Safaricom, the telecoms giant from Kenya, is known for its many services, including fibre optics, cloud computing, and, most famously, its mobile money banking platform, M-PESA.

Originally incorporated as a private limited liability company in 1997, it became a public company with limited liability in 2002. In the years gone by, it has experienced steady growth. We looked through its recently released annual report to glean a few insights.

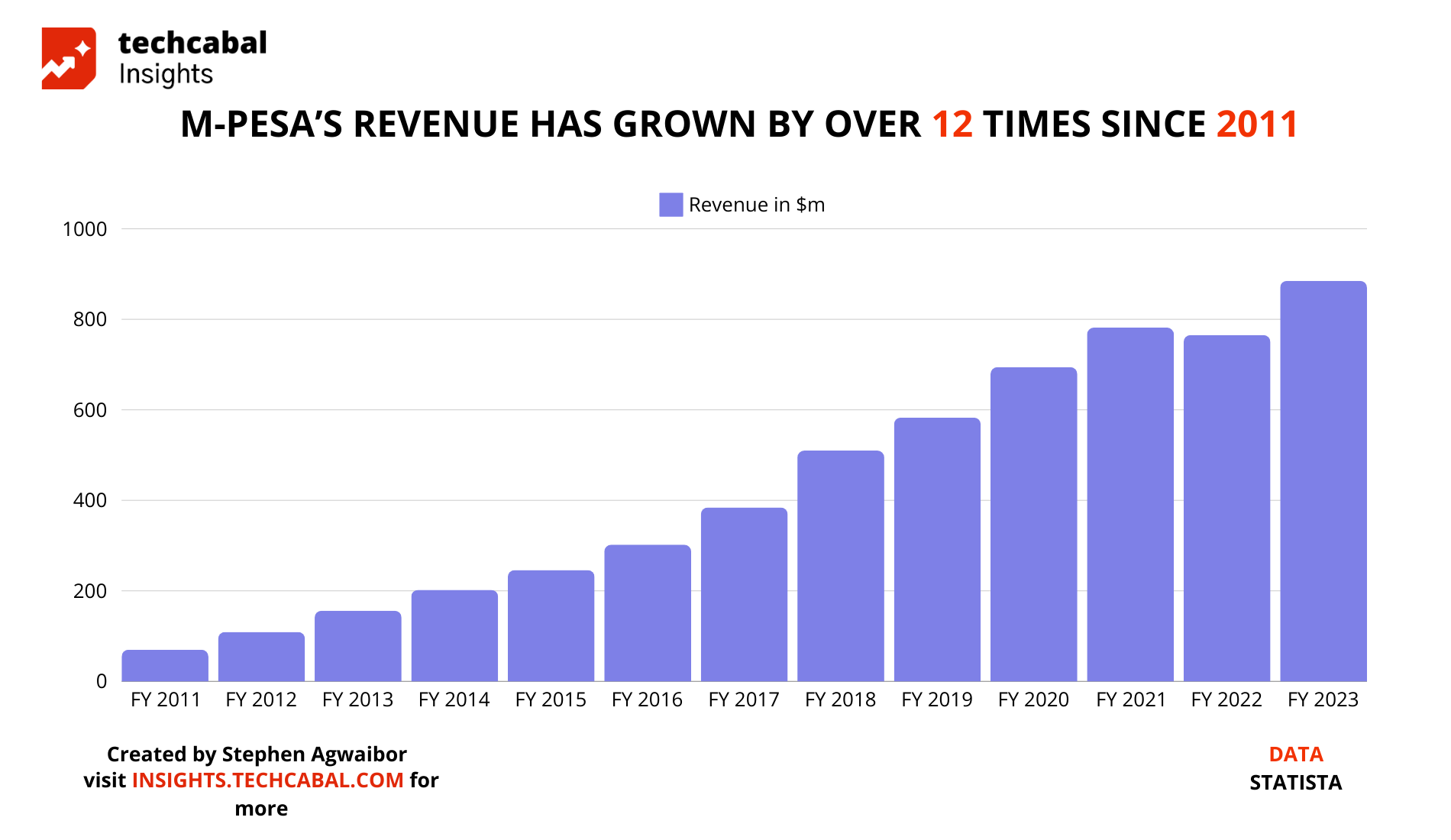

M-PESA: The revenue powerhouse

Named after the Swahili word for money, M-PESA remains Safaricom’s biggest moneymaker. Gross transactions on M-PESA were valued at KSh 35.9 trillion (~$267bn) in 2023, up from KSh 29.6 trillion (~$220bn) in 2022. Safaricom’s revenue grew by 5.2% from KSh 281.11 bn (~$2.1bn) in 2022 to KSh 295.69 bn (~$2.21bn) in 2023. Most of that came from M-PESA, contributing KShs 117.19bn (~$870mn) of Safaricom’s revenue. Year on year, M-PESA’s revenue grew by 8.8%.

A mix of high-utility products and an aggressive expansion strategy across East Africa is at the heart of M-PESA’s growth. Its Lipa na M-PESA (LNM), an e-commerce service that allows merchants to collect payments from customers using a till number, has been a smash hit. Safaricom recorded a 23.1% Y-o-Y increase in LNM merchants, from 492,772 in 2022 to 602,662 in 2023.

