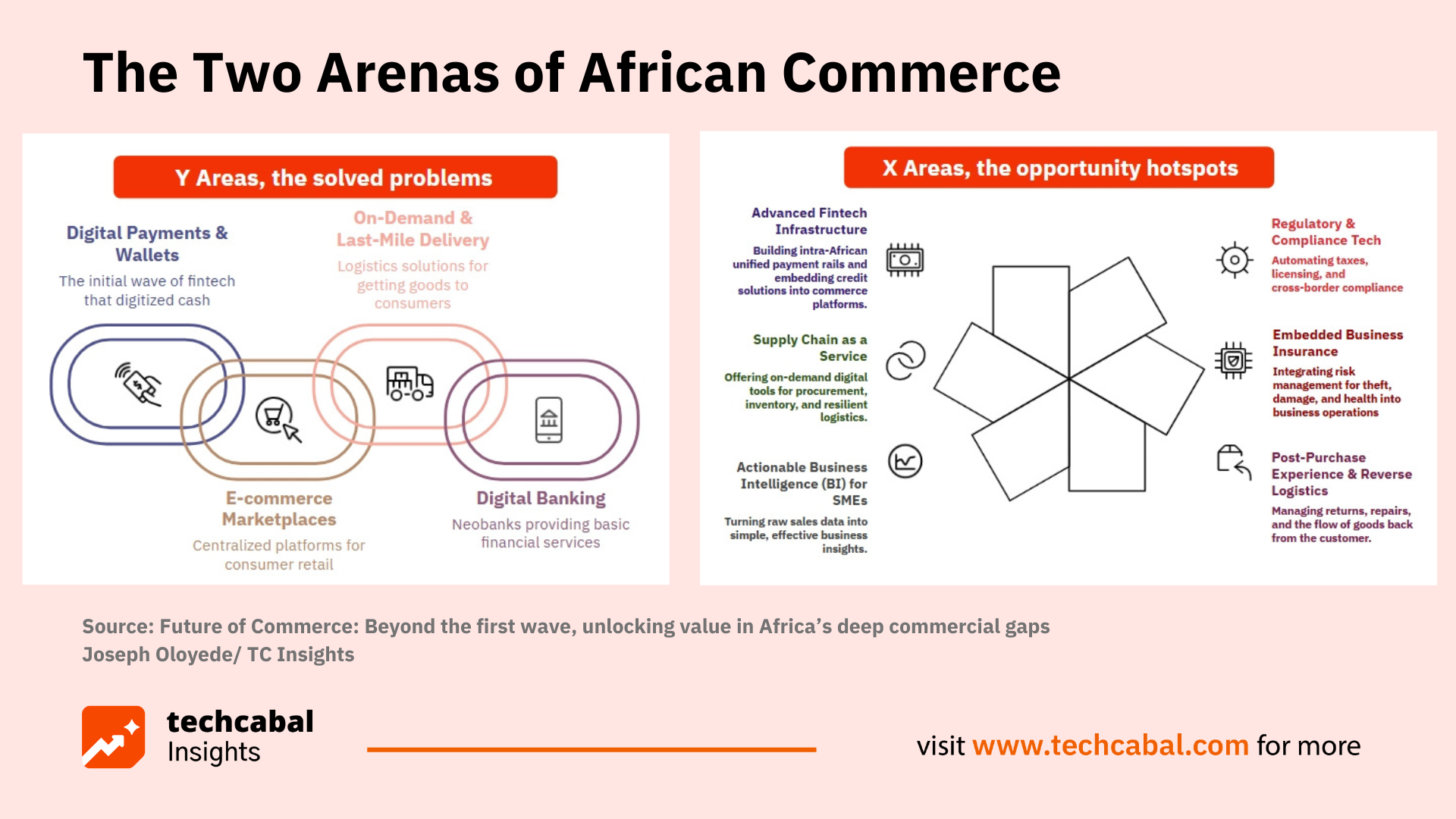

Just a decade ago, African commerce was defined by traditional banks and the friction of raw cash. A transformative wave of innovation has since swept the continent, led by fintech startups that digitized payments, logistics apps that tackled the last mile, and e-commerce marketplaces that brought the store to the smartphone. This first wave solved the most visible problems, the “Y Areas.”

But a deeper set of challenges the “X Areas” remain. These are the foundational hurdles that keep businesses from truly scaling: the complexities of compliance, the absence of accessible business insurance, and the difficulty of turning raw transaction data into actionable retailer intelligence. The next frontier for innovation and value creation lies in solving these deep, operational problems.

