African startups stayed afloat amid economic headwinds, regulatory changes, and venture capital funding shifts. While total funding dropped by 22.73% from 2023 levels, the second half of the year saw a resurgence driven by mega rounds from Moniepoint and TymeBank. Landmark mergers, strategic expansions, and AI-focused policy developments signalled a maturing landscape.

This report breaks down the key trends shaping Africa’s tech industry in 2024, offering insights into funding patterns, acquisitions, regulatory shifts, and the future outlook.

Funding Trends

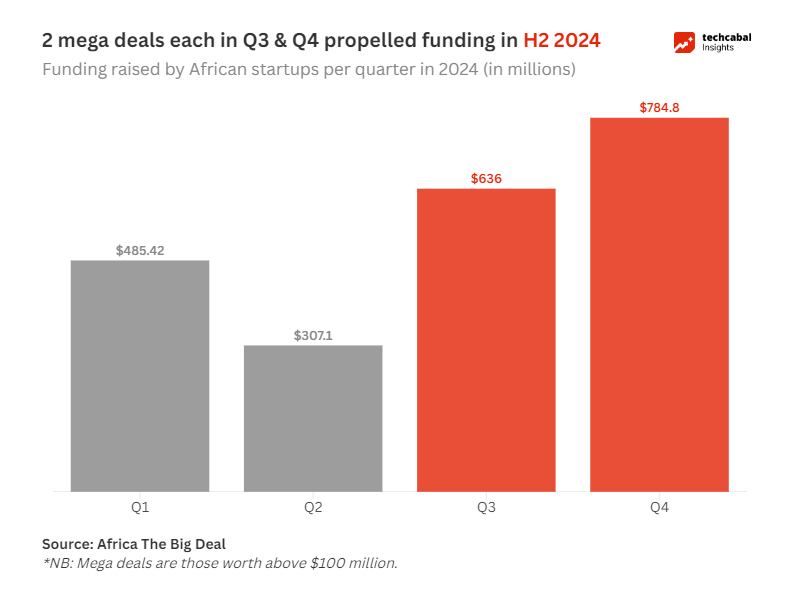

Total VC funding for African startups stood at $2.21 billion across 488 deals in 2024, a 22.73% decline from 2023. However, H2 2024 saw a 24.96% increase in funding compared to H2 2023, driven mainly by mega rounds from Moniepoint ($250 million Series C) and TymeBank ($110 million Series D). These late-year capital injections may indicate renewed investor confidence, particularly in established fintech players, although early-stage funding remained sluggish.

Despite the downturn, funding remained highly concentrated. 83.27% of total VC funding flowed to the “Big Four”—Kenya, Nigeria, Egypt, and South Africa—while Central Africa received less than 1%, reinforcing a historical trend of underrepresentation in the region. However, some emerging markets showed impressive growth, with Ghana (+56.39%), Tanzania (+107.74%), and Uganda (+304.17%) experiencing year-over-year (YoY) funding increases, suggesting the rise of new secondary hubs outside the dominant markets.

Sectorally, fintech remained the undisputed leader, securing $1.04 billion in funding—more than three times what it raised in H1 2024. A mix of digital banking solutions, payment infrastructure, and credit services drove this dominance. Logistics and transport ranked third, thanks to investor interest in solving Africa’s supply chain inefficiencies. Despite a growing global focus on climate-related investments, climate tech and AI ventures struggled to attract substantial capital, indicating an opportunity gap in sectors that could drive long-term innovation on the continent.

