Welcome to the new year, and thank you for being a part of our journey at TechCabal Insights.

Objectively speaking, 2024 continued the great reset for African tech. Unfavourable macro factors saw several African economies underperform—particularly Nigeria, whose naira made Bloomberg’s list of worst-performing currencies, and Kenya, dealing with the burden of unpopular tax reforms.

Overall, this was not surprising. A year ago, we wrote about five things to expect in African tech in 2024, which you can read in full here. Before we discuss our expectations for 2025, let’s recap our predictions and how they played out.

2024 predictions

Following up from 2023, an adjustment year marked by a dropoff in funding across African startups, we said that cost-cutting measures would continue, with a decline in funding likely to persist going into 2024. Indeed, that materialised. On cost-cutting, layoffs happened at scale, most notably Jumia and Copia Global, with second-round layoffs in which the former let go of 900 workers. Similarly, Alerzo laid off 400 employees, while Renmoney relinquished 391 employees of their jobs.

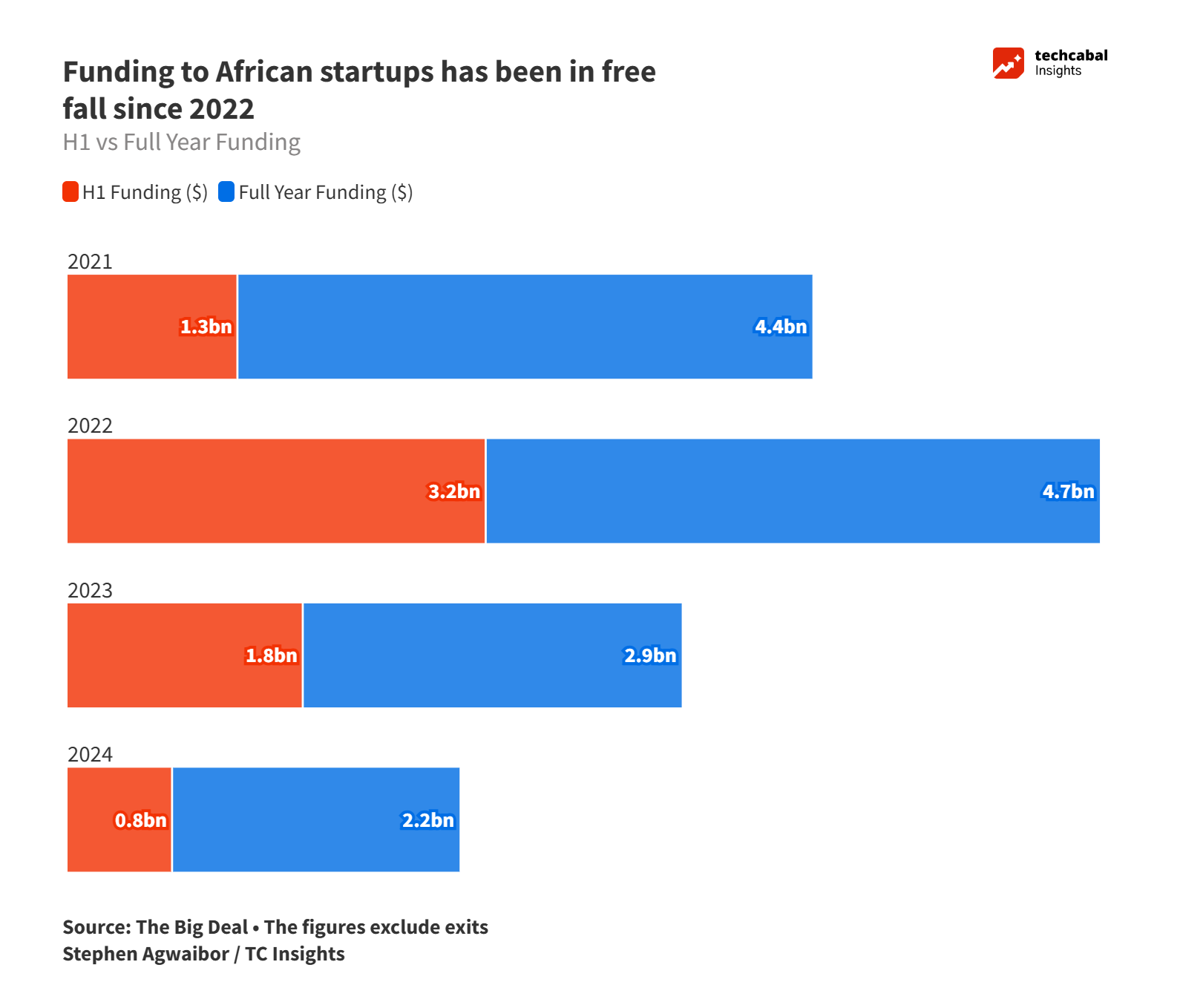

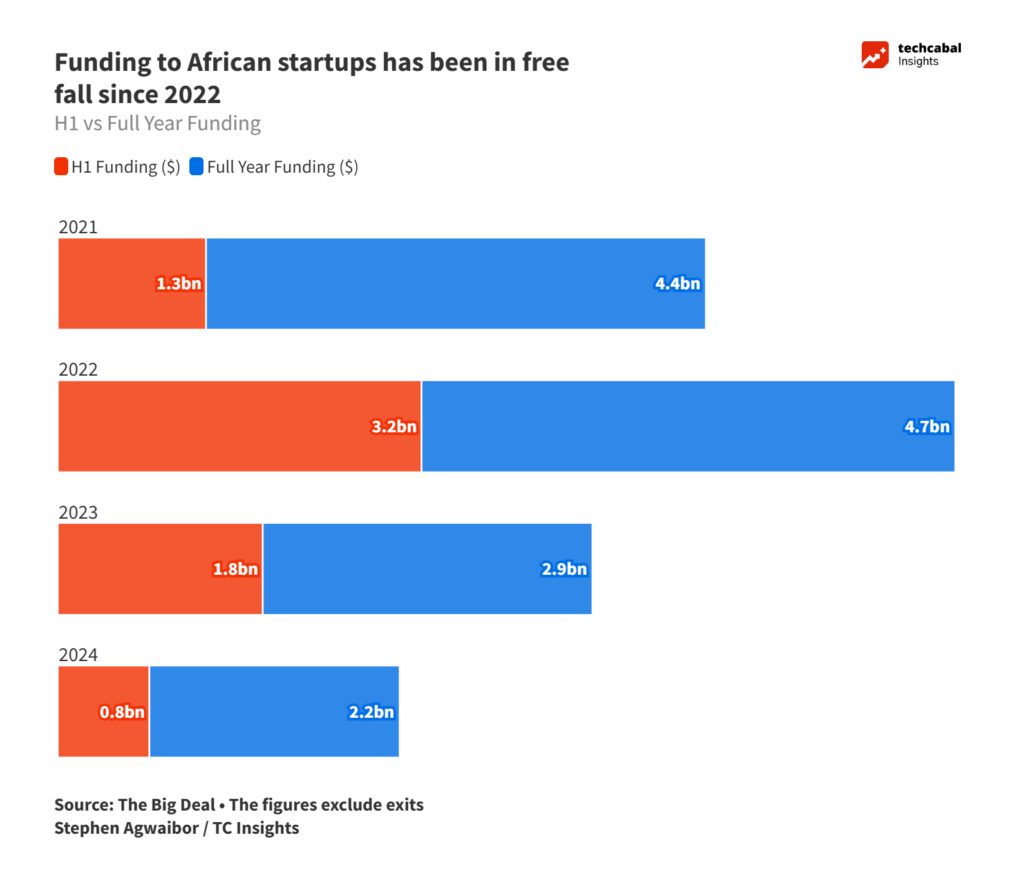

At the end of H1 2024, African startups had raised a combined $780m, a 57% decline and over $1bn less than the same period in 2023. By the end of the year, per The Big Deal, startups accrued $2.2 billion in funding—a 24% decrease compared to the $2.9 billion raised in 2023.

