By Tunde Alade-Bakare

Walk into any major African city today, and you will notice something interesting: the fintech companies that remain standing are not necessarily the ones that made the most noise five years ago. They are the ones who figured out how to build sustainable businesses while everyone else was chasing unicorn valuations.

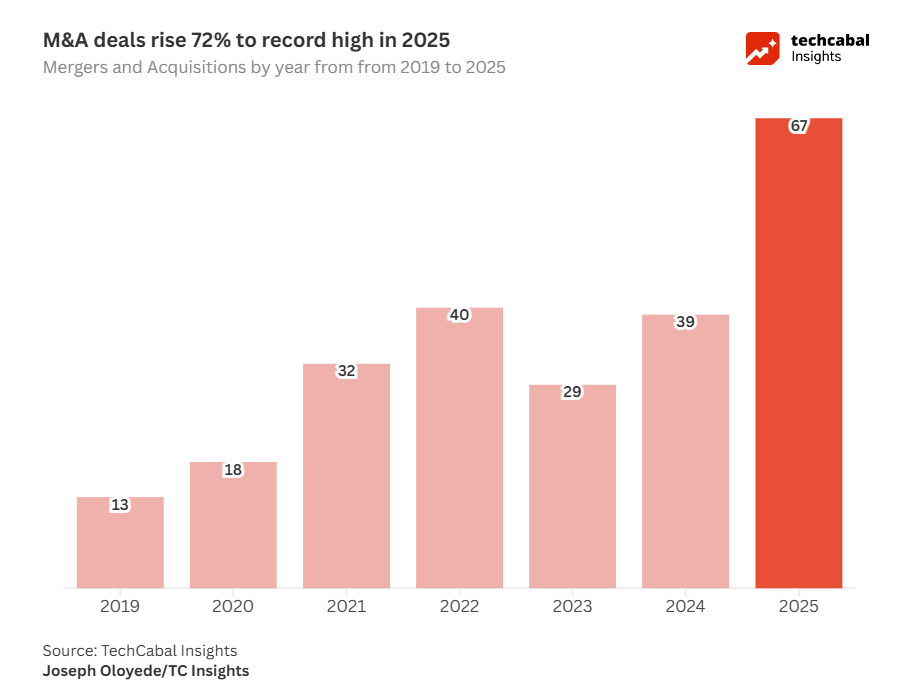

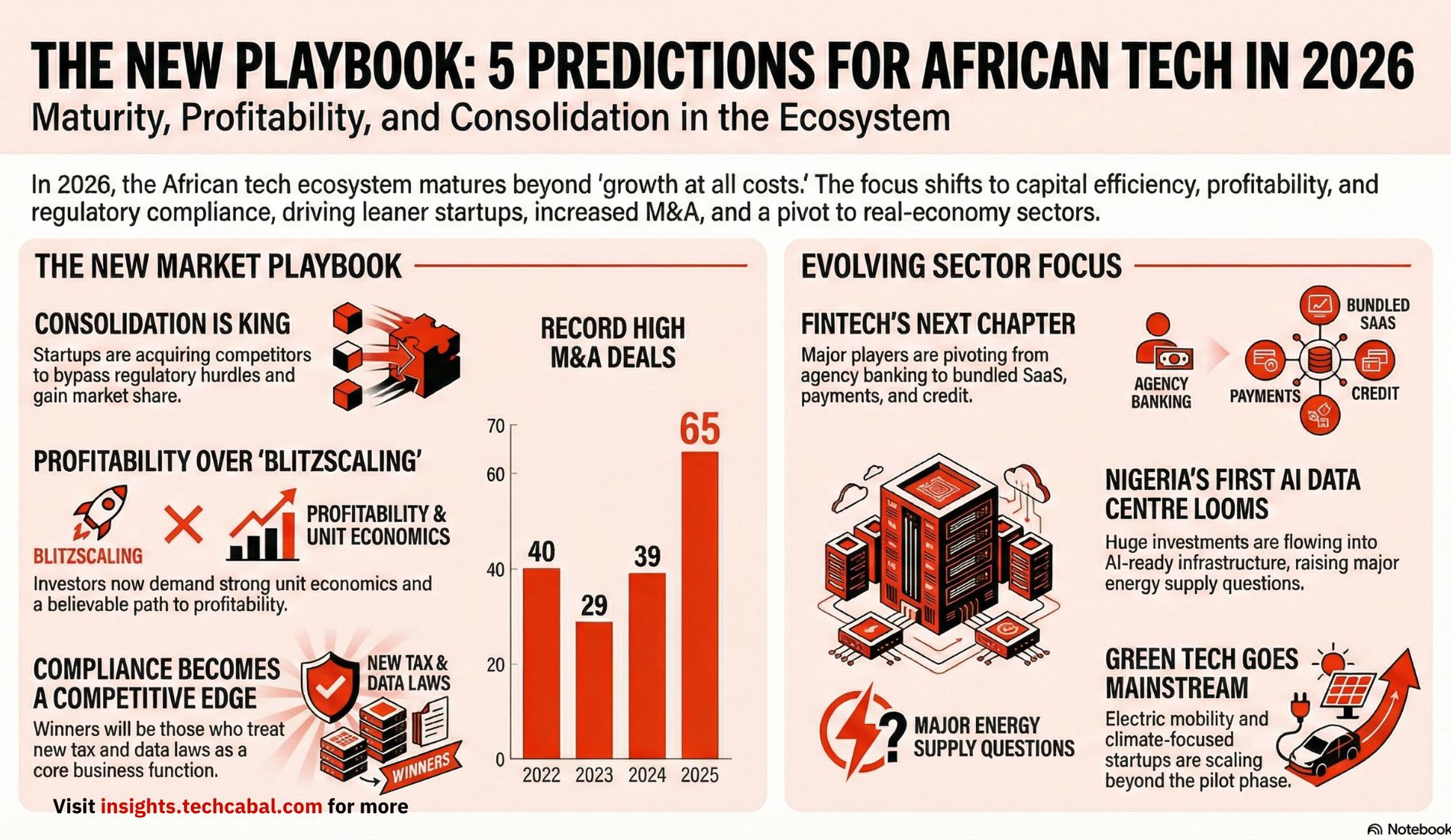

The numbers tell a sobering story. According to the European Investment Bank’s “Finance in Africa 2024” report, fintech investment plummeted by 78% year-over-year as global financial conditions tightened. Yet even as capital dried up, the sector itself exploded from 450 companies in 2020 to 1,263 by early 2024. In 2024 alone, fintech captured 60% of total African equity funding. Investors have not abandoned African fintech; they have simply become more discerning.

