According to the International Monetary Fund (IMF), the informal economy comprises activities with market value and would add to tax revenue and GDP if recorded. Over the last few decades, the size of the informal economy has been decreasing globally. Nonetheless, it represents a substantial part of the economy, especially in sub-Saharan Africa, where 85% of employment is informal.

In Nigeria, the informal sector is a critical backbone of its economic landscape, contributing significantly to employment and about 58.2% of GDP. A recent report by Moniepoint revealed crucial insights into this often overlooked economy, revealing its potential and challenges. Below are five highlights from the report:

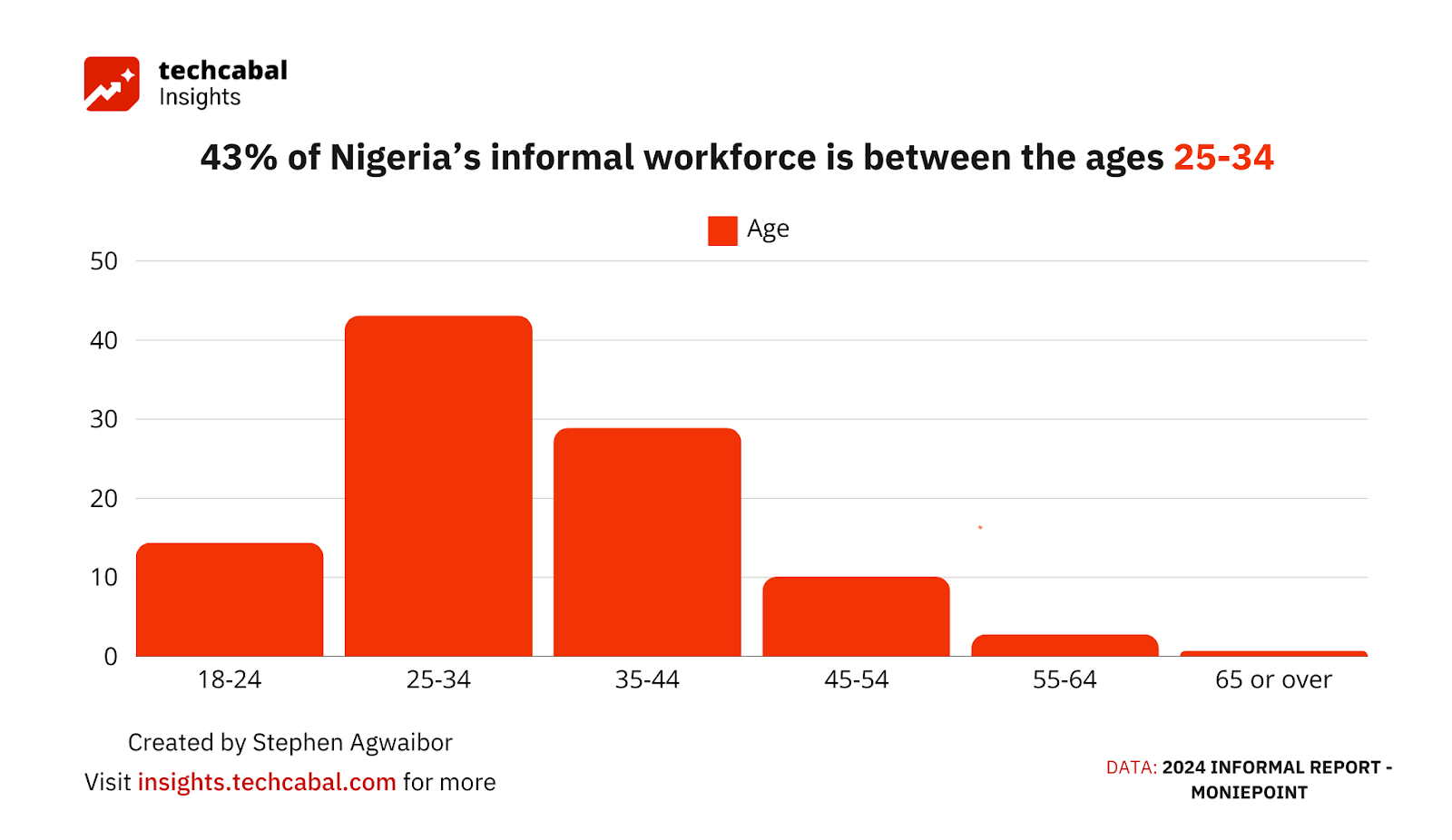

The informal economy is powered by young entrepreneurs

Nigeria’s informal economy is predominantly driven by young entrepreneurs. The report showed that 58% of informal business owners are under 34, with the largest group (43%) falling between 25 and 34 years. However, the prevalence of young entrepreneurs in the informal sector also points to wider economic issues. With unemployment being the primary motivation for 51.6% of respondents to start their businesses, the informal economy serves as a safety net in a challenging job market.

