Identity fraud describes the unauthorised use of a person’s credentials in carrying out fraudulent activities. A related concept is identity theft, which involves stealing someone’s personal or financial information for fraud.

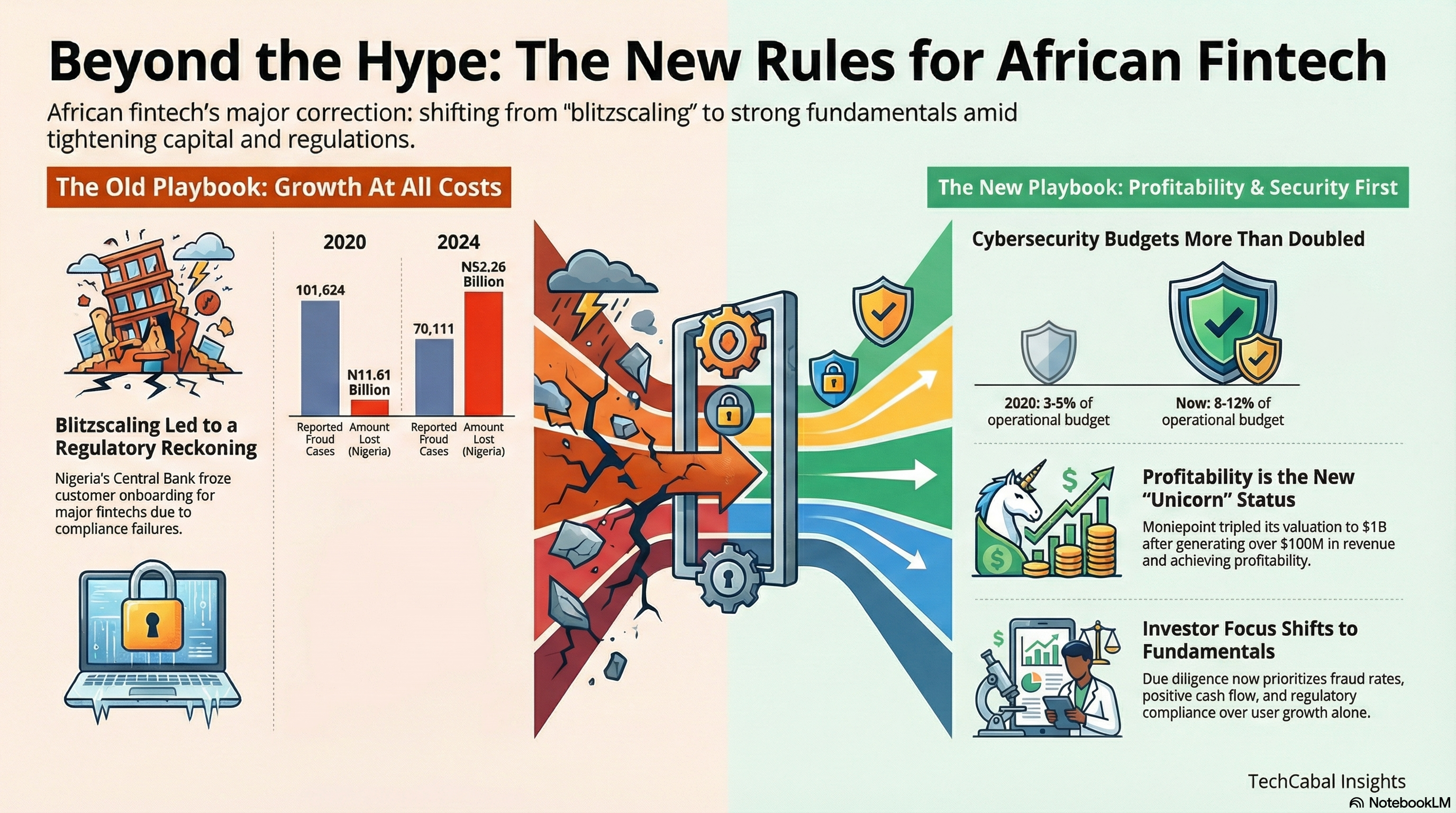

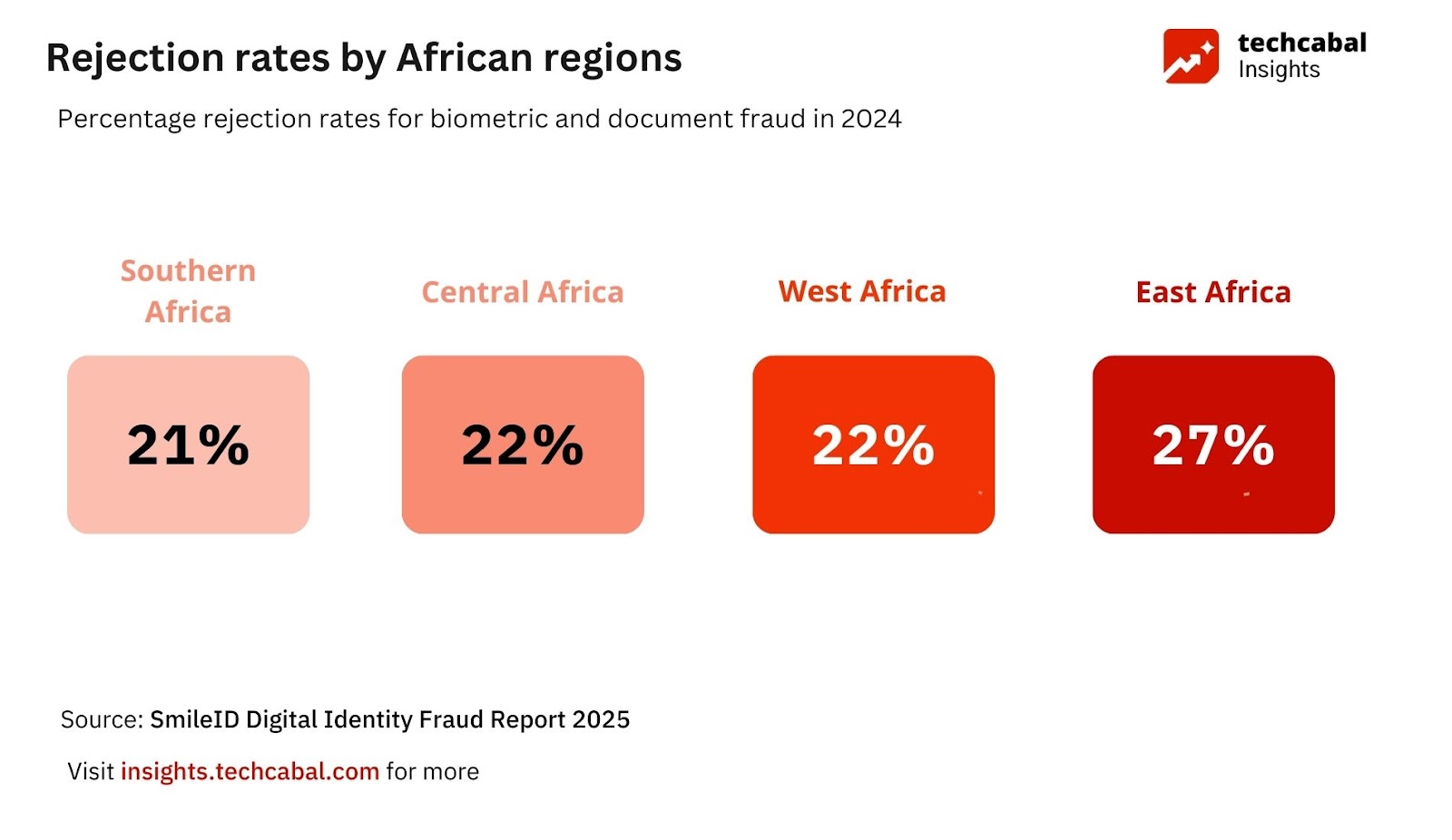

As Africa catches up to the rest of the world in the digital and intelligence age, safeguards must be in place to stymie the misuse of technology for malicious purposes. One study by PWC estimates that global cumulative merchant losses to online payment fraud will exceed $343 billion between 2023 and 2027, highlighting the scale of the challenge.

