African tech has evolved from being a budding market with minimal venture capital activity to becoming a robust sector. To date, it has attracted billions of dollars in investment. However, as funding has flowed, a persistent question continues to loom large in boardrooms. When will African tech deliver more exits and returns?

This was the focus of the TC Live Podcast’s debut episode, which aired on March 28. The Exit Series brought together industry leaders, including Osarumen Osamuyi (The Subtext), Derin Adebayo (Unevenly Distributed), Tokunboh Ishmael (Alitheia Capital), Babacar Seck (Askya Investment Partners), and Chirantan Patnaik (British International Investment). These thought leaders provided insights spanning decades of observation and investment across various African markets. Their conversation revealed not only how far the continent has come but also provided a nuanced perspective on viable paths forward for African tech exits.

The evolution of African tech

Africa’s tech landscape has experienced radical shifts in just ten years. In his retelling, Osarumen vividly illustrated how what was once considered a major funding event has become relatively commonplace:

“Back when hotels.ng raised a $1.2 million Series A from Echo VC and Omidyar Network, it was one of the biggest rounds that year with 70k users… Today, Series A user bases are typically measured more in millions or hundreds of thousands of users.” This evolution is not just about larger funding rounds, but also about the growing impact of technology companies across the continent. Fintech has particularly transformed daily life: “I can be in Lagos traffic buying from a street vendor by making payment online. This was not the case 10 years ago,” he added.

The scale of this transformation becomes apparent when examining the investment numbers. From just $35 million raised across the continent in 2010, African startups now regularly secure over a billion dollars annually, with 52 rounds exceeding $1 million in the first quarter of 2025.

Understanding the venture capital cycle in Africa

To properly assess exit activity in African tech, it is essential to understand its position within the broader venture capital cycle. The data presented during the discussion identified three distinct phases in the African tech journey:

1. The Run-up (2010-2020): A period of gradual growth in investment activity

2. The Bubble (2021-2022): An acceleration of investment with heightened expectations

3. The Crash (2023): A correction that brought expectations back to realistic levels

This analysis reveals that Africa has just completed its first full venture capital cycle, an important milestone that contextualises the current state of exits on the continent.

