Africa stands at a pivotal moment in its energy future. The continent is experiencing an unprecedented surge in renewable energy investment, rising from $2.6 billion in 2021 to an estimated $40 billion in 2024. Yet, Africa’s renewable energy investments represent under 3% of global clean-energy flows, despite housing 19-20% of the world’s population and immense renewable potential. This leaves Africa with an annual clean energy investment gap of approximately $60 billion, based on 2024 flows ($40 billion) compared to the $100 billion needed annually to meet the continent’s 300 GW target by 2030.

This surge in investments has enabled the development of impressive megaprojects across the continent: Morocco’s 580 MW Noor solar plant spanning 3,500 football fields in the Sahara; Kenya’s 310 MW Lake Turkana wind farm generating 17% of the country’s installed capacity; and Egypt’s massive 1.8 GW Benban solar park with 41 solar plants across 37 square kilometers of desert.

Despite this influx, investment inefficiencies remain a challenge. Bureaucratic delays and grid constraints often slow project execution, with some developments facing 12–18 month regulatory setbacks before reaching implementation.

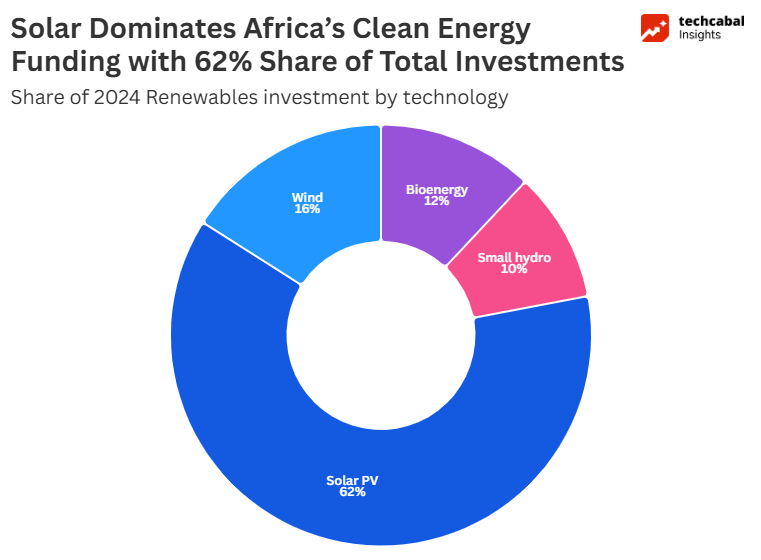

Solar dominates Africa’s renewable energy investments in 2024

Africa’s renewable energy investment landscape in 2024 reveals a significant imbalance in technology allocation. According to the International Energy Agency (IEA) World Energy Investment 2024 report and IRENA’s Renewable Energy Transition in Africa study, Solar PV dominates with 62% of total renewable funding, split between utility-scale (40%) and distributed (22%) installations. Wind energy receives just 16% of investment despite the continent’s abundant wind resources, while bioenergy (12%) and small hydro (10%) complete the portfolio. The overwhelming concentration on solar, while leveraging Africa’s strong solar irradiation, masks critical gaps in the continent’s renewable diversification strategy.

Beyond institutional investments, private equity and venture-backed renewables are emerging as critical drivers of Africa’s energy transition. The continent’s private equity market is projected to reach $900 million in 2025, with investors prioritising solar and wind startups using innovative financing models, such as blended finance and risk-sharing mechanisms.

The persistent energy access gap

The investment surge stands in sharp contrast to the lived reality of hundreds of millions of Africans. Over 600 million people across Africa, roughly 43% of the continent’s population, still lack access to electricity. For those who do have grid connections, reliability remains a persistent challenge. Power outages and load shedding are commonplace across many African countries, with businesses and households often experiencing daily disruptions lasting hours. The economic impact is substantial. One study finds that failing utilities and outages can cost national economies up to 4% of GDP annually. This stark disconnect between growing investment and persistent energy poverty raises critical questions about the nature and direction of Africa’s energy transition.

ALSO READ: Africa’s climate tech sector needs winners to justify recent funding jump

Jobs and growth potential

This is a huge missed opportunity. Investment in renewables creates roughly three times more jobs per dollar than the same spending on fossil fuels. If Africa scaled up clean energy, models suggest that on the order of 14 million jobs 2030 could be added in the sector. Under current investment trends, however, that job creation growth opportunity risks slipping away as millions of potential green jobs could simply never materialise.

Climate vulnerability

Africa also sits at the front lines of climate risk. Many of the world’s most climate-vulnerable countries are in Africa, so delays in deploying clean power compound the problem. The United Nations Environment Programme (UNEP) projects that adaptation costs alone could hit $50 billion per year by 2050 even under a 2 °C warming scenario. In other words, underinvesting in clean energy now means a far steeper “climate tax” on African economies later.

Conclusion

As Africa continues to attract record levels of renewable energy investment, the challenge lies in ensuring that the growing capital flows translate into meaningful energy access for the hundreds of millions still lacking basic electricity services, while the true measure of success will not be found in headline investment figures or megawatt additions alone. It will be measured in homes illuminated, businesses empowered, improvements in healthcare services, and economic opportunities created.

For Africa to fully realise its renewable energy potential, investment must not only increase in volume but also diversify in both technology mix and geographic distribution. Only then can the continent transform its energy paradox into an equitable and sustainable energy future.

Explore our dashboard: Track African exits and acquisitions in energy and other related sectors