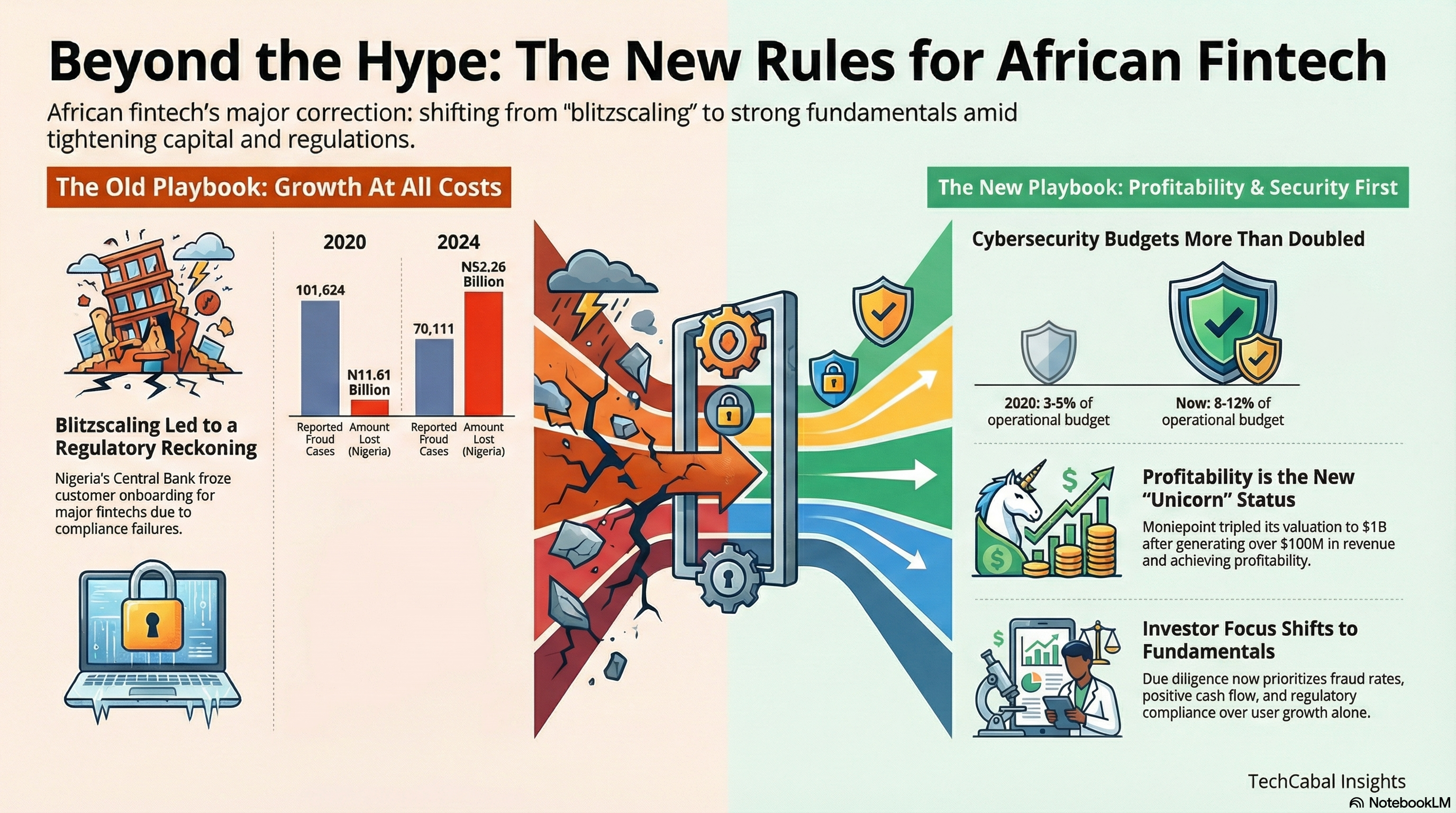

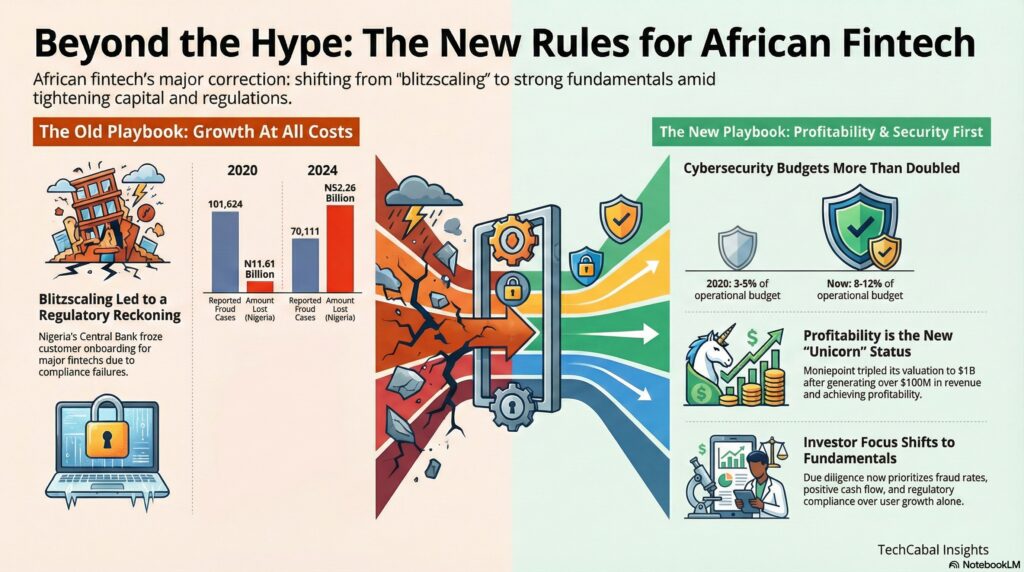

The urgency is clear. Nigeria’s Inter-Bank Settlement System reported that financial institutions lost ₦52.26 billion (approximately $34.5 million) to fraud in 2024, nearly triple the amount lost in the previous year. Seven out of every ten naira stolen came through digital channels, the very infrastructure fintechs built their empires on.