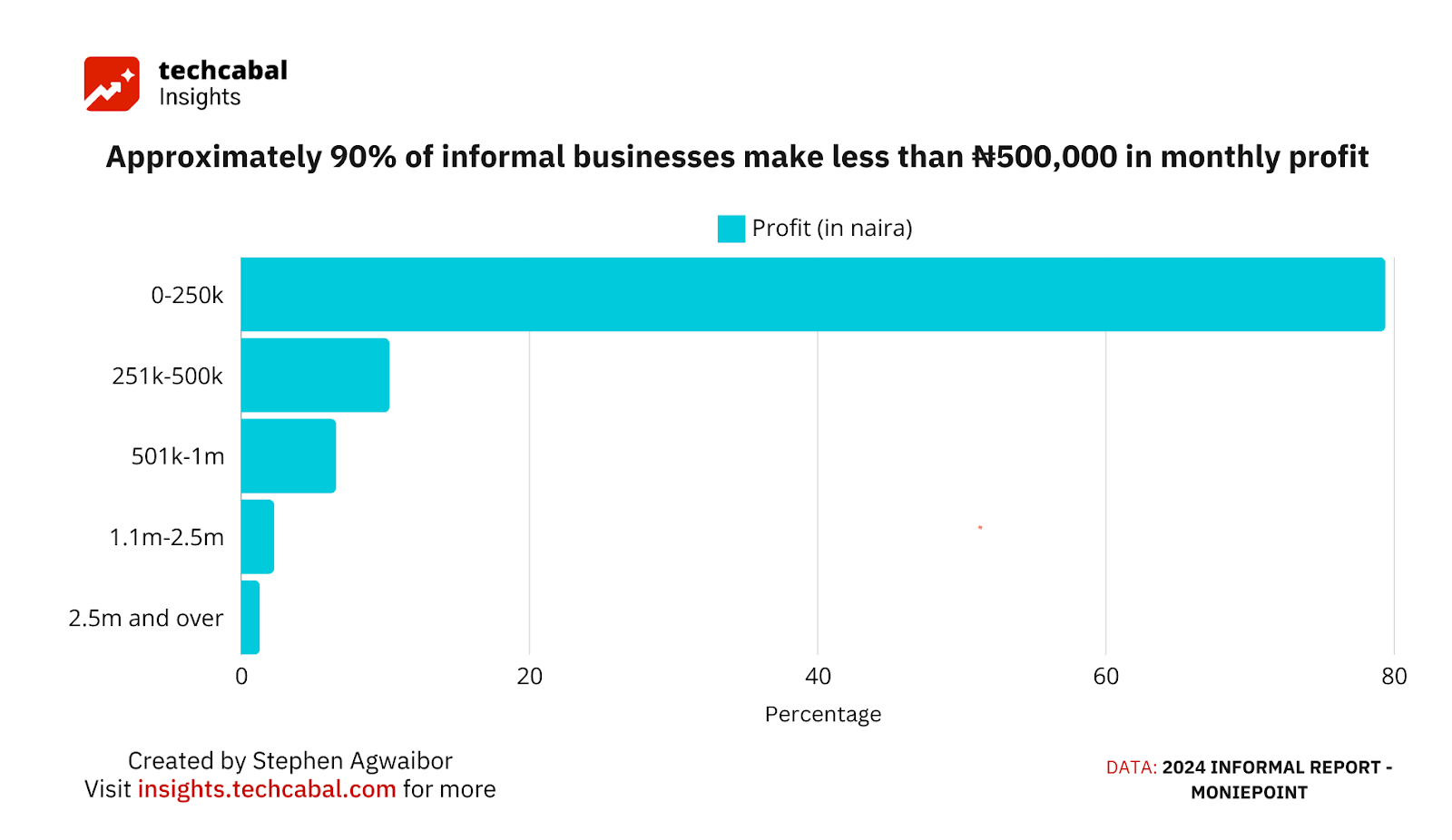

A wide gap still exists between generating revenue and profit-making

One of the most striking findings from the report is the disparity between revenue and profit in informal businesses. While many of these enterprises generate substantial revenue, with 72.3% reporting monthly revenues of over ₦1,000,000, profitability remains a significant challenge. Of the two million informal businesses surveyed, a staggering 90% of them make less than ₦500,000 in monthly profit.