The return on early African tech investments

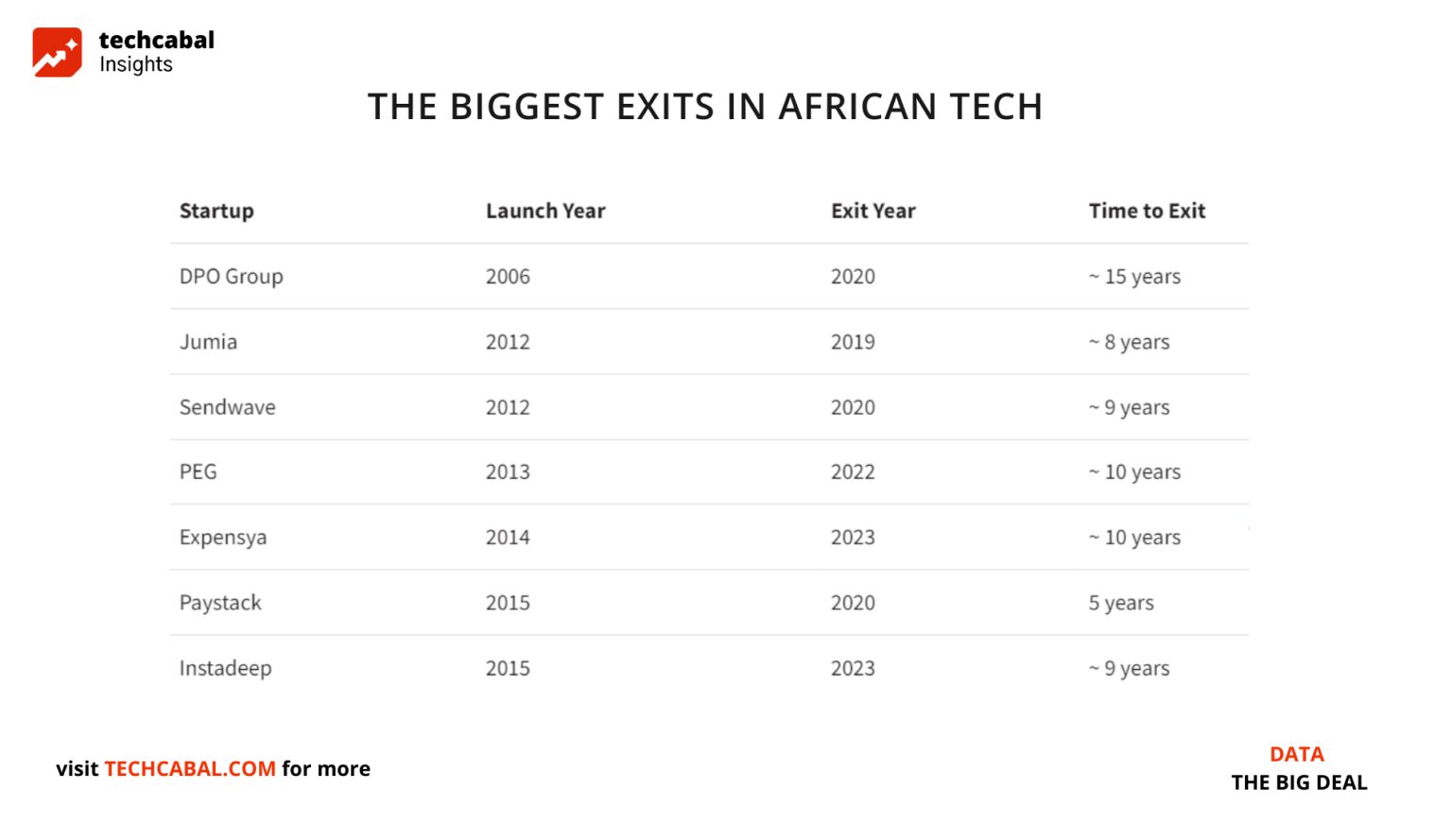

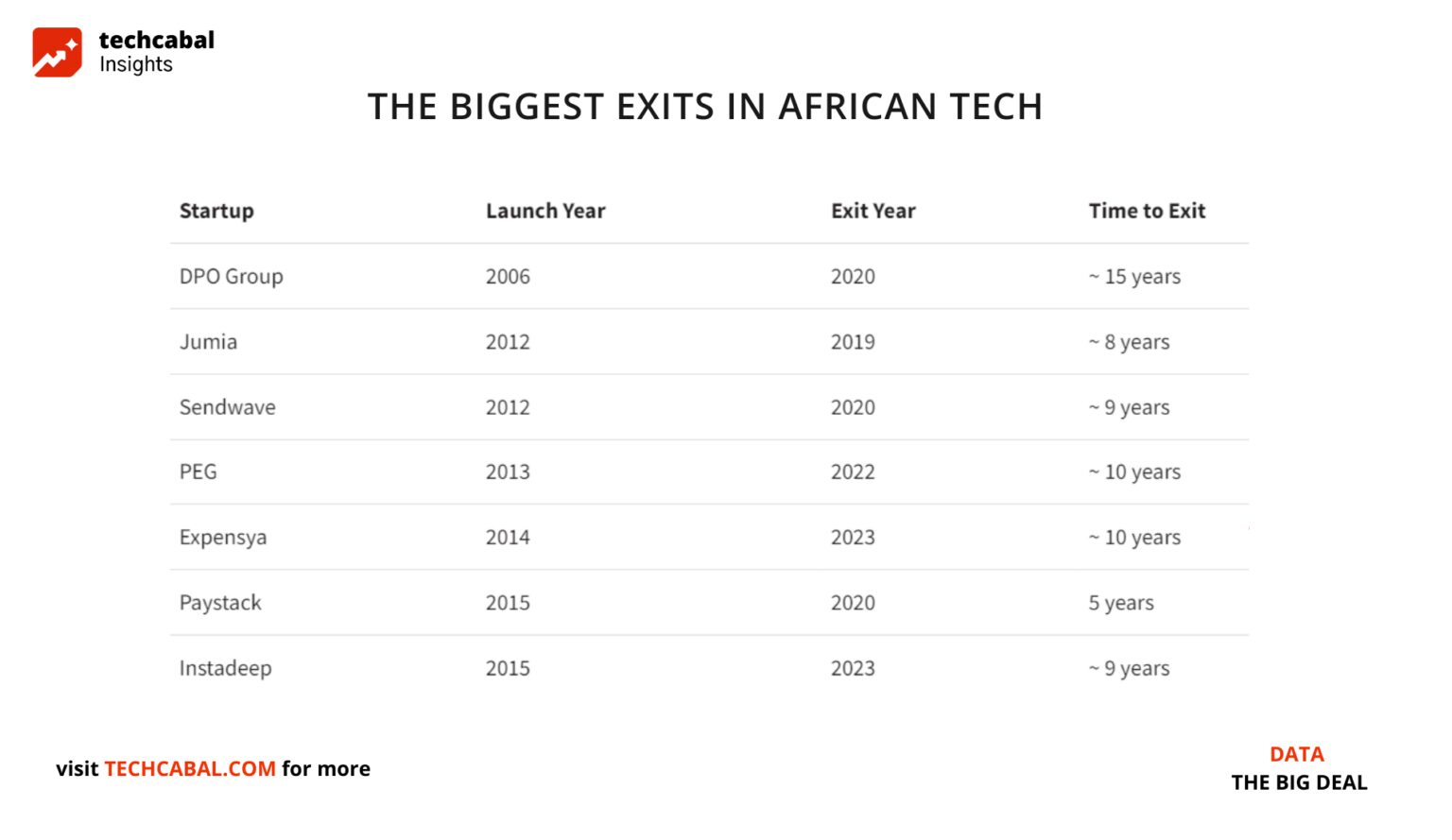

Perhaps the most compelling data point from the discussion was the revelation about returns from the first wave of investments. Osarumen noted, “Of the nearly 600 companies that were funded from 2010 to 2017, just five of them have returned all the capital that flowed in. Five companies have returned $2.5 billion.”