The Growth-at-All-Costs Reckoning

Nigeria’s fintech story offers a masterclass in contrasts. Paga, which started in 2009, spent fifteen years building carefully. By 2024, the company had achieved three consecutive profitable years, processing ₦14 trillion ($9.2 billion) annually.

OPay, launched in 2019 with Chinese backers, took the opposite approach. The company expanded aggressively, operating at a loss, to capture market share. By April 2024, OPay announced its first monthly profitability with daily active users approaching ten million. Today, it serves 50 million users and processes over $12 billion in monthly transactions. Then came the regulatory fallout.

That same April, the Central Bank of Nigeria ordered OPay, PalmPay, Moniepoint, Kuda Bank, and Paga to halt customer onboarding due to KYC compliance issues. The six-week freeze represented the tangible cost of prioritising growth over infrastructure. For OPay, which had been adding 1.1 million users weekly, roughly 6 million potential customers walked away. Later in 2024, both OPay and Moniepoint received ₦1 billion fines each. Paga, meanwhile, had proactively engaged with regulators and even written a white paper that shaped the revised CBN regulations.

Chipper Cash followed a similar trajectory. After hitting unicorn status in 2021 with backing from SoftBank and Jeff Bezos’s fund, market volatility forced the company to cut nearly 200 jobs. Their valuation dropped 37.5%. CEO Ham Serunjogi refocused on four core markets and prioritised operational efficiency. By 2024, Chipper Cash was processing over 125,000 daily transactions with renewed focus on profitability.

How Infrastructure-First Companies Won

In South Africa, JUMO built banking-as-a-service infrastructure rather than directly chasing retail customers. The company partnered with banks and mobile operators. Over $8 billion has been disbursed to 31 million people across nine African countries, with lending risk costs remaining below 4% thanks to AI-driven risk management. When JUMO raised $120 million in 2021 from Fidelity and Visa, the company deepened existing operations and expanded only when infrastructure could handle it.

The potential remains enormous. McKinsey estimates that African fintech revenues, which stood at $4 to $6 billion in 2020, could reach $30 billion annually if penetration levels match Kenya’s success across the continent. Statista projects that digital payments alone will reach $314.80 billion by 2028, up from $195.50 billion in 2024.

African Fintech Fraud: The Rising Cost of Digital Growth

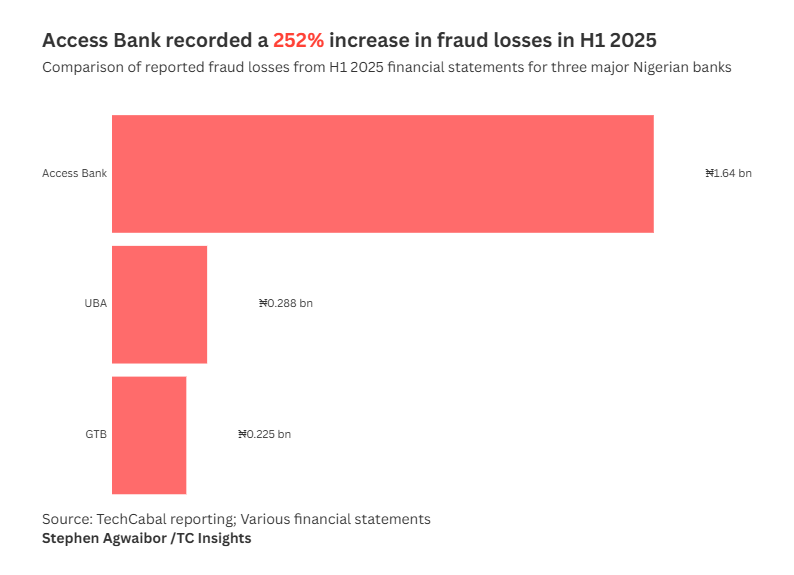

The cybersecurity crisis reveals a troubling pattern. According to NIBSS’s 2024 Fraud Report, while reported fraud cases decreased by 31% from 101,624 in 2020 to 70,111 in 2024, the amount lost increased by 350%, from ₦11.61 billion to ₦52.26 billion. Fraudsters are becoming more sophisticated and successful.

