As an eventful year in African tech draws to a close, 2025 stands out as a year of structural reset. Capital returned, but investors became more selective, favouring scale, resilience, and clear paths to value creation.

In response, companies consolidated, markets shifted from consumer-facing applications to core infrastructure, and payments and trade rails quietly matured to support cross-border commerce at scale.

Against this backdrop, artificial intelligence emerged as the next and most consequential test, not of ambition, but of Africa’s readiness to build the data, compute, and governance foundations required to compete in a rapidly evolving global economy. Here are six key takeaways from African tech in 2025.

African startups raised $3.24B in 2025, outpacing 2023 & 2024

African startup funding in 2025 has officially crossed the $3 billion mark in early December, surpassing the total investments for both 2024 and 2023. This milestone represents a critical inflection point: a 44.6% year-on-year increase that marks the continent’s first positive growth trajectory in three years.

This resurgence signals that while global venture capital remains cautious, investors have returned to Africa with a renewed appetite for high-value, scalable assets.

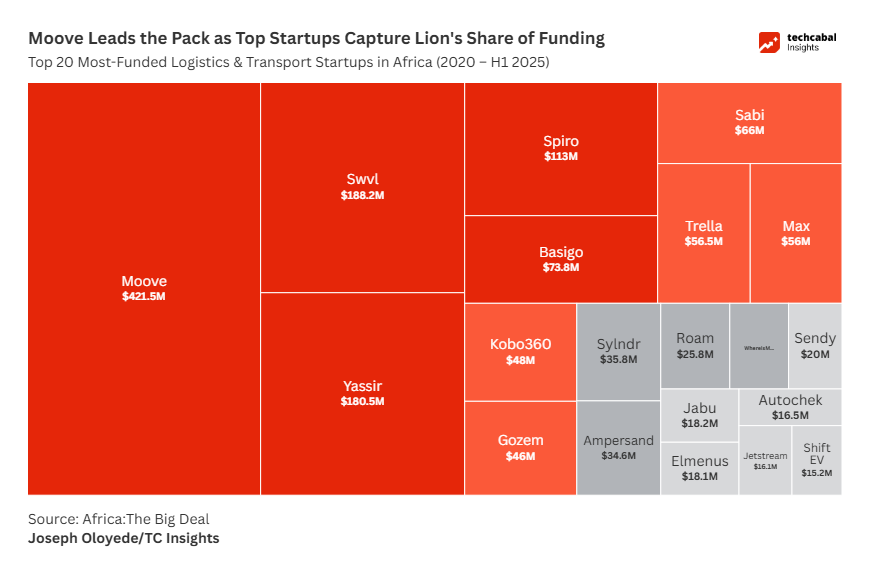

The recovery is not evenly distributed but is instead defined by a “flight to quality” in specific sectors. Clean energy and fintech have attracted the strongest interest, with major debt and equity deals in e-mobility and solar power driving the topline numbers.

Geographically, the “Big Four” markets- Kenya, Egypt, Nigeria, and South Africa- continue to dominate, with Kenya retaining its position as a preferred destination for infrastructure-heavy investments.

Perhaps the most significant sign of ecosystem maturity, however, is the reopening of the exit window. November 2025 ended a long drought with the first two major startup IPOs in over six years. South African fintech Optasia listed on the JSE at a $1.4 billion valuation, followed by Moroccan fintech Cash Plus listing in Casablanca.

These public listings, detailed by TechCabal, provide the “missing link” in the African tech narrative: proving to global investors that African startups can not only absorb capital but return it at scale.