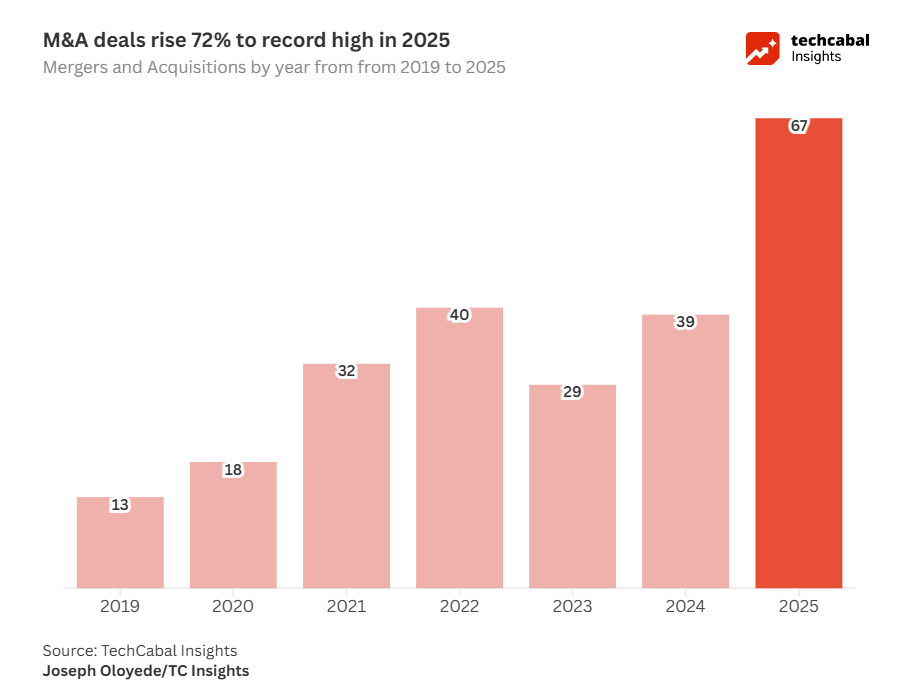

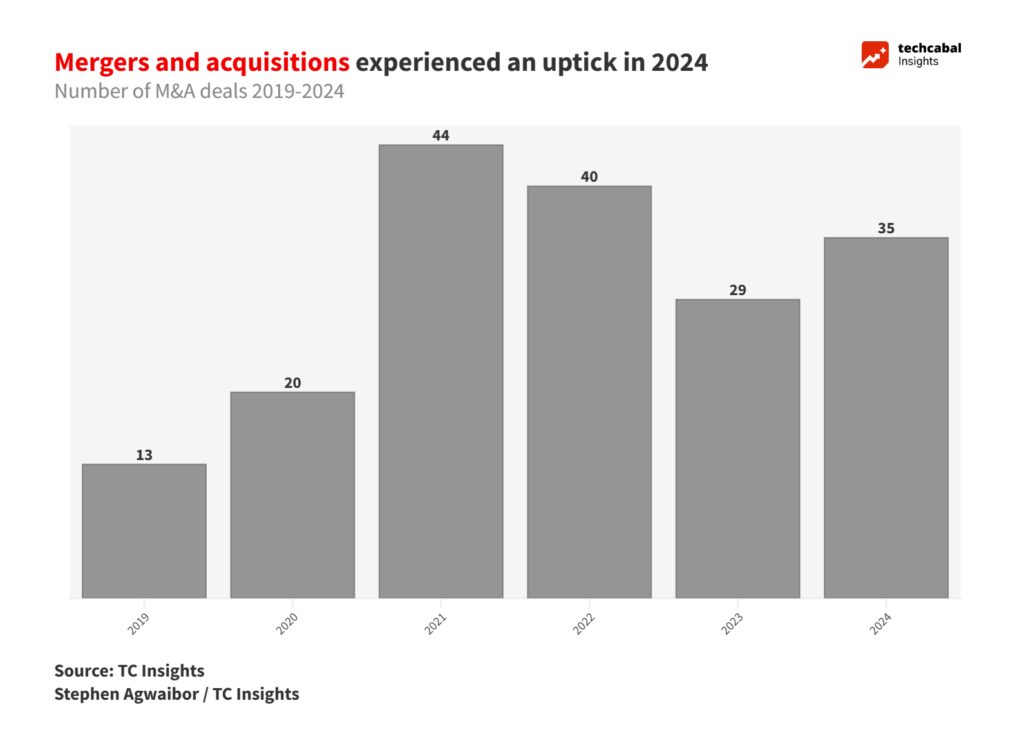

We also predicted that startups could use mergers and acquisitions to extend their runway or consolidate. We were correct, too, on that front. According to our analysis, there were 35 acquisitions in 2024, up from 29 in 2023. Mastercard’s $200m acquisition of Momo and the finalisation of the long-awaited merger between Wasoko and MaxAB were the standout deals.