The same report shows a 338% spike in attempted fraud between 2023 and 2024. Over 740,000 attempted digital fraud incidents hit Nigerian financial platforms in 2023 alone. Flutterwave lost $24 million in October 2023 due to unauthorised POS transactions. Access Bank reported 11,410 fraud incidents in 2024, involving ₦3.5 billion in attempted losses; enhanced security measures limited actual losses to ₦1.69 billion.

World Bank data reveals that Sub-Saharan Africa leads the world in mobile money adoption, with 40% of adults holding mobile money accounts in 2024, up from 27% in 2021. This rapid digitisation creates both opportunity and vulnerability. While cash is still used in around 90% of transactions in Africa, the shift to digital channels demands a robust security infrastructure.

ALSO READ: Is cybercrime outpacing Africa’s digital revolution?

Regulatory Response: New Compliance Requirements Across Africa

Across the continent, regulators are imposing stricter standards. In Nigeria, the CBN rolled out new KYC rules in November 2023 requiring physical address verification for all POS agents and customers. For OPay with 563,000 agents, that meant spending an estimated $376,000 just on verification. In January 2025, the CBN directed NIBSS to debit banks for fraudulent transactions automatically.

Kenya’s Central Bank imposed a fine of KES 191 million on eleven commercial banks for compliance failures and established comprehensive cybersecurity requirements. South Africa was grey-listed by the Financial Action Task Force in 2023, forcing the South African Reserve Bank to accelerate reforms. By October 2024, FATF acknowledged that South Africa had addressed 16 of 22 required action items.

The penalties are substantial. Kenya’s Data Protection Act can impose fines up to KES 5 million or 1% of annual turnover. South Africa’s Protection of Personal Information Act carries penalties up to R10 million (about $540,000). Leading African fintechs now allocate 8-12% of their operational budgets to cybersecurity infrastructure, up from 3-5% in 2020.

What Investors Look For in African Fintech Now

The funding environment has changed fundamentally. Moniepoint raised $110 million in October 2024 at a $1 billion valuation, triple their $400 million valuation from two years earlier. The company achieved this by processing 5.2 billion transactions worth $150 billion in 2023, generating over $100 million in annual revenue and turning a profit.

When investors conduct due diligence now, they ask different questions: What is your fraud rate? Show us unit economics by customer cohort. What is your regulatory compliance status? Where are your security certifications? When will you achieve positive cash flow? Can you survive a regulatory audit tomorrow?

Market forecasts indicate that the Middle East and Africa fintech market, currently valued at $5.03 billion in 2024, is expected to grow at an annual rate of 18.9% through 2031. However, European Investment Bank analysis reveals that this growth will favour companies with proven unit economics, with 70% of fintech operators concentrated in Nigeria, South Africa, Kenya, and Egypt attracting 80% of funding.

The Path Forward for African Fintech

The next decade’s winners will not be whoever scaled fastest in 2020. They will be the builders who understood unit economics from day one, the operators who treated regulators as partners, and the founders who embedded security from the beginning. Even OPay’s current success stems from eventually doing the hard work of building compliant, secure, profitable operations.

This shift represents a necessary correction. African fintech is finally acknowledging what should have been evident from the start: fundamentals always matter. Compliance is not optional. Security cannot be retrofitted. Profitability is not something you figure out eventually. Africa needs fintechs that serve its hundreds of millions of people with secure digital financial services, not companies that serve investors with hype and headlines.

Tunde Alade-Bakare is a cybersecurity and technology transformation leader who has led major security programmes across financial services, telecoms, and digital platforms in Africa.

Explore how Africa’s digital infrastructure is reshaping commerce. Download the Future of Commerce 2025 report.