Investors adopted tiered strategies based on market maturity

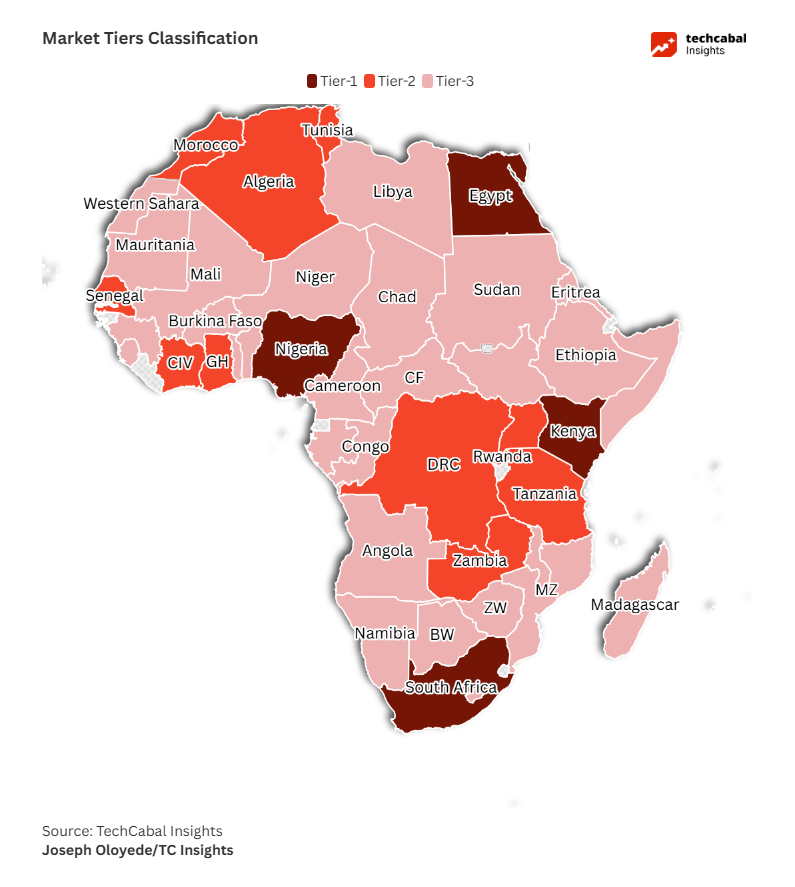

The cooling global market forced investors to adopt a more nuanced strategy, moving away from viewing Africa as a monolith. Our analysis confirmed that investment potential is heavily concentrated in Tier 1 markets, namely Nigeria, Kenya, South Africa, and Egypt.

These hubs command most disclosed deals, backed by deep founder networks, established VC ecosystems and sector diversity. Yet, they carry significant macroeconomic risk from policy volatility, naira devaluation, and FX restrictions that complicate exits and capital repatriation.

Heightened interest emerged in Tier 2 markets, including Ghana, Rwanda, Tunisia, Senegal, and Morocco. These demonstrate moderate startup activity and rising international attention, which is improving through government tech strategies and innovation-friendly policies, such as Rwanda’s Startup Act.

Tier 3 markets represent the rest of the continent, struggling with minimal VC penetration and weak policy frameworks. This tiering reinforced a key lesson: successful investment requires regional clarity, balancing the scale of Tier 1 against the emerging opportunities of Tier 2.

ALSO READ: Africa’s AI divide: The three tiers of digital readiness

M&A deals rose by 69% to a record high in 2025

M&A surged as consolidation became a growth strategy in 2025, redefining the African tech exit landscape. In a decisive break from the cautious deal-making of previous years, M&A volume surged by 69% year-on-year, closing the year with 66 reported deals, a record high.

This activity brings the cumulative total of M&A transactions between 2019 and 2025 to 171, signalling a maturing ecosystem where consolidation is no longer a distress signal, but a primary growth lever.

A prime example is Chowdeck’s acquisition of Mira in June 2025. The deal positions Chowdeck to integrate Mira’s hardware and invoicing suite with its 20,000-strong delivery fleet, effectively locking in merchants by solving their operations, not just their delivery.

Notably, 2025 marked a shift where African startups aggressively targeted international companies for strategic fit, acquiring seven ventures across the US, UK, Europe, and Latin America. Fintech leaders like Moniepoint and Pesa acquired UK-based Bancom and Authoripay, respectively, while LemFi’s purchase of Ireland’s Bureau Buttercrane secured a critical gateway to the EU.