In Tanzania, where mobile money adoption rose from 60% in 2017 to 72% in 2023, M-PESA has cornered over a third of the market share, ahead of local competitors Tigo-Pesa and 15% more than Airtel Money.

Safaricom’s foray into Ethiopia remains a gamble

In 2021, Safaricom, via a consortium, bought a telecoms license for $850 million to operate in Ethiopia, targeting its large population that has been described as the “last frontier.” The move was fraught with substantial risk, especially as it happened in the thick of the country’s civil war and because, before establishing itself there, the telecoms sector was a government monopoly.

In 2023, Safaricom further secured a mobile money license for $150 million. Ethiopia now has three million Safaricom subscribers, contributing significantly to its estimated 45 million customers across Africa, including Lesotho, the Democratic Republic of Congo, Ghana, Mozambique, and Egypt.

MTN poses a significant competition

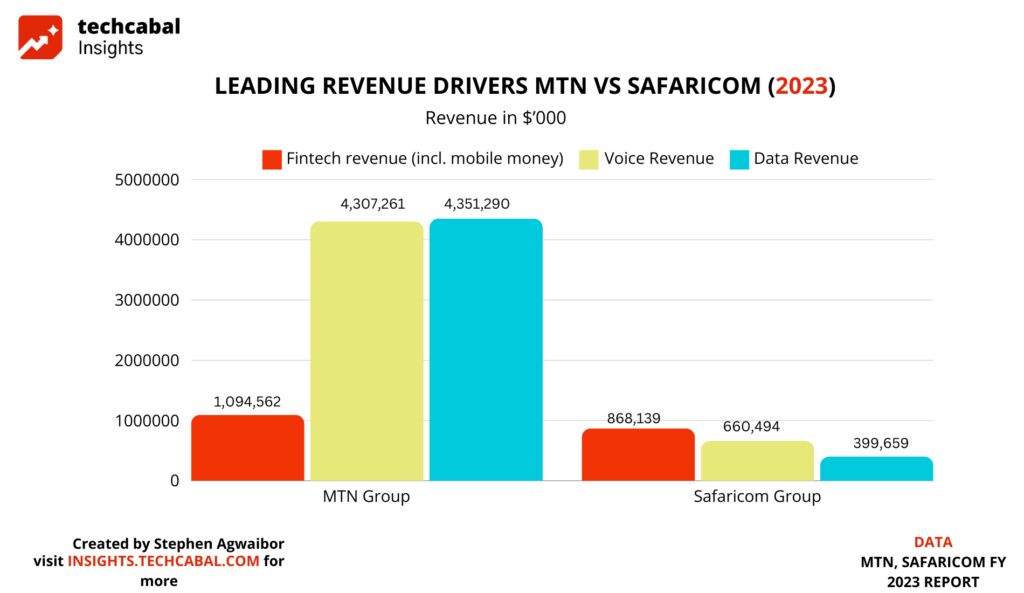

Safaricom has established a presence in East Africa, even in the face of players like Airtel. However, zooming out, it still faces competition from MTN, whose mobile money platform, MoMo, has already made inroads into 13 African countries, including East Africa, particularly Rwanda and Uganda. Although MTN has 72.5 million active mobile money users (compared to Safaricom’s estimated 45m), mobile money does not contribute as much to its bottom line as its core data service. Based on MTN’s latest financial report, fintech services make up only 9.3% of MTN’s revenue, with data services being the growth engine, contributing 37%. By comparison, fintech services comprise around 45% of Safaricom’s revenue.

[MTN and Safaricom’s revenues are reported in the local currencies of the rand and shilling, respectively. The above values are based on current dollar conversions and may not reflect the values as of when the financial reports were released.]

Despite growth, concerns persist over stock performance

In the past five years, Safaricom’s best stock performance occurred during a one-year rally between July 2020 and August 2021, when its stock peaked at KShs 44.45 per share.

However, it has been on a downward trend since then. Experts noted that its stock price was overvalued, driven mainly by future earnings speculation.

Its expansion into Ethiopia has also proven to be a double-edged sword. While it has opened the company to a new market, analysts say a combination of factors, including political instability and government intervention, has contributed to its declining stock. As of April 30, 2024, SCOM traded at KSh 15.95 per share.

Its mobile money play has also faced a few challenges. A 2023 news report noted that in Tanzania, the number of person-to-person (P2P) and cash-out transactions dropped by 38% and 25%, respectively, making mobile money less affordable. This drop has been attributed to the stiff implementation of high taxes that have eroded gains in the financial sector for both Tanzania and Kenya.

According to an African Business report, Kenya’s central bank (CBK) has been looking to delink M-PESA from Safaricom to enhance oversight. Still, moves have stalled over what has been described as a “fairly significant tax liability.” For the move to happen, a tax waiver might be necessary.

Nonetheless, Safaricom remains the darling of the Nairobi Securities Exchange equity market with a market capitalisation of KSh 639 billion, making it the exchange’s most valuable company, capturing about 40% of its market.

While stock fluctuations are inevitable in light of macroeconomic conditions, Safaricom’s resilience and staying power have proved invaluable. As the company expands, its ability to adapt against threats, innovate, and capitalise on emerging trends while seeing off competition will be crucial in sustaining its market leadership and driving long-term success.