[For data requests or research services, reach out to TC Insights via this link]

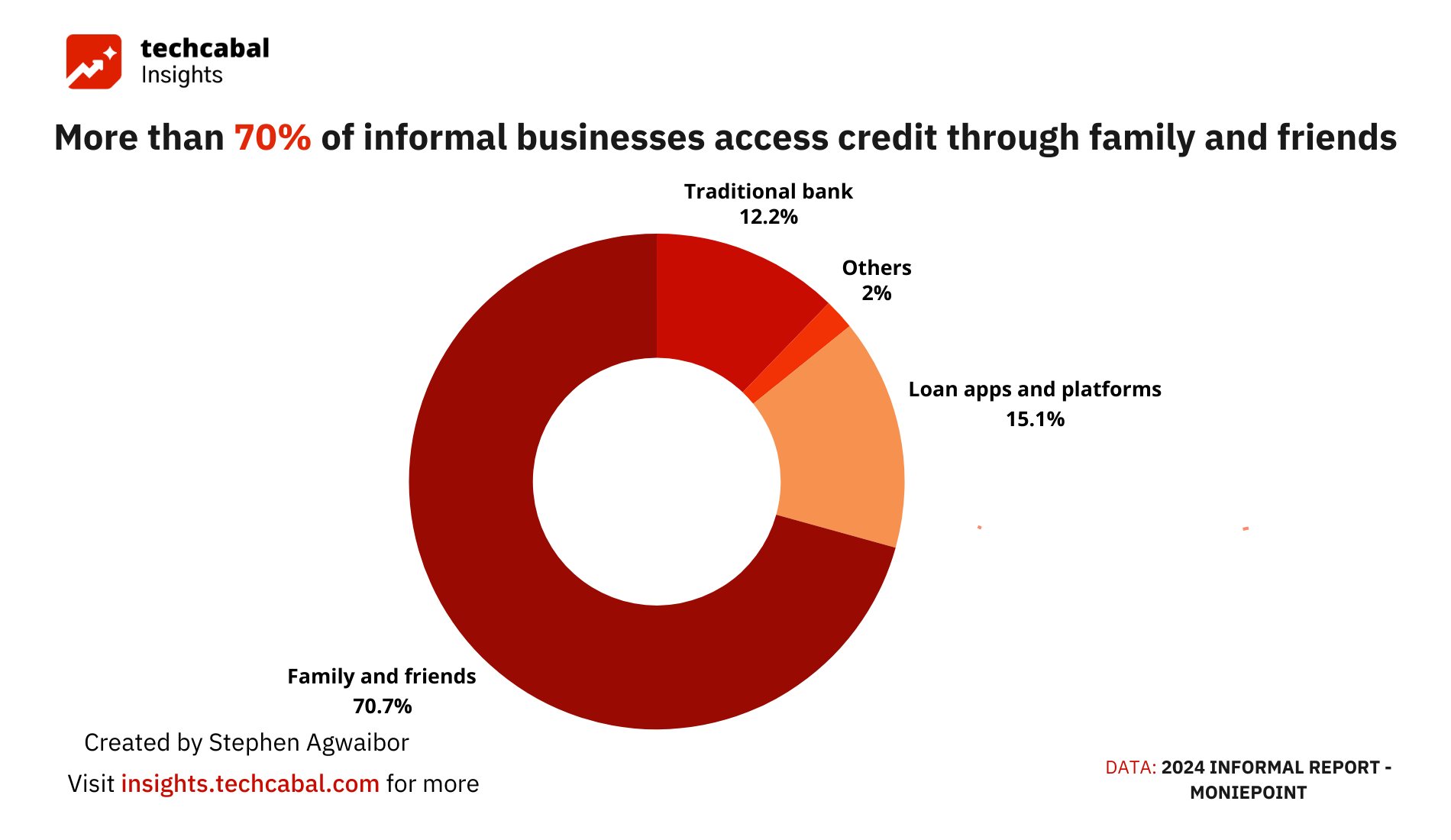

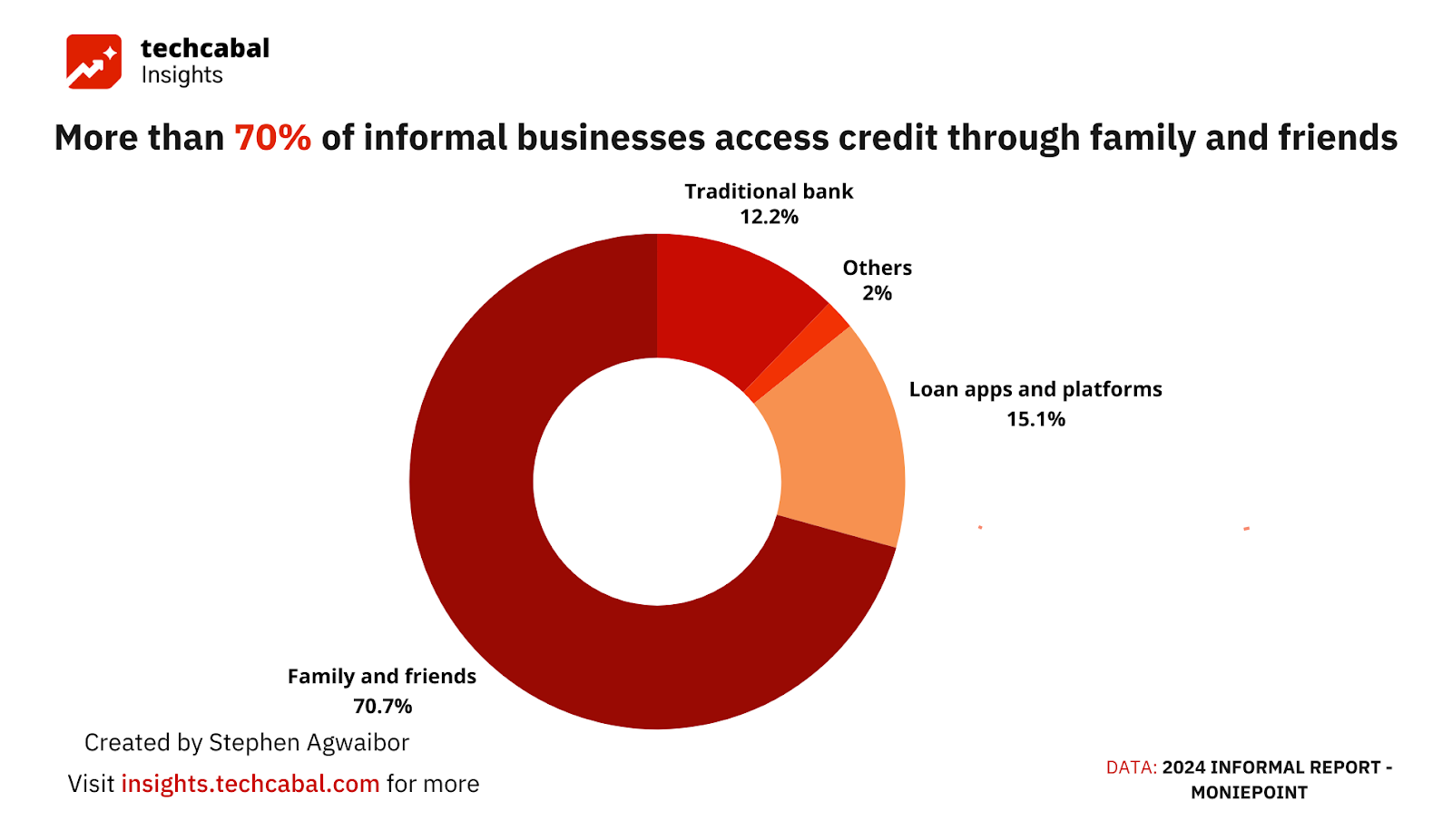

There’s an overreliance on personal networks to access credit

Access to credit is necessary for businesses to grow, and the report highlights how 70% of informal enterprises have accessed some form of credit. However, the primary source of this credit is friends and family (70.7%), followed distantly by loan platforms (15.1%) and traditional banks (12.2%).

This reliance on personal networks for financing indicates a significant gap in formal financial services catering to the informal sector and may speak to the difficulty in accessing these loans, coupled with high interest rates that make the idea less appealing for smaller businesses with low profit margins.