Simultaneously, scale-ups pursued vertical depth and global footprints: Moove entered Brazil via Kovi, Nawy tapped into the UAE real estate market through Smartcrowd, and HearX acquired US-based Eargo. This trend of high-value integration was further underscored by Syspro’s acquisition of US-based Datascope and Stitch’s deal with Netherlands-based Exipay, proving that African tech is now importing global capabilities to fortify its own infrastructure.

ALSO READ: The State of Startup Exits in Africa in 5 Charts

E-commerce shifted from consumer apps to B2B infrastructure

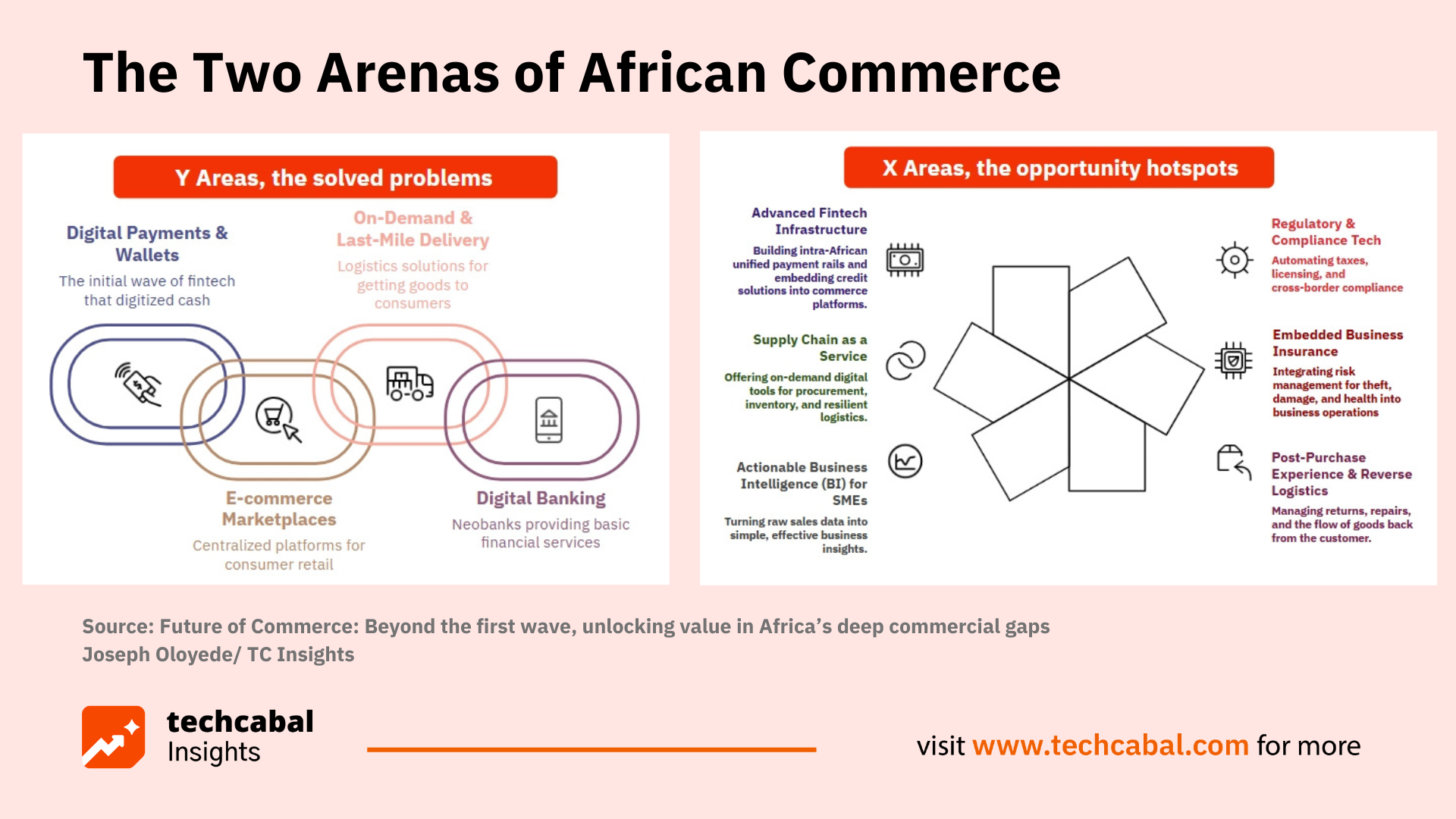

2025 was the year African commerce pivoted from the storefront to the engine room. Our Future of Commerce 2025 Report found that the initial wave successfully digitised what we call “Y Areas”: the consumer-facing layers, including payments, marketplaces, and last-mile delivery.