Acquisitions

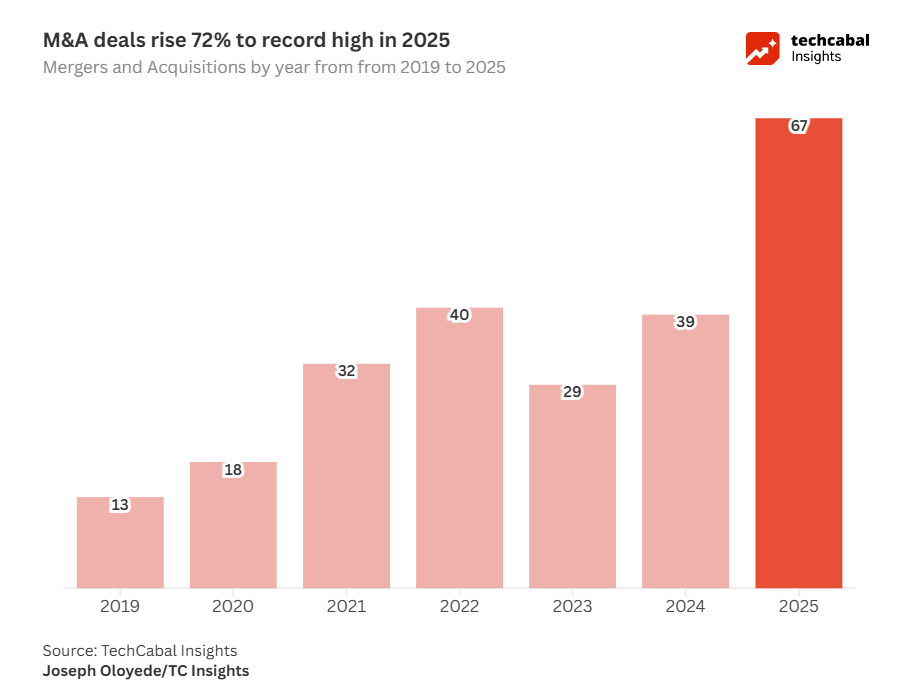

Africa’s startup ecosystem witnessed a 34% year-over-year increase in mergers and acquisitions (M&As) in 2024 due to funding constraints and the need for market consolidation. As VC funding became harder to secure, many startups turned to acquisitions as a pathway to sustainability, particularly in the fintech sector, which accounted for the largest share of deals. This reflects the sector’s growing maturity as established players leverage acquisitions to expand market share, enhance operational efficiencies, and strengthen their competitive positions.

One of the year’s most significant deals was the Wasoko and MaxAB merger, which created Africa’s largest B2B e-commerce platform while keeping an eye on the big prize—a $600 billion informal retail sector. Other notable acquisitions included LemFi’s acquisition of Modular Finance in Ireland and Prembly’s acquisition of Peleza in Kenya, which bolstered HR tech capabilities across Africa. These transactions highlight a growing trend of African startups looking for synergies through strategic acquisitions rather than relying solely on organic growth.

