest 20-30% cost reductions for SMEs and merchants, primarily through reduced correspondent banking fees and faster settlement times. With AZA processing over $9 billion in transactions since inception, the combined platform would handle approximately $34.6 billion in annual payment volume across 30 countries.

Risk factors

Currency volatility and capital controls

African fintech companies face unique challenges that don’t affect their global counterparts. Currency volatility remains a persistent issue—the Nigerian naira depreciated over 40% against the dollar in 2023, while the Ghanaian cedi faced similar pressures. These fluctuations complicate revenue planning and investor returns, particularly for companies with multi-country operations.

Capital controls in markets like Angola and Zimbabwe create additional complexity for cross-border payment providers. The dLocal-AZA combination, while strategically sound, must navigate these regulatory constraints while maintaining operational efficiency.

Talent retention and integration

Post-acquisition integration presents significant challenges in Africa’s competitive fintech talent market. Engineers and product managers command premium salaries, and acquisition-related uncertainty often triggers talent flight. The success of several such M&As may rely on the incentives in place to retain top talent.

Regulatory harmonisation

Cross-border fintech success requires regulatory frameworks that match commercial realities. The African Continental Free Trade Area (AfCFTA) provides a policy foundation, but implementation remains inconsistent. Payment service provider licensing requirements vary significantly between countries, creating compliance complexity that may undermine operational efficiency.

In summary, while execution challenges may lie ahead, these deals provide positive signals of Africa’s slow but steady transition from venture experiment to institutional-grade market. What are the key takeaways?

- For investors: Secondary sales remain the most popular mode of exits, recycling capital for smaller investor rounds

- For corporates: Acquisitions provide digital transformation levers and offer a viable lifeline

- For regulators: Cross-border frameworks must evolve to match commercial realities