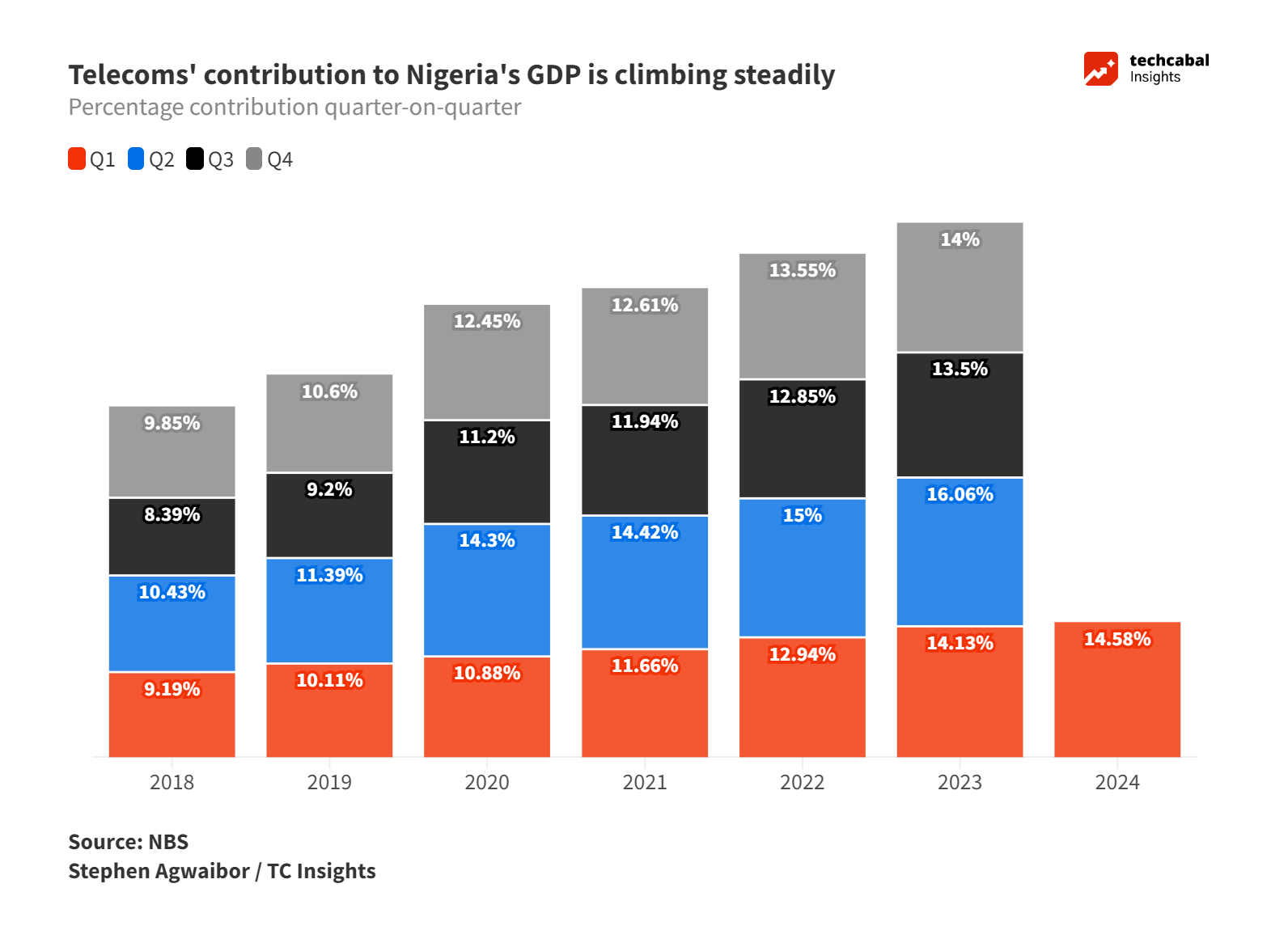

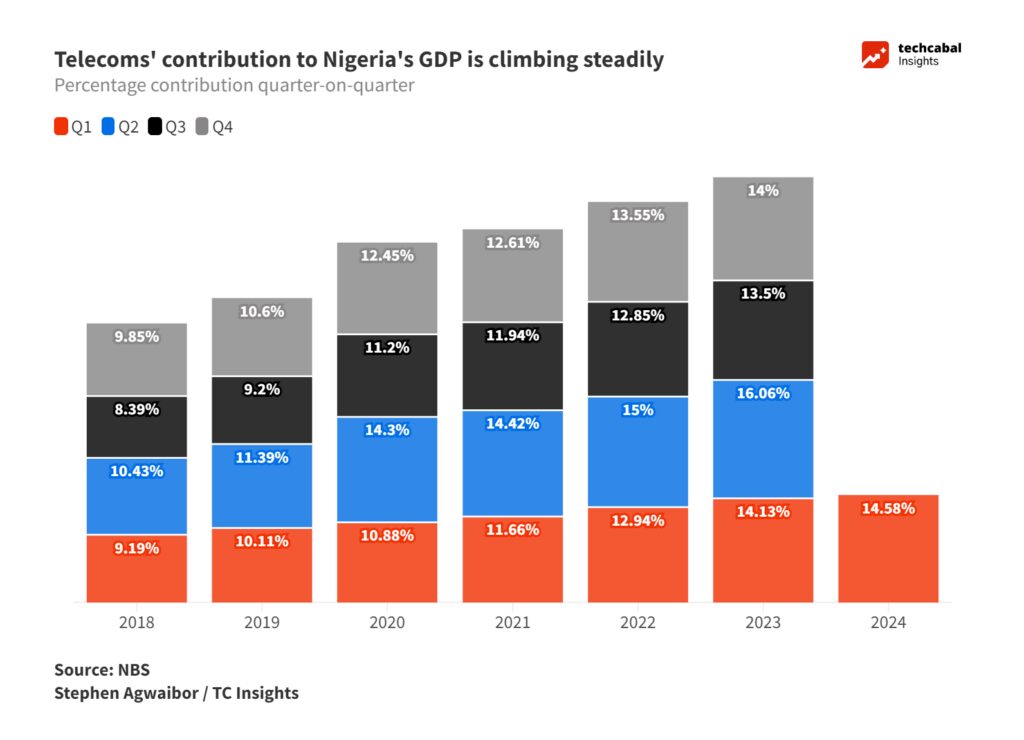

The telecoms industry is now a bedrock of Nigeria’s economy. From contributing 7.6% to GDP in 2014, it has nearly doubled a decade later, accounting for 14.58% of GDP as of Q1 2024. By comparison, the erstwhile booming oil sector, which accounted for 8.9% of Nigeria’s GDP in Q4 2014, had declined to 6.38% by Q1 2024.

Much of that progress can be attributed to policy reforms like deregulation from the late 90s to the early 2000s. On the back of these reforms in sectors like telecoms, banking and pension management, Nigeria witnessed an unprecedented 15.33% growth rate in 2002.

The rise and rise of telephone lines in Nigeria

Telephone lines rose from 450,000 in 1985 to 38 million in 2007. By 2010, that figure more than doubled to 85 million. As of 2023, Nigeria had 224.7 million active telephone lines.