Although laws like Nigeria’s Cybercrimes Act attempt to fight back, the reality is that technology is evolving faster than legislation. A case in point is the African Union Convention on Cyber Security and Personal Data Protection (Malabo Convention), which was adopted by 55 African Heads of State in 2014. Yet, only 14 countries had signed the treaty by 2022, with eight having ratified it.

The “Digital Identity Fraud in Africa Report 2025” by Smile ID highlights tactics used in identity fraud and solutions to tackle these threats effectively based on over 200 million identity checks it has conducted since its inception in 2017.

The role of generative AI in fraud

One of the more worrying trends identified in the report is fraudsters’ use of generative AI. This advanced technology allows criminals to create hyper-realistic fake documents, voices, and images, making it easier to bypass traditional verification systems. A notable incident involved the impersonation of the African Union’s Chairperson using deepfake technology, which now accounts for 4% of new threats in biometric spoofing on the continent. In January 2025, a French woman was conned out of $850,000 by scammers who used a deepfake to pose as the actor, Brad Pitt. If left unchecked, generative AI fraud poses significant risks to trust for individuals and businesses.

Identity farming and money laundering

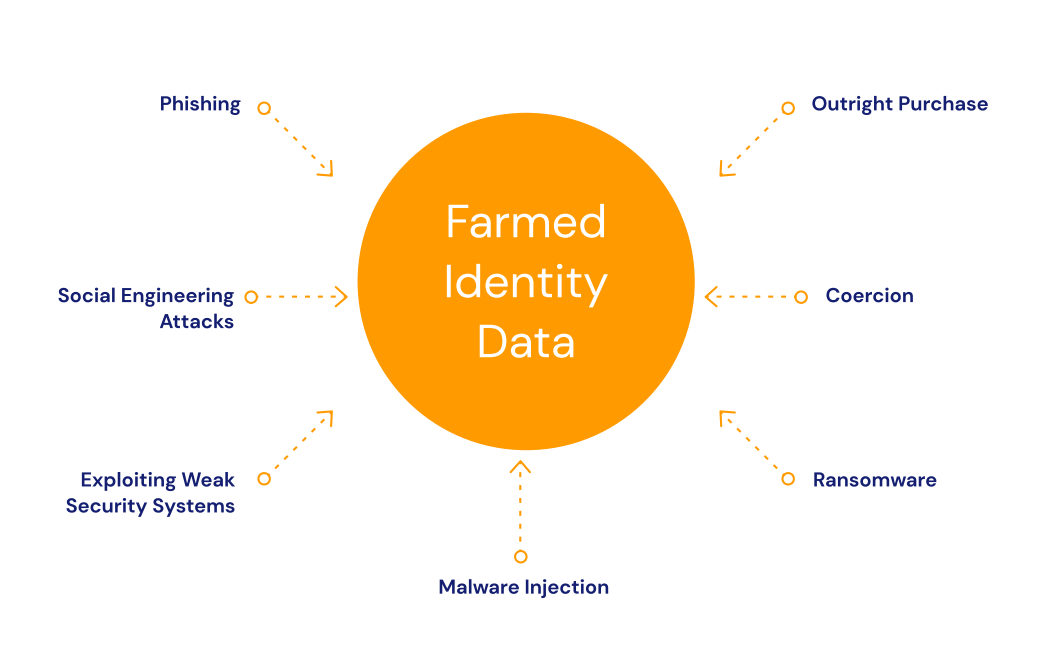

Identity farming—which involves creating multiple fake identities—is an established threat notably in the fintech space. It is prevalent in regions with low literacy and high unbanked populations. Fraudsters harvest personal data from vulnerable individuals and, with the help of insiders, take over accounts to create suspicious accounts that facilitate complex money laundering activities. Some fintech platforms promote less stringent KYC regulations and faster transaction processes as a unique selling point. This steep tradeoff makes them prime targets for fraudulent attacks.