Despite concerns about exit activity, the early wave of African tech companies has already returned more capital than was invested during that period, and that’s without counting unrealised gains from unicorns and scaling companies still building value.

As Babacar emphasised, “Africa is delivering the returns. The returns are not yet fully realised, but the value has been created, and it’s here on the continent… more than $10 billion in value that has been created from that capital that was invested.”

The exit challenge: Multi-dimensional factors

Several interconnected factors affecting exit opportunities for African tech companies include:

Underdeveloped local capital markets

A significant challenge is the lack of appropriately structured local exchanges. As Chirantan noted, “We do need to think about the layering of the capital markets to have specific windows for the VC-backed type companies… It can’t be in the same capital markets that will have the large cap and the banks.”

Limited buyer pool

The conversation highlighted the need for more consolidation within sectors: “We need to see more consolidations within sectors, more roll-ups. We need to see more activity between financial buyers and improved implementation strategies.” Interestingly, the discussion revealed that local banks and financial institutions have not been as acquisitive as one might expect, often preferring to develop technology solutions internally rather than acquire startups.

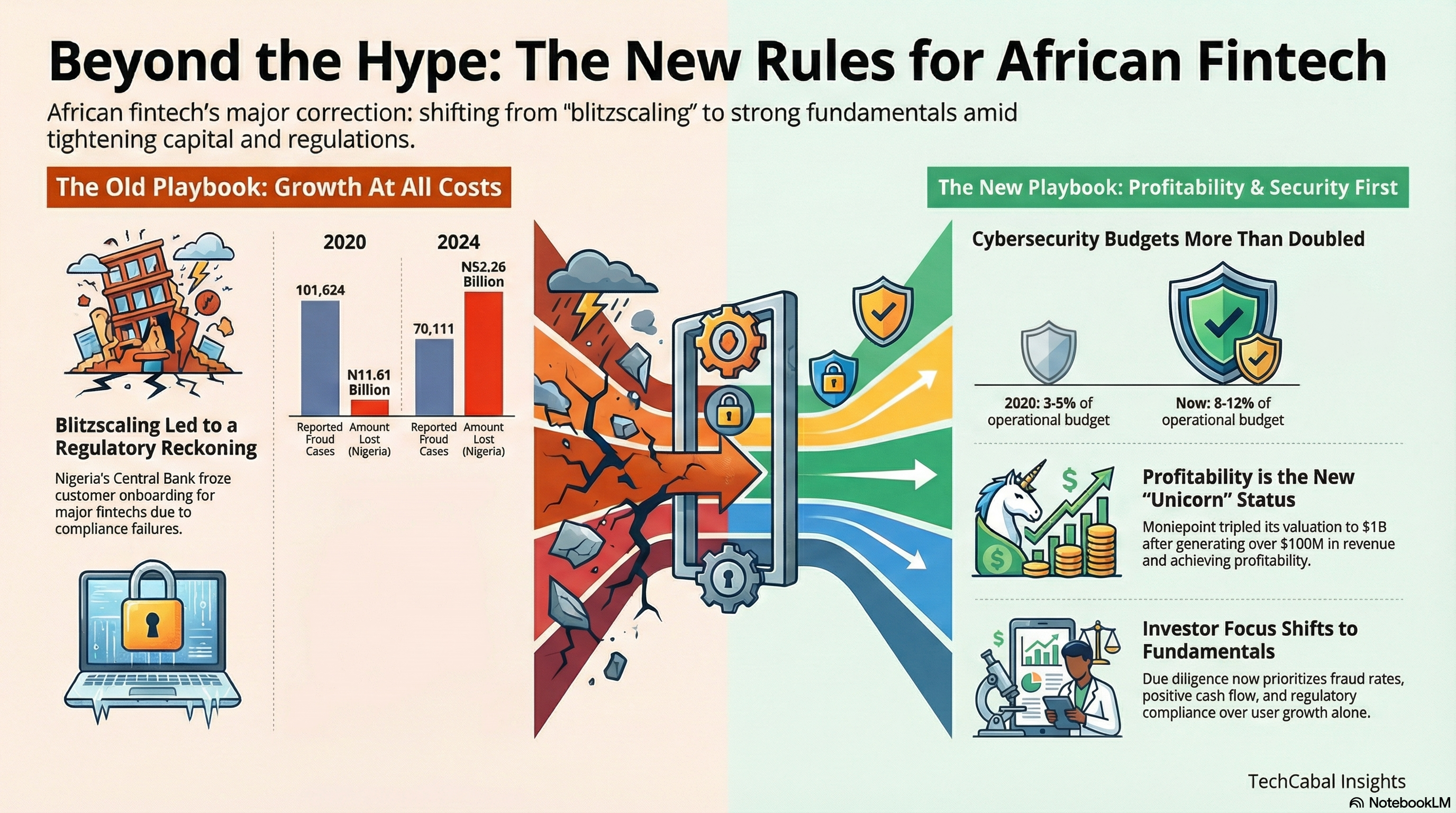