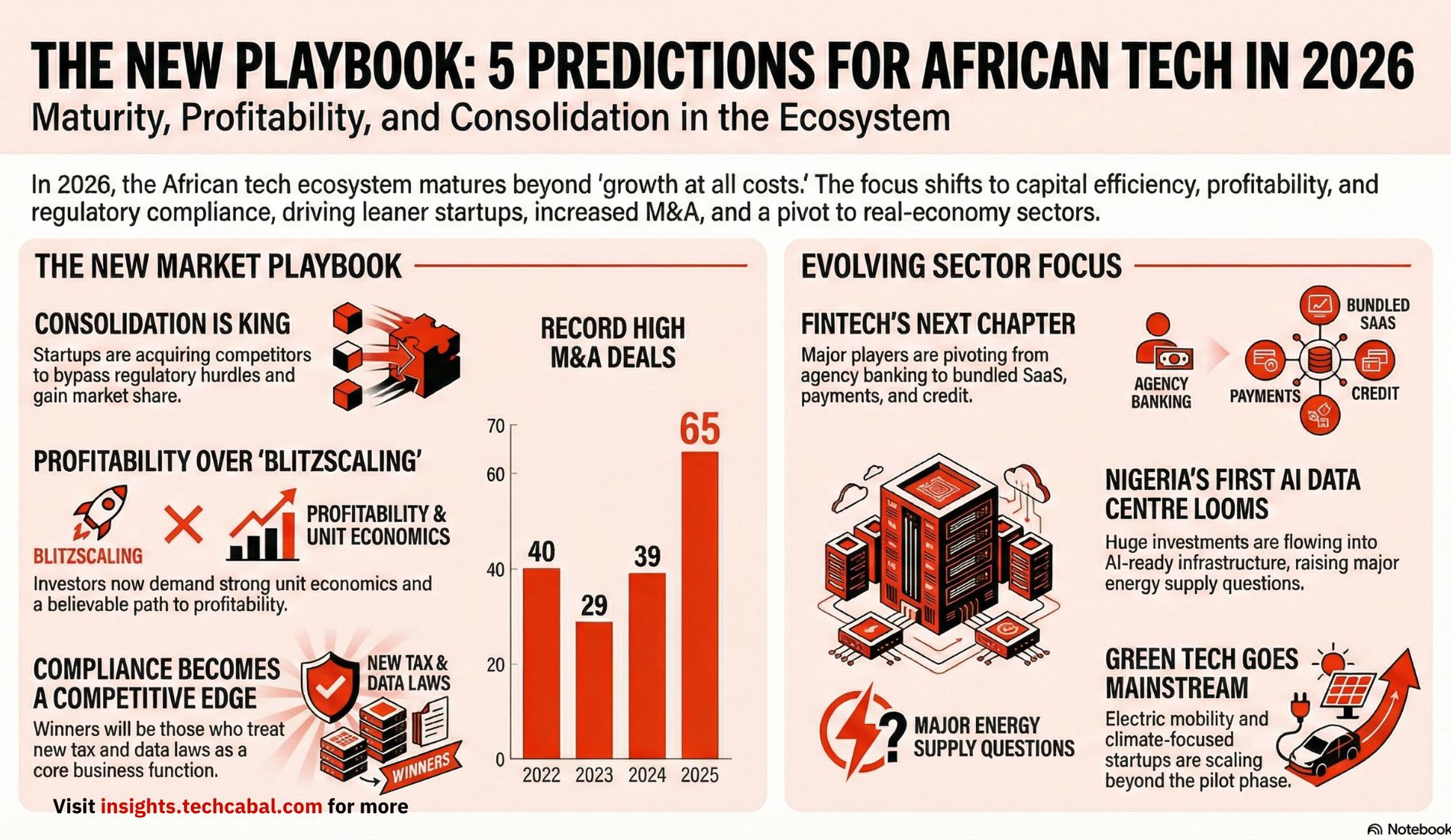

Experts predict even more M&A activity in 2025, though the nature of these deals is expected to shift. Rather than exits that generate returns for shareholders, many acquisitions will likely be what Victor Basta, founder and managing partner of Magister Advisors, describes as “coping deals”—mergers driven by the need to survive rather than scale aggressively. With funding challenges persisting, more startups will seek consolidation to reduce costs, achieve operational efficiencies, and improve profitability in a landscape where achieving scale as a standalone company remains difficult.

ALSO READ: Two Predictions for African Tech in 2025

Expansions

African startups pursued aggressive expansion strategies in 2024, entering 38 new markets—more than double the 16 recorded in 2023. Economic pressures, regulatory shifts, and the pursuit of diversified revenue streams largely drove this surge. Nigeria led the charge, accounting for 47% of all expansions, as startups sought to hedge against currency devaluation, high inflation, and shrinking purchasing power by venturing into new territories.

At the same time, Kenya solidified its position as a preferred expansion hub, attracting startups with its business-friendly regulations, advanced digital infrastructure, and strong investor confidence. The country’s strategic location within the East African Community (EAC) and its leadership in fintech adoption made it a natural choice for companies looking to scale regionally.

As in previous years, fintech remained the dominant driver of cross-border expansion, with leading players like Grey, PayRetailers, and MNT Halan expanding into multiple regions. The sector’s continued growth reflects the increasing demand for digital banking, payment solutions, and alternative lending models across the continent. As more startups scale beyond their home markets, Africa’s digital economy becomes more interconnected, setting the stage for broader continental integration and deeper capital flows.

[For data requests or research services, reach out to TC Insights via this link]

Regulation

AI governance gained traction, with the African Union launching a Continental AI Strategy. At the same time, South Africa, Nigeria, and Kenya introduced national AI policy frameworks, aiming to balance innovation with ethical safeguards.