But innovation became saturated in these visible spaces. The true path to scale lies in solving “X Areas”, the back-end operational gaps inhibiting growth for millions of SMEs: regulatory compliance, accessible business insurance and turning transaction data into valuable intelligence.

A conservative capital environment reinforced this pivot. Investors shifted from chasing growth to seeking resilience, hunting for solutions to real business problems rather than consumer apps. Market activity reflected this.

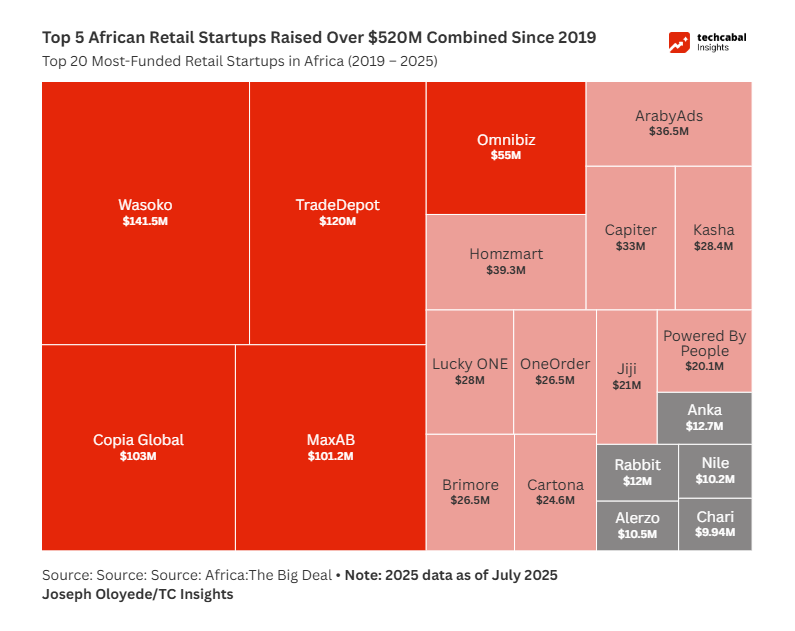

The core retail sector secured over $1 billion of the ecosystem’s total $2.27 billion in funding since 2019, with deployment focused on efficiency. Signs of maturity included consolidation, such as MaxAB-Wasoko acquiring Egypt’s Fatura, and Jumia narrowing losses while cutting services like food delivery to focus on profitability.

The next wave of value creation focuses on building Africa’s modern “trade backbone”. Advanced fintech infrastructure now embeds credit solutions into platforms. As Mobola da-Silva of Capria Ventures noted, verifiable data enables AI-driven credit models to underwrite SME loans in minutes rather than weeks.

Supply-chain services and reverse logistics have become critical as cross-border trade has increased. Going forward, success may hinge on how seamlessly platforms can integrate financial services into their commercial operations, creating the infrastructure for efficient pan-African trade.

Stablecoins became Africa’s preferred cross-border settlement rail

Cryptocurrencies shed their speculative reputation this year and became business infrastructure. The driver was stablecoin adoption for cross-border settlements. Faced with high inflation (Africa’s average: 18%) and currency volatility that erodes margins, African businesses turned to dollar-pegged stablecoins like USDT and USDC.

Stablecoins now account for 43% of all cryptocurrency transactions in sub-Saharan Africa, overtaking Bitcoin as the preferred settlement method. Nigeria received over $20 billion in stablecoin inflows alone, accounting for 40% of the sub-Saharan total.

Over-the-counter (OTC) trading desks powered this shift. Traditional banking imposes high fees (often 2-8% in Africa) and settlement delays of three to five days. OTC trades using stablecoins occur in minutes at fees of less than 1%. OTC platforms facilitate large transactions privately, preventing market slippage and ensuring confidentiality for businesses that require dollar liquidity.