Another area with high fraud risk is in the use of mobile money. In a 2022 study on the dark side of mobile money in Nigeria, some respondents surveyed disclosed that they “shared their personal identification number with a mobile money agent (MMA) they had come to trust” while acknowledging that accounts were opened on their behalf even though they didn’t request them. The MMAs admitted that customers have limited technological understanding, often depending on agents to complete critical financial transactions. This dependent relationship creates significant vulnerability for customers who may not fully comprehend the processes or potential risks.

[How identities are farmed/ SmileID]

ALSO READ: State of African Tech in 2024: Key Trends and 2025 Outlook

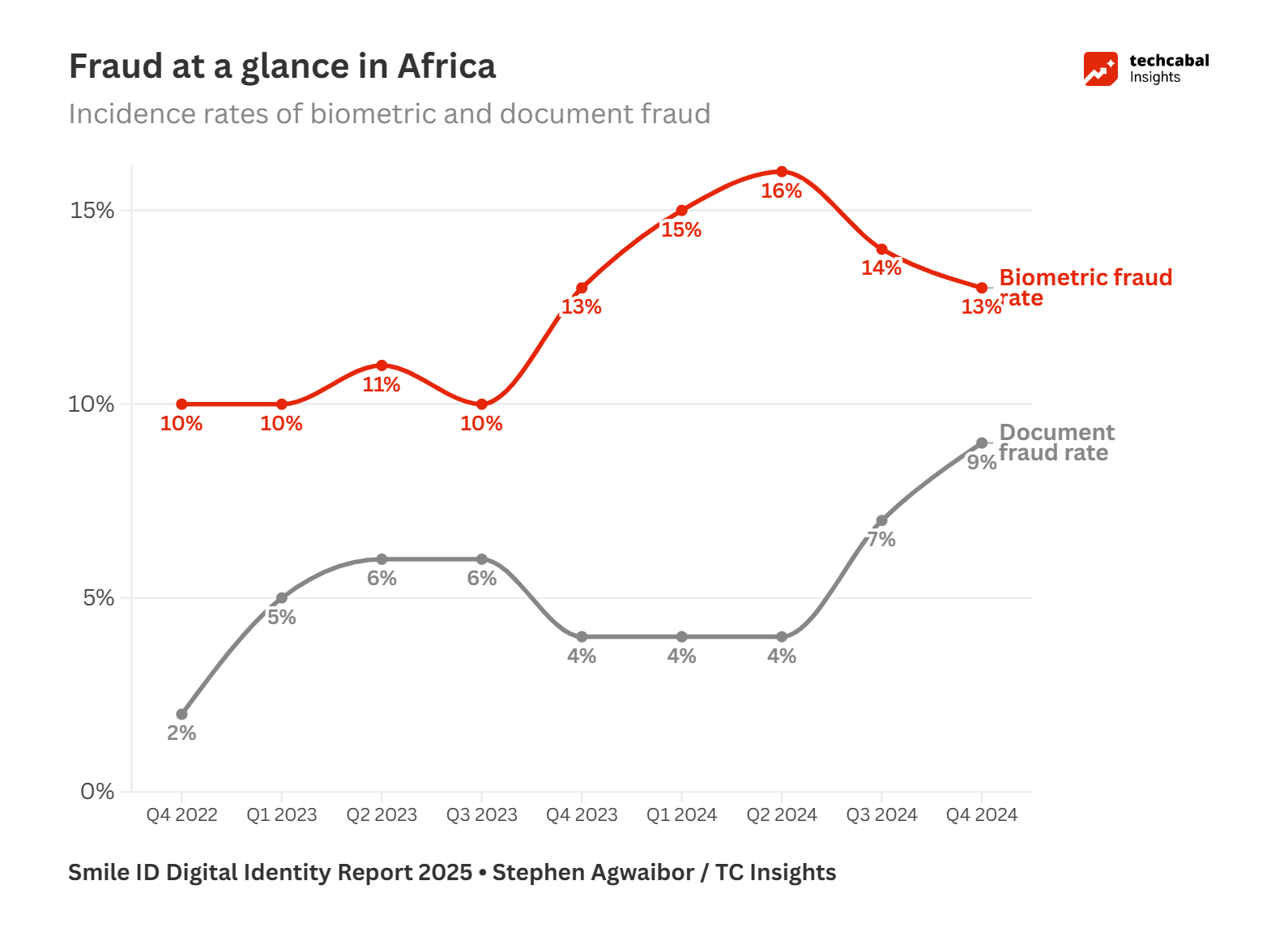

Regional variations and biometric fraud tactics

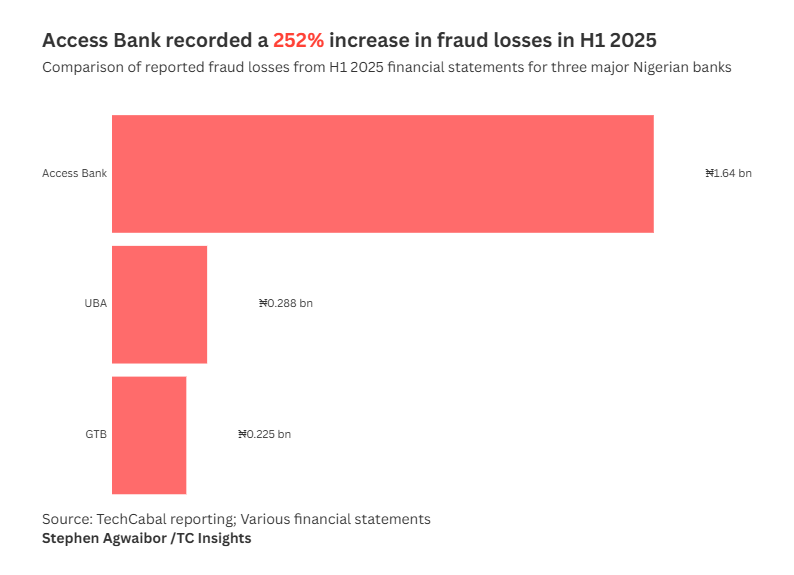

The report revealed regional variations in fraud rates across Africa. At 27%, East Africa reported the highest biometric and document verification rejection rates, driven by reliance on outdated identity documents. There were sharp increases from the previous year across the remaining regions under consideration. West Africa experienced a surge in biometric fraud attempts—from 12% in 2023 to 22% in 2024. Increasingly sophisticated AI-driven attacks explain this surge. Central Africa went from 19% to 22%, while Southern Africa jumped from 9% to 21% for the same period.

[For data requests or research services, reach out to TC Insights via this link]

Document manipulation and fraud detection