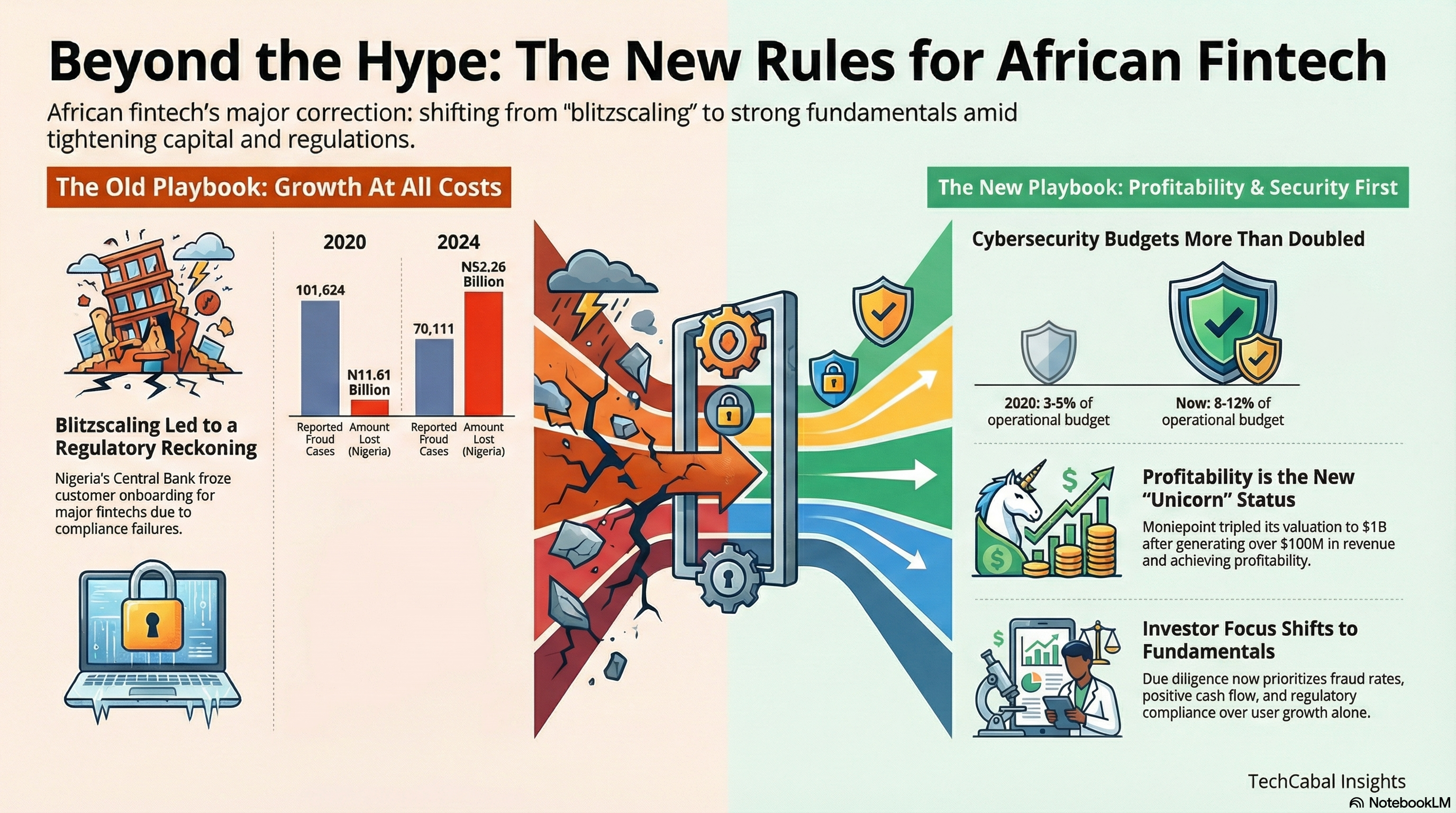

Fintech faced tighter oversight, particularly in Nigeria and Uganda, where stricter KYC and AML regulations increased compliance costs. Digital lending also came under intensified scrutiny to curb predatory practices. Meanwhile, crypto regulation saw mixed signals. South Africa’s FSCA granted 63 crypto business licenses, enhancing legitimacy, while Zimbabwe announced plans for a national regulatory framework to boost industry confidence.

Looking ahead, stricter regulations are expected in 2025, particularly in healthtech, agritech, and creative industries. Governments may tighten oversight of blockchain-based financial services to balance innovation with consumer protection.

Unicorns & Profitability

Two new unicorns emerged in 2024—Moniepoint and TymeBank. Moniepoint solidified its dominance in digital payments, processing 5.2 billion transactions (+205% YoY), while TymeBank achieved profitability for the first time, leveraging strategic partnerships and a 30% growth in its lending portfolio.

Beyond fintech, other startups showed promise. Swvl pivoted into a B2B model, cutting costs and boosting efficiency, while Jumia restructured by exiting South Africa and Tunisia, allowing it to focus on high-growth markets like Nigeria.

Outlook for 2025

Africa’s tech ecosystem is expected to maintain strategic consolidation in 2025, with increased M&A activity as companies seek operational efficiencies. Climate tech investments are set to rise, particularly in renewable energy and agri-tech, while Flutterwave and Tizeti explore IPOs, though market conditions remain uncertain.

Regulatory scrutiny in fintech and AI will intensify, requiring startups to engage proactively with policymakers to navigate compliance challenges. Despite global economic uncertainties, Africa’s tech industry is positioning itself for long-term resilience, with profitability, regulatory alignment, and strategic partnerships emerging as key success factors.

Click this link to download the 2024 State of Tech in Africa Report.