Regulatory changes helped legitimise the shift. Nigeria’s 2024 crypto licensing regime and operational approvals for platforms like Quidax and Busha signalled a continental move from prohibition to engagement. This clarity suggests stablecoins will evolve into invisible infrastructure, powering cross-border trade alongside efforts like the AfCFTA and providing 24/7 dollar liquidity for African businesses.

You can read more about it here.

ALSO READ: How OTC trading and stablecoins could transform African payments

Africa’s AI readiness hinges on solving the compute paradox

One of our earliest predictions was that 2025 would be the year of AI agents. This was an easy call given the frenzied race among frontier AI models. We hazarded an informed guess that announcements by Google and Microsoft to commit tens of billions of dollars towards data centres (the physical infrastructure powering these agents), along with rising demand, would create FOMO among other enterprises in cloud computing and data, all wanting a slice of the AI pie.

Zooming inwards, the African Development Bank projects AI could add $1 trillion to Africa’s GDP by 2035, but this ambitious forecast collides with a stark reality: only 5% of Africa’s AI talent has access to the computational power needed for research, while the continent accounts for less than 1% of global data center capacity despite housing 18% of the world’s population.

The gap isn’t about ambition but economics. In Kenya and Senegal, a single GPU costs 75% and 69% of GDP per capita, respectively, making innovation a privilege of geography rather than capability.

Many African countries aspire to the archetype of being “national enablers” by promoting the use of AI to improve socio-economic conditions and quality of life. However, a gaping digital divide looms. As Dario Amodei, Anthropic’s chief executive, warns: “If AI further increases economic growth and quality of life in the developed world, while doing little to help the developing world, we should view that as a terrible moral failure.”

2025 thus marked the year Africa made some noticeable strides towards entrenching AI. Two-thirds of countries on the continent now have data protection laws in place. Nigeria deserves particular mention. Outside South Africa, it boasts the largest data centres on the continent by capacity.

In one of our most-read articles, we mapped the country’s data centres, verifying at least 26 (operational or planned). Nearly all are powered by telecoms and independent operators, although none are fully AI-ready. However, there are plans for hyperscale expansions with a combined IT load that could exceed 150MW by 2027—if all goes to plan.

Cassava Technologies also announced a partnership with Nvidia to deploy 12,000 GPUs across five African countries.

Yet data centres alone won’t close the gap. Nigeria’s grid supplies only 5,800 megawatts against 13,000MW installed capacity, forcing data centres to build their own energy infrastructure, a pattern repeated across the continent.

Meanwhile, 95% of African AI practitioners still rely on Google Colab for free compute access, facing usage limits that force them to wait nearly a week. By contrast, their peers in technologically advanced nations iterate every 30 minutes.

The emerging solution is GPU-as-a-Service models that pool demand and lower barriers, supported by the African Union’s Continental AI Strategy and a planned $60 billion Africa AI Fund. Infrastructural issues aside, more can still be done, from doubling down on data sovereignty to creating AI tools that speak, literally and figuratively, the language of Africans. We broke it down here and here.

Success here will determine whether Africa becomes an AI producer or merely a consumer of imported solutions. The infrastructure being laid today represents the foundation, but 2025 made clear that compute capacity, affordable access, and reliable power must advance in lockstep, or the divide will only widen.

ALSO READ: The building blocks Africa needs for AI adoption

Looking ahead

2025 came with its fair share of challenges, but if there is any ray of hope, it is that despite what has been a season of corrections in African tech, the ecosystem raised enough liquidity to surpass the last two years.

Notably, M&As, IPOs and stablecoins have also experienced an upward trend, and artificial intelligence is gaining serious traction, far beyond what one may call a fad.

The companies that have shifted to B2B infrastructure, acquired international capabilities, and built credit into their platforms; they’re all betting on a 2026 where African businesses transact at a velocity much faster than today. Whether the ecosystem can build on and consolidate on these gains may become the defining question for African tech in 2026 and beyond.