We noted that artificial intelligence will gain wider use, with forecasts projecting the African AI market to reach $6.9bn in revenue in 2024. The jury remains out on that one. However, an important milestone was Vodafone and Microsoft signing a 10-year partnership in January 2024, worth $1.5bn, to bring generative AI, digital services, and cloud infrastructure to over 300 million customers. In July 2024, the African Union (AU) developed its strategy document to improve AI uptake on the continent.

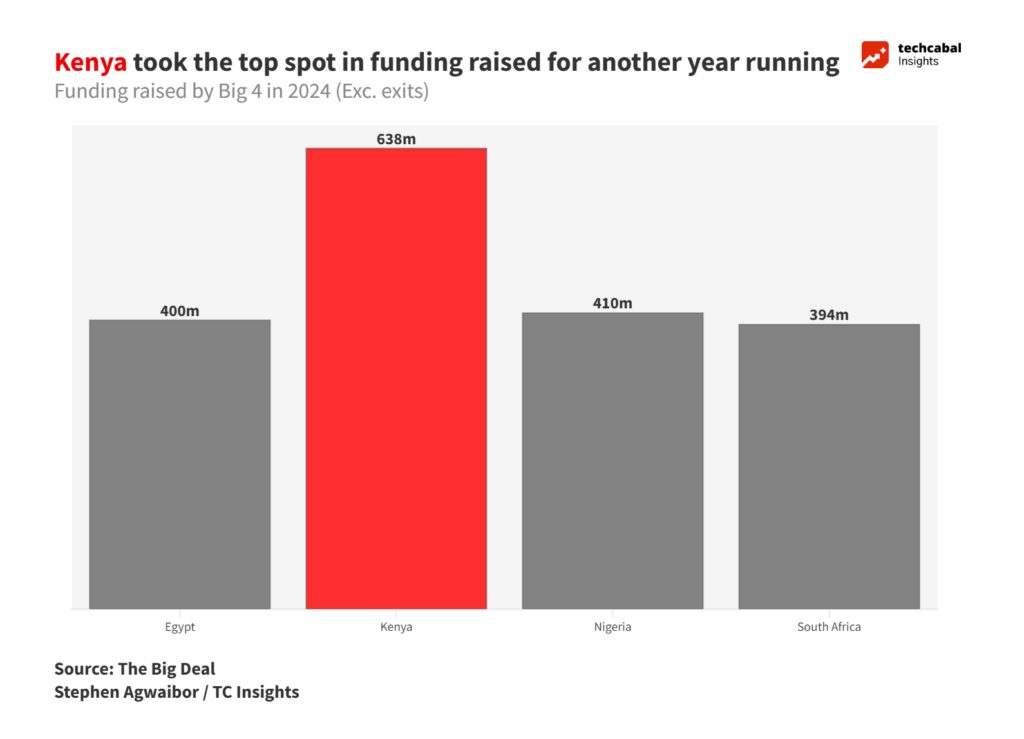

Also predicted was a regional shift in funding preference, with West Africa losing its crown to East Africa, which is fast becoming an investor favourite. For the second consecutive year, East Africa was the top destination for venture capital funding. According to data from The Big Deal, one-third ($725m) of all funding went to this region, with Kenya alone receiving $630m —mostly from climate tech deals— 55% higher than the next on the list, Nigeria.