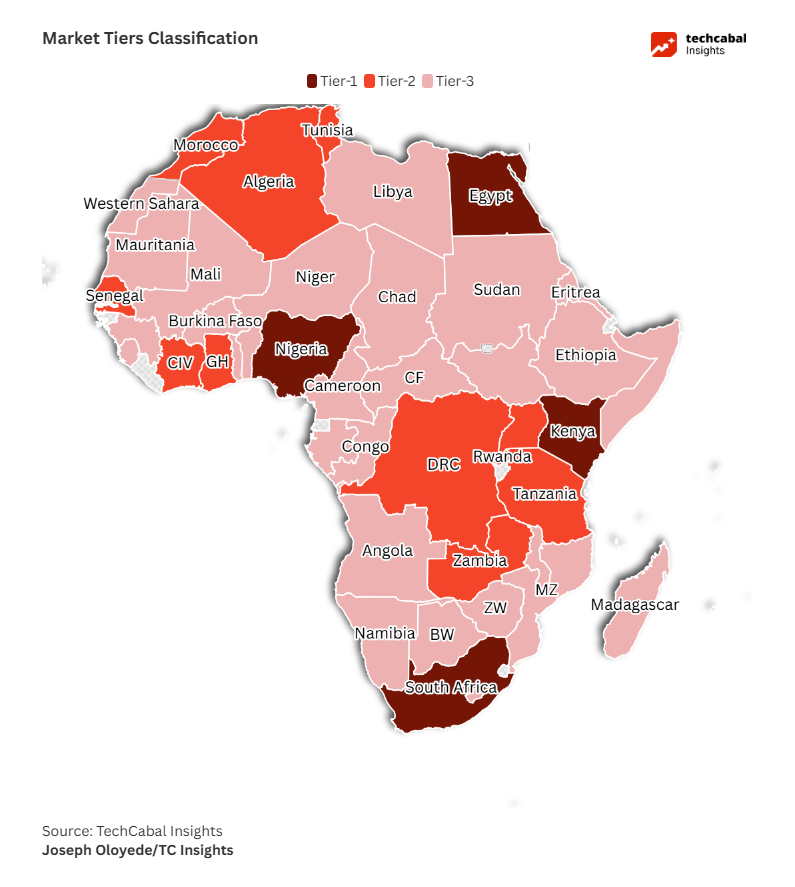

Africa’s market potential is immense, with a population of over 1.5 billion people and 675 million internet users. However, its nearly 165 million e-commerce users are highly concentrated, with North and West Africa leading the way.

This digital landscape is built on a complex foundation. The continent’s average scores on indices like the Africa Infrastructure Development Index and Logistics Performance Index reflect the varied ease of doing business; where scores are low, commerce faces significant headwinds. This creates a broad spectrum of markets, each with its own consumer purchasing power, user journey, and exposure to microeconomic and climate risks.