Fraudsters employ various document manipulation techniques, including screen-based manipulation, portrait anomalies, and non-document submissions. These methods exploit the appearance of legitimacy in digital displays, making detection challenging for systems that rely on visual checks. No-face match remained the most common fraud type in Africa in 2023, with a rise in liveness fails indicating evolving efforts by bad actors to bypass biometric verification systems.

How to combat these threats

Combatting digital identity fraud in Africa begins with recognising that fraud involves both technological and human components. Loopholes in the two must be addressed. The technological component includes improving biometric verification systems beyond traditional checks, implementing dynamic liveness detection, real-time anomaly recognition, and cross-referencing against a standardised database to create nearly impenetrable identity protection.

Nonetheless, a human-centered approach prioritising continuous digital literacy and community empowerment is equally essential. This means designing comprehensive education programs that help individuals—from mobile money agents to everyday consumers—understand digital risks, recognise potential fraud attempts, and participate actively in their digital security.

Collaboration remains an important defense mechanism. According to Mactar Seck, chief of technology and innovation at the United Nations Economic Commission for Africa (ECA), successfully implementing a successful digital ID system, “requires a comprehensive and collaborative approach, considering the specific needs and challenges of each African country.” Regulators and financial institutions must stay connected and current on the latest cybersecurity trends and take proactive measures to address them. The future of fraud prevention lies in adaptability, continuous investment in technology, and fostering a culture of vigilance and collaboration.