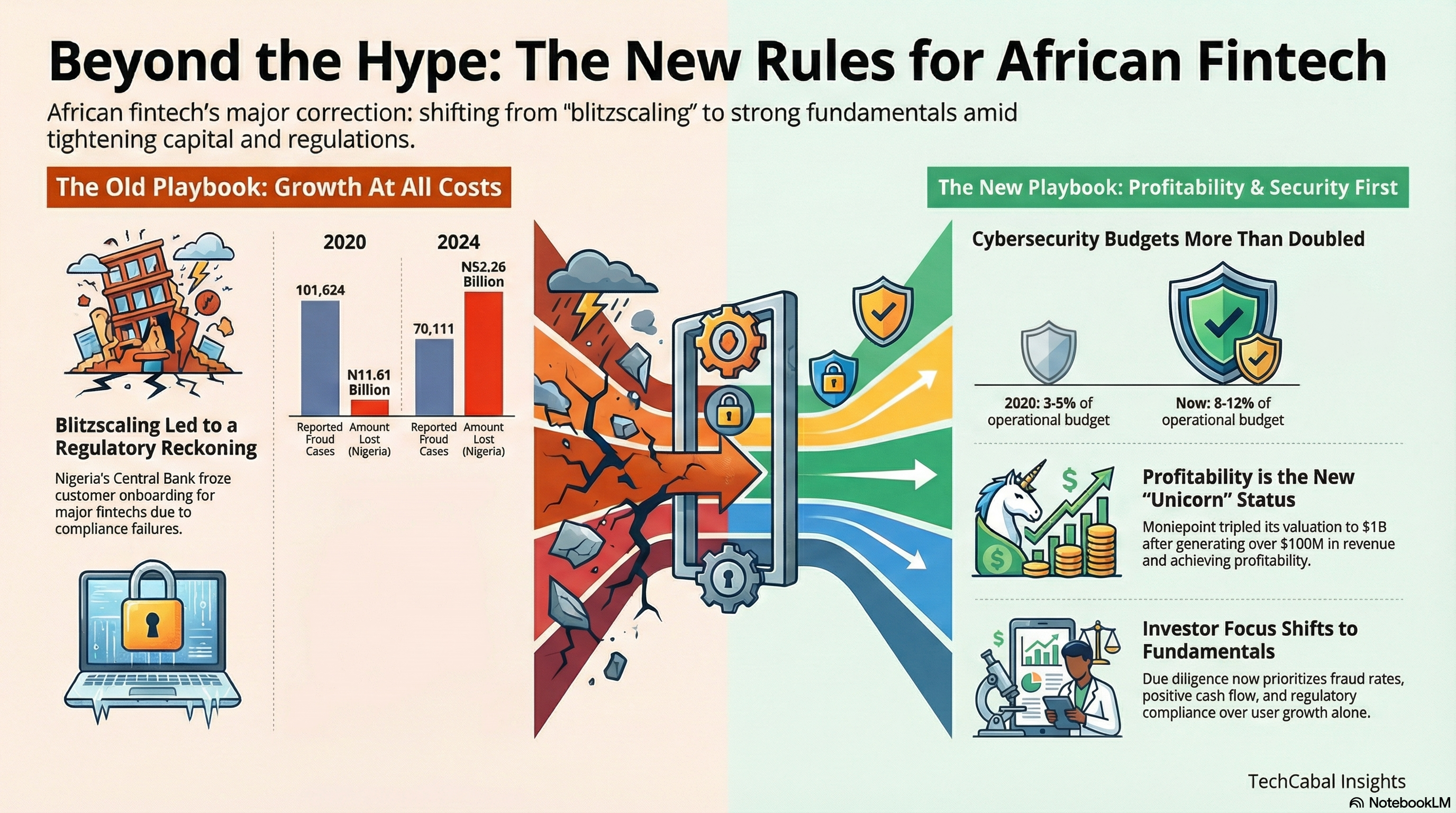

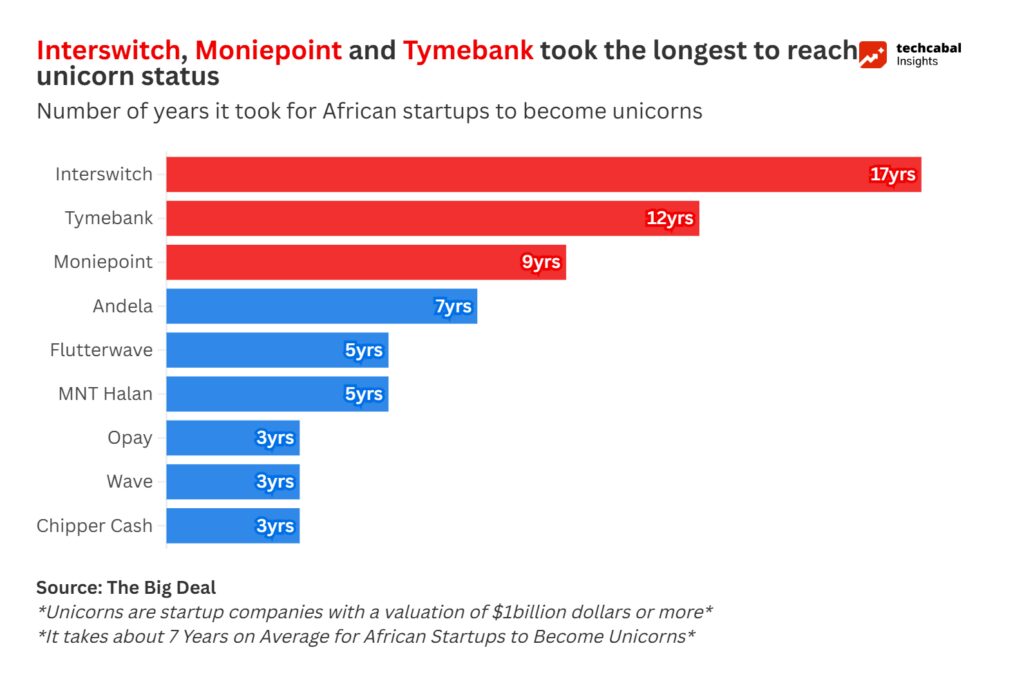

Some pleasant news we did not foresee was the addition of two unicorns—Nigeria’s Moniepoint and South Africa’s Tymebank—to an exclusive list of predominantly fintech startups.

So, what can we expect in African tech in 2025? Here are two predictions:

Renewed focus on research

It is known that doing business in Africa is very difficult. Frictions arise from a combination of factors, including a disabling environment, low purchasing power, currency fluctuations, poor logistic and electricity infrastructure, sparse capital allocations, and unfriendly interest rates that make business costly. The total addressable market is negligible compared to its growing population.

One example is how the streaming platform Amazon Prime struggled to make headway in the African market despite its global heft. In 2024, with its estimated 575,000 subscribers in Sub-Saharan Africa (2021), it scaled back on producing African content amid layoffs. One key reason Amazon failed in Africa was a lack of understanding of the African market. The signal here is that big players—foreign or local—looking to invest in Africa in 2025 must have native intelligence and conduct proper research, aided perhaps by boutique consultancies with a niche focus on the continent’s systemic challenges and opportunities before risking capital. Given the conditions mentioned above, just because something works elsewhere does not guarantee it will thrive here.

[For data requests or research services, reach out to TC Insights via this link]

The year of AI agents

Google released its whitepaper on AI agents toward the end of last year. An agent is an application that attempts to achieve a goal by observing the world and acting upon it using tools at its disposal. It is autonomous and can act independently of human intervention. Today, the concept of AI agents for work is gaining traction due to the range of impressive tasks they can perform.

Why is this important?