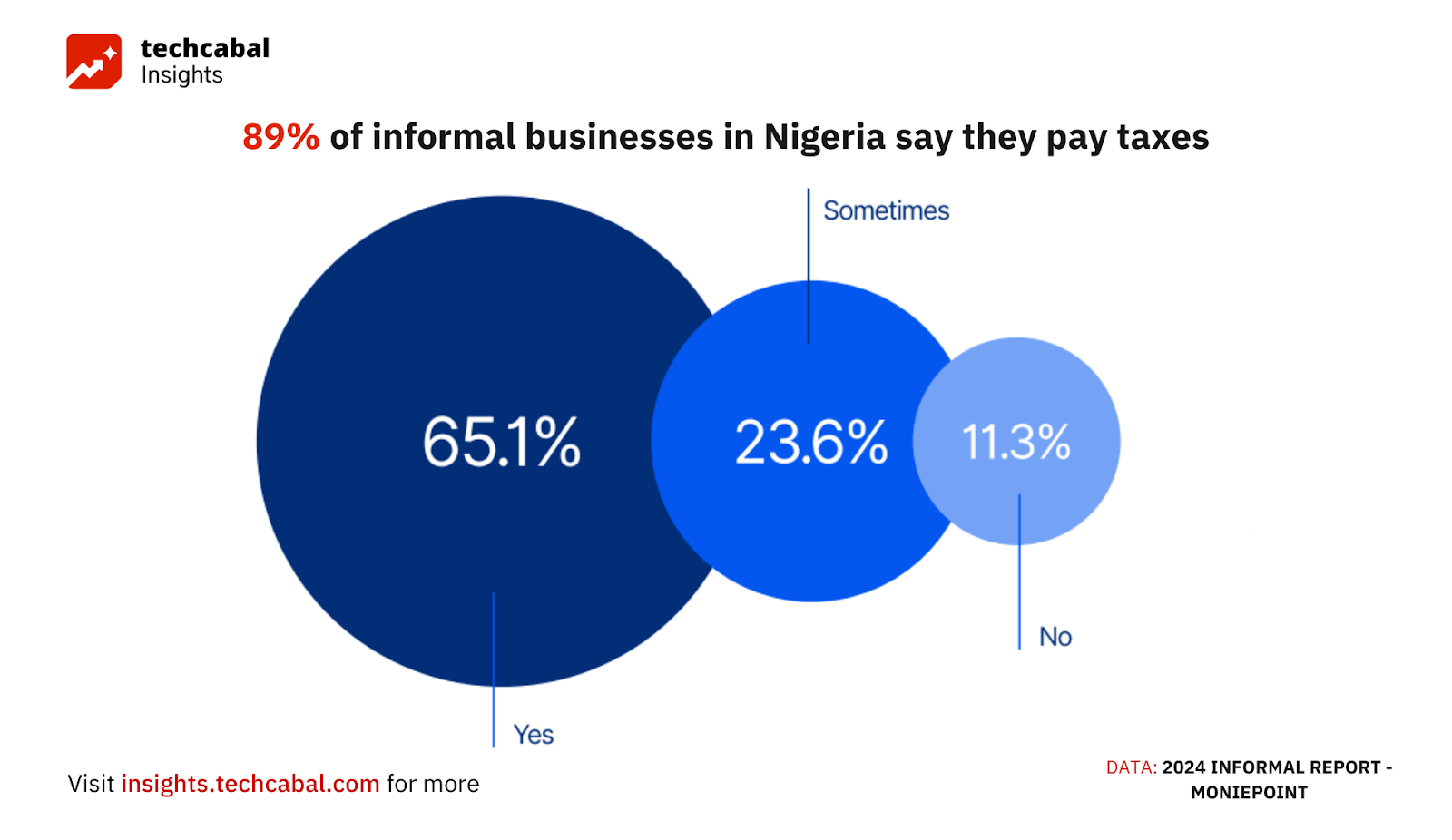

Informal businesses are likely to pay taxes

The most common indicator used to differentiate the formal economy from the informal economy is the level of taxation, with the latter being either non-existent or largely unregulated. At 7% of GDP, Nigeria has the fourth lowest revenue-to-GDP ratio globally. The report suggested that contrary to the popular idea that Nigerians hate taxes, 89% of businesses in the informal sector say they pay taxes. However, it comes in the form of market levies, which may not funnel into official channels and can vary from ₦3,500 to ₦15,000 annually.