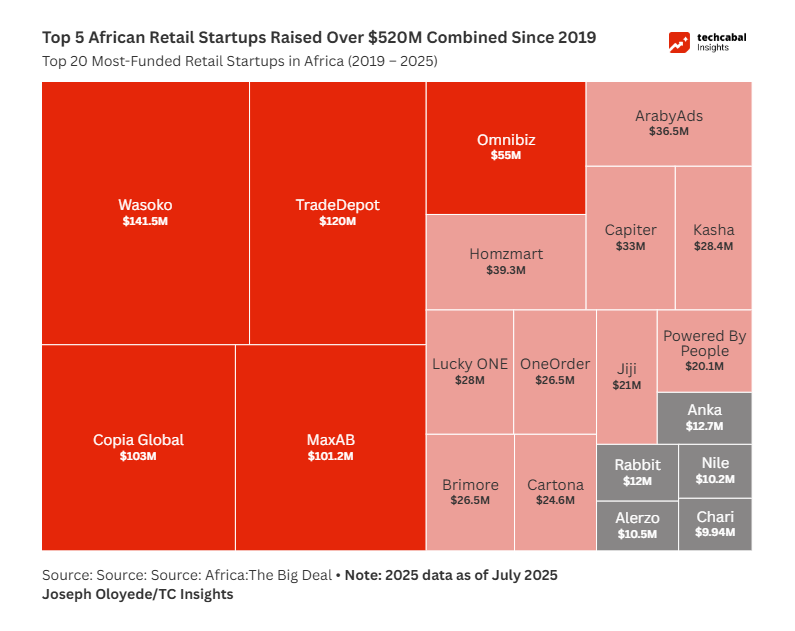

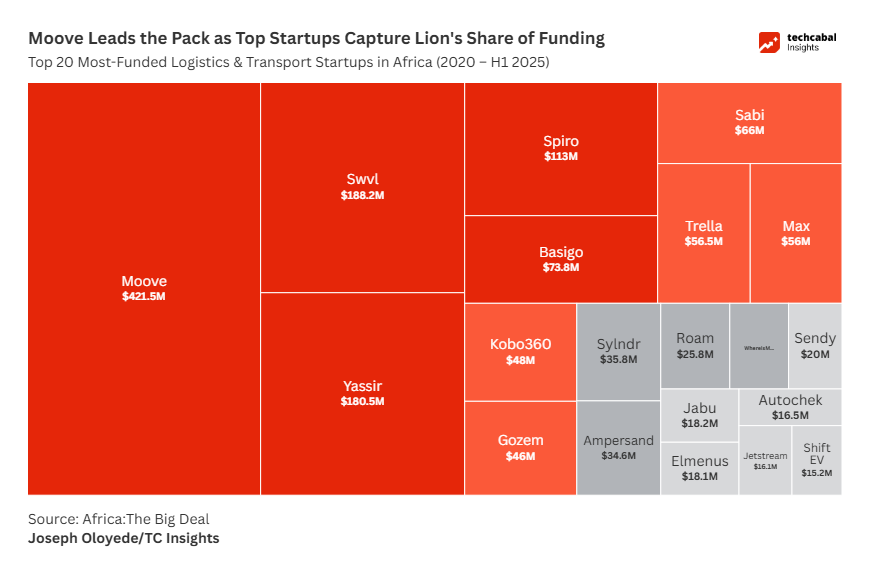

The continent’s e-commerce ecosystem has attracted over $2.27 billion in venture funding since 2019, with capital flowing to distinct sectors. Our analysis shows that Retail is the dominant channel, making up 53.6% of startups and capturing nearly half of all investment with over $1 billion raised. Critical enabling sectors follow, with Fintech attracting $508 million and Logistics & Transport securing $246 million, underscoring their foundational role in facilitating digital trade.

ALSO READ: A billion-dollar boom and the shakeup that followed: The story of African retail tech

A Maturing Ecosystem: Mergers, Pivots, and a Push for Profitability

The last year has shown that the market is getting more serious and competitive, with big players making strategic moves. In a major sign of consolidation, the newly merged MaxAB-Wasoko acquired Egypt’s Fatura as its first big move, while Twiga Foods bought majority stakes in three distributors to strengthen its supply chain. E-commerce giant Jumia showed a clear push for profitability, narrowing its losses as its Q2 2025 revenue grew by 25% to $45.6 million.

At the same time, the company shut down its food delivery service to focus on its core retail business. These events, along with the operational challenges and shutdowns faced by other players, prove that only strong, efficient business models will last in this maturing market.

The ‘X Area’ Playbook: Building Africa’s Trade Backbone

To fully solve for the ‘X Areas,’ the ecosystem must move beyond standalone solutions. According to investors featured in our report, the path forward lies in embedding finance directly into commercial platforms. As Mobola da-Silva of Capria Ventures notes, this creates a verifiable data trail that allows AI-driven credit models to underwrite loans for SMEs in minutes, not weeks.

Founders are advised to leverage payment orchestration platforms to manage complexity and to build B2B “painkillers, not vitamins” resilient solutions for non-negotiable business problems. Ultimately, these innovations must coalesce to build a modern “trade backbone” for the new era of pan-African and South-South trade.

The Path Forward: A Call to Action

The future of commerce in Africa is not in the storefront, but in the engine room. Our research concludes that the narrative has shifted from reaching consumers to empowering businesses.

- For Founders, the mandate is to solve deep, operational problems with resilient, profitable models.

- For Investors, the playbook is to look beyond the crowded ‘Y Areas’ to the B2B platforms forming the core infrastructure of trade.

- And for Policymakers, the priority must be to accelerate AfCFTA implementation and harmonize regulations.

The next wave of value will be created by those who build the foundational rails upon which a truly integrated and prosperous continental market can run.

Download the full Future of Commerce 2025 report to get the data, insights, and strategic playbook you need to win: https://insights.techcabal.com/report/future-of-commerce/