At the start of 2025 and just within days of each other, significant announcements followed that set the tone for the emergence of Artificial General Intelligence (AGI). Sam Altman, CEO of OpenAI, said, “We are now confident we know how to build AGI as we have traditionally understood it. We believe that, in 2025, we may see the first AI agents ‘join the workforce’ and materially change the output of companies.”

Microsoft also announced it would spend $80 billion constructing AI data centres in 2025.

While this may seem abstract now, the explosion of AI in the last couple of years means that the realisation of this abstraction is merely a matter of time. Consider, for example, an earlier report from last year that disclosed that within a six-month period, generative AI use nearly doubled, with 75% of knowledge workers using it—up from 46%. Eighty-five per cent of workers said it helped them focus on important work, while 90% reported time savings.

Africa will inevitably join the party. In a piece for TechCabal, Eghosa Omogui, founder of EchoVC, said, “We’re witnessing a major shift with AI. In e-commerce, expect widespread deployment of AI agents for customer service and semi-autonomous transactions. These innovations will reduce consumer anxiety around spending, with AI tools offering budget forecasts and value assessments.”

Naturally, the rise of AI agents will exacerbate growing concerns about them replacing human jobs. However, a useful framework to consider is that AI can help skilled workers become more productive while revealing the limitations of underperformers. This cuts across all positions, from knowledge workers to CEOs.

One research paper highlights this dichotomy. It found that high-performing entrepreneurs saw 15% profit gains with AI, while weaker peers lost 8%. Thus, the big lesson going into 2025 is the existential need to upskill, so that AI will serve not as a competitor but as a companion that can be leveraged to deliver high-quality output consistently.