Africa’s journey into the age of artificial intelligence is not a single story, but a tale of stark contrasts. Across the continent, a digital transformation is underway, fueled by over $1.25 billion in AI-specific venture capital and supported by a growing network of 211 data centers. On the policy front, over 70% (39) of African countries have enacted data protection laws, building a foundation for digital trust. However, a closer look reveals that these resources and investments are not evenly distributed. To understand this complex landscape, the continent’s AI readiness can be classified into three distinct tiers, revealing why some nations are accelerating while others are still building their foundation.

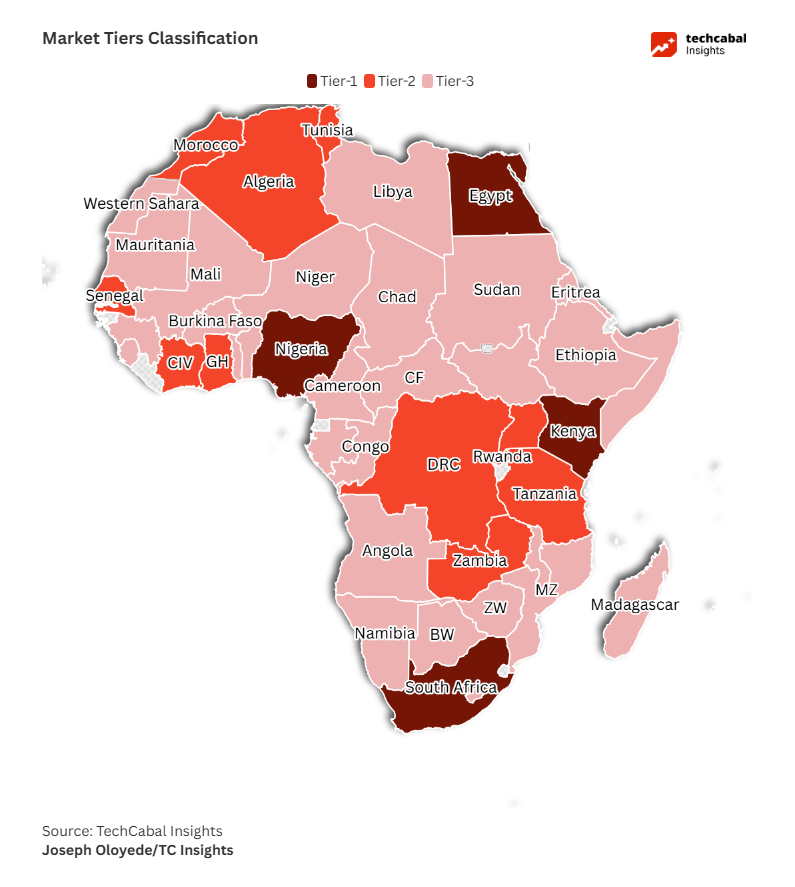

The first and most critical differentiator is the concentration of skills and talent, which serves as the engine for any tech ecosystem. The Tier 1 markets of Nigeria, Kenya, South Africa, and Egypt exhibit a strong talent density, acting as magnets for the continent’s developers and entrepreneurs. They are home to over 230 AI-specific startups and a staggering 7,000+ general tech startups across the four markets. In contrast, the Tier 2 nations, such as Morocco and Ghana, have a growing but less concentrated talent base with around 160 AI startups combined. The Tier 3 countries typically feature a more fragmented skills landscape, with most having fewer than 50 AI startups, indicating a nascent pipeline for specialised talent still in its early stages of development.

ALSO READ: Africa Investor Guide

This talent distribution is directly supported by the availability of data infrastructure, the physical backbone required to build and deploy AI solutions. Here again, the tiers are clearly defined. Tier 1 nations boast a high concentration of data centres, with 49 in South Africa, 18 in Kenya, 16 in Nigeria, and 14 in Egypt. Crucially, they host direct cloud infrastructure from global hyperscalers like Amazon AWS, Microsoft Azure, and Google Cloud. Tier 2 countries show mid-range but growing coverage, with markets like Morocco and Ghana hosting 8 and 7 data centres respectively, and are beginning to attract direct cloud investments. Tier 3 ecosystems have a much sparser distribution, with most having fewer than ten data centres and a heavy reliance on services from regional hubs, which can impact latency and cost.

A mature policy framework is the third pillar, providing the stability and trust necessary for investment to flow. The Tier 1 countries lead with comprehensive and enforced data protection laws, such as Nigeria’s Data Protection Act, 2023, and South Africa’s Protection of Personal Information Act, 2021. In Tier 2, most nations have made significant progress by enacting similar data protection laws and are actively pursuing national digital strategies to encourage innovation. The regulatory landscape in Tier 3 is characterised by mixed adoption, where many countries are still drafting legislation or have yet to build strong enforcement capacity, creating a less certain environment for data-intensive AI businesses.

Ultimately, the flow of capital is the starkest indicator of this tiered reality, creating a significant funding gap between the continent’s leading hubs and its emerging ecosystems. This financial disparity makes it clear that progress cannot happen in silos and presents a critical opportunity for strategic, cross-continental collaboration. For a truly pan-African digital leap, the well-funded Tier 1 hubs must serve as regional anchors, channeling investment, infrastructure access, and talent to their Tier 2 and Tier 3 neighbors. Fostering these connections is essential for building a resilient ecosystem where innovation can thrive across the entire continent.

Conclusion

Looking ahead, the future of AI in Africa will be defined by a crucial shift from consumption to creation, driven by a unique “learning by doing” culture as innovators tackle urgent challenges in healthcare, agriculture, and climate. This adoption may even accelerate to fill workforce shortages in roles that AI is increasingly capable of performing. Realizing this vision, however, will require more than just venture capital; it demands innovative and blended financing models where public-private partnerships like the Cassava-Nvidia AI factory are mobilized to build the foundational compute power and stable energy supply the continent needs. Ultimately, the trajectory is one where African nations transition from being passive data sources for global models to becoming active architects of a responsible and context-aware AI, built by Africans, for Africa.

Want deeper insights or a custom report on this topic? Fill out our quick form, and the TechCabal Insights team will get in touch with you.