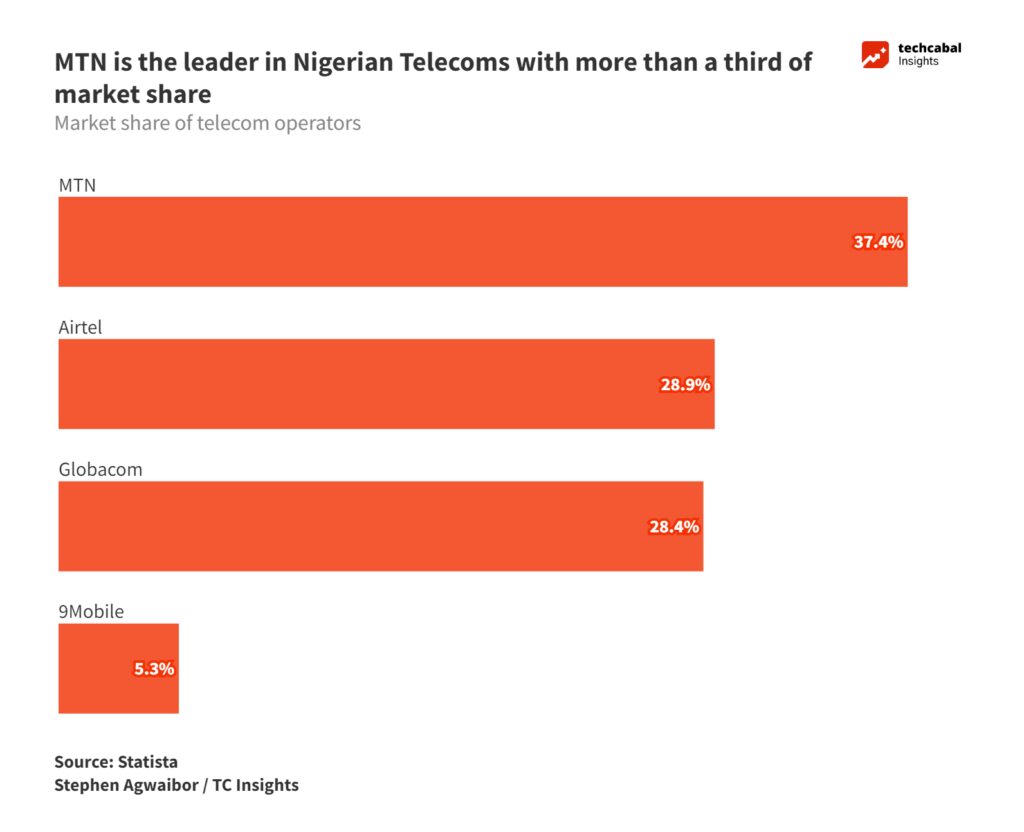

There are four major service providers in Nigeria. As of March 2024, MTN was Nigeria’s largest mobile telecom operator, with over 77 million subscribers or roughly 37% of the market share. Airtel and Globacom follow closely, holding about 29% and 28% respectively.

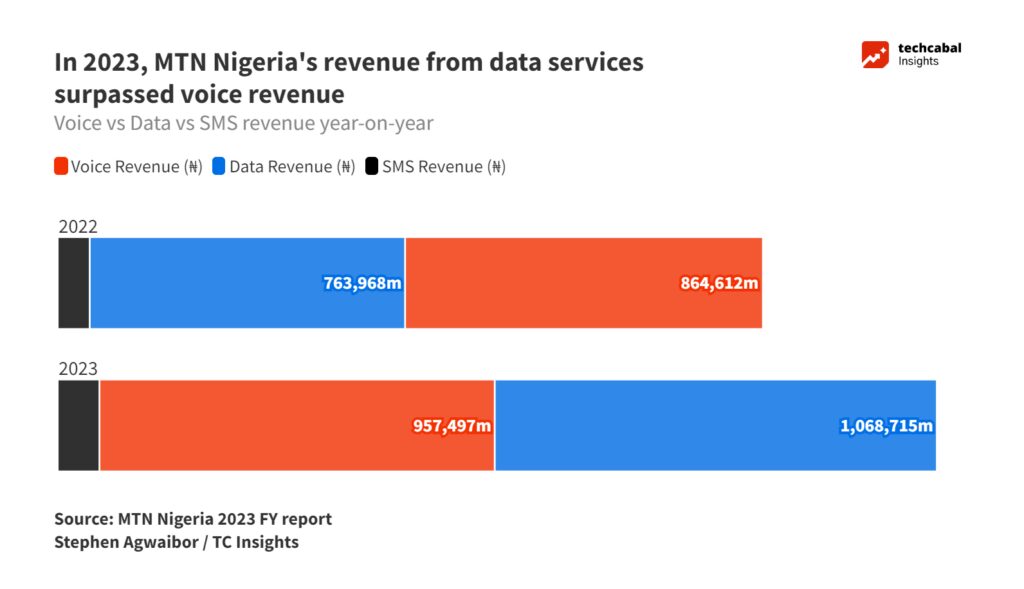

Data service is becoming a key revenue driver for telecoms operators

Based on Q1 data from the National Bureau of Statistics (NBS), voice subscriptions lead data subscriptions by 219.3m to 164.3m. Looking closely, there’s a noticeable trend with voice subscriptions falling and data subscriptions rising. Active voice subscribers fell 2.41 per cent quarter-on-quarter, just as active internet subscribers rose by 4.33 per cent quarter-on-quarter.

MTN’s revenue from data has been growing tremendously in the last decade. In contrast, its revenue from voice calls has fallen as more users are switching to data services for anything from calls to conducting online transfers. At the end of the 2023 financial year, data services alone contributed to 43% of its revenue, surpassing voice for the first time.

[For data requests or research services, reach out to TC Insights via this link]