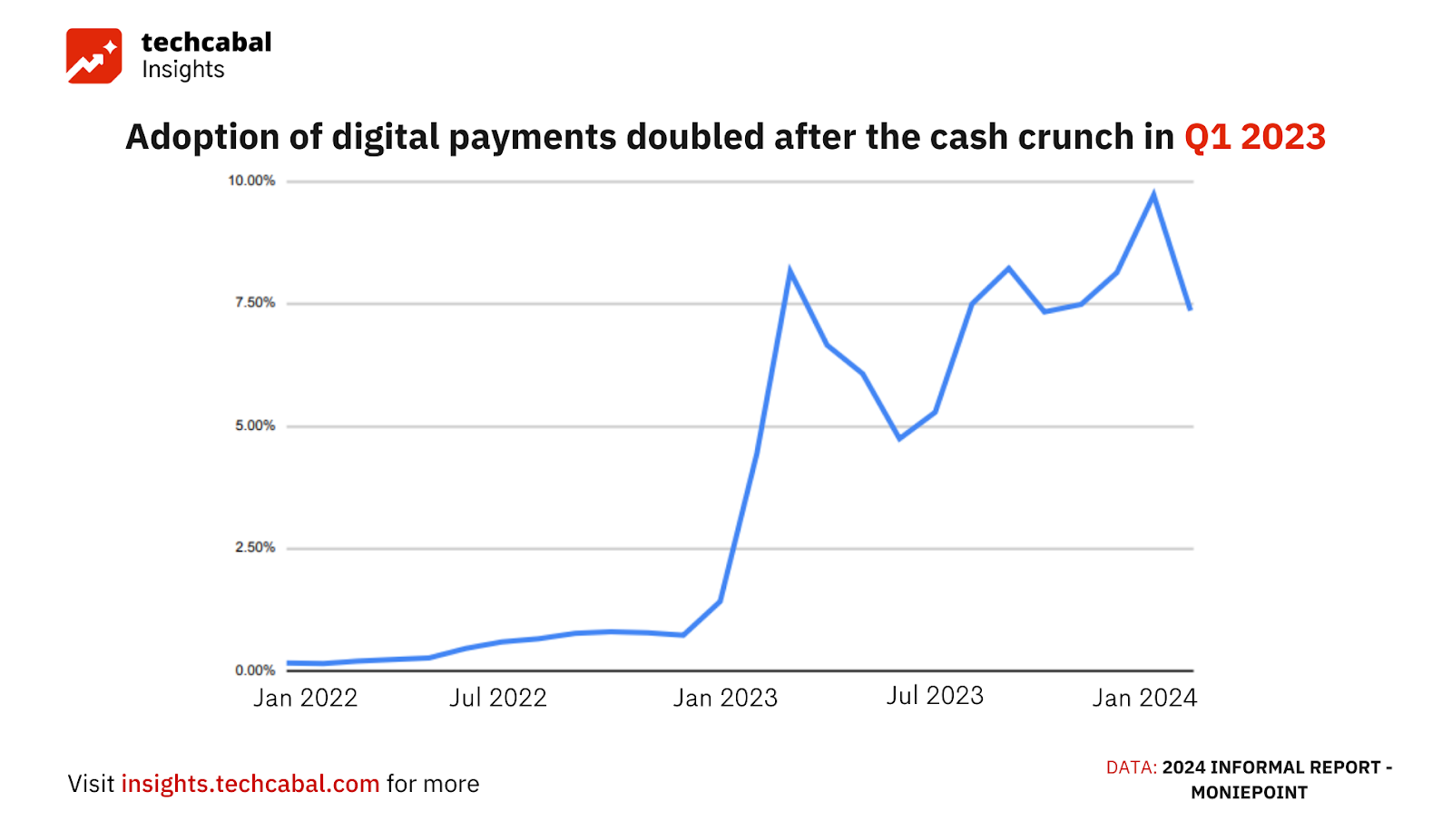

Digital payment is growing fast among informal enterprises

The report confirmed the truism that cash is king, with 52% of informal business owners stating they prefer to receive cash payments, citing reasons such as safety and ease of doing business. However, there’s a significant shift towards digital payments. Moniepoint’s data revealed that card payments are the most common method for resolving transactions (80.2%), more than four times online transfers (19.8%).

Following the cash crunch in Q1 2023, digital payment adoption doubled among informal businesses demonstrating the sector’s adaptability and the potential for technology to drive financial inclusion.

Conclusion

Nigeria’s informal economy presents enormous potential for economic growth and development. However, addressing critical issues such as low profitability, limited access to formal credit, and the need for business skills development is vital. Policymakers, financial institutions, and development partners must work together to create an enabling environment that supports the growth and formalisation of these businesses which serve as a lifeline for millions of Nigerians.