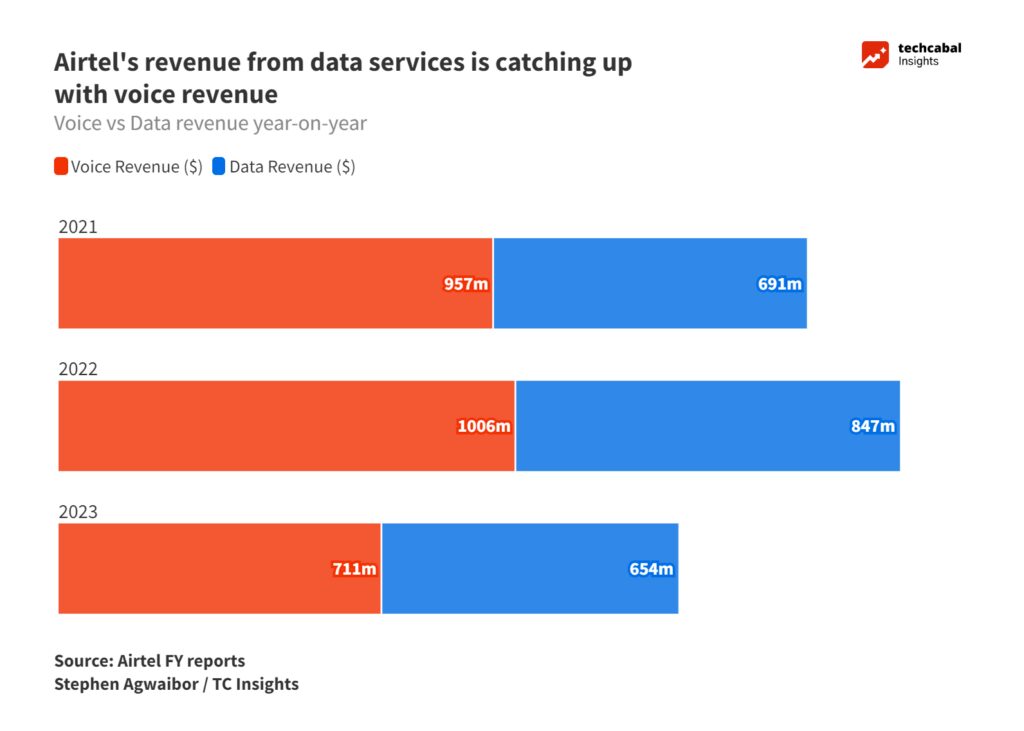

For the same period, Airtel Nigeria posted $711m in voice revenue and $654m in data revenue. In 2022, Airtel recorded $1.06bn and $847m as voice and data revenues, respectively. In 2021, it was $957m and $691m respectively. The trend suggests data is catching up, and may only be a matter of time before it becomes Airtel’s primary revenue driver.

Telecoms companies are keying into adjacent financial services

In 2018, the Central Bank of Nigeria (CBN) granted mobile providers the license to operate mobile payment solutions, such as mobile money, through payment service banks, which have traditionally been the remit of banks, payment service providers and fintechs. The arguments for a Telco-led mobile money framework are boosted by their subscriber numbers, available infrastructure and growing agent network.

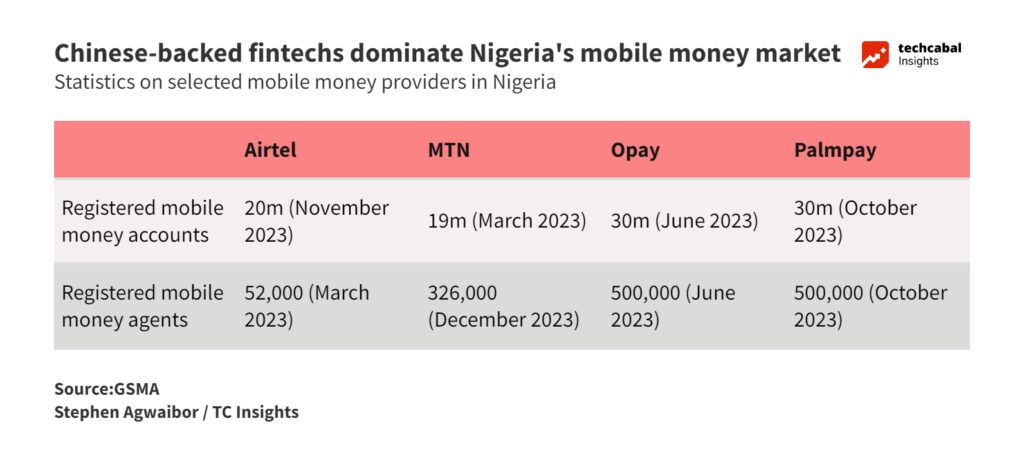

However, telcos must contend with established players like Chinese-backed fintechs, Opay and Palmpay, which have a wider reach. MTN Momo has also had to deal with losses of around ₦22bn due to a glitch it suffered at its launch in May 2022. Still, its active users increased from 3.3 million to 5.3 million in 2023, and it claims an agent base of 326,000.

With the unbanked population in Nigeria still significant, an increase in mobile money penetration via telecom providers, especially in rural areas, could be pivotal towards improving financial inclusion.

Conclusion

Given current challenges, including forex losses, right of way, and fears around increased taxation, continued large-scale investment in internet infrastructure may not be feasible, contributing to fluctuating service delivery and significant downtime, as observed recently. Despite these challenges, the rapid growth of Nigeria’s telecoms sector emphasises its critical role in the economy.

Looking ahead, the shift from voice subscriptions to data services as an emerging revenue driver signals a growing demand for digital services, just as fintech services become a battleground for both telecom operators and longstanding players in the banking and financial sectors. Ultimately, competition breeds innovation, which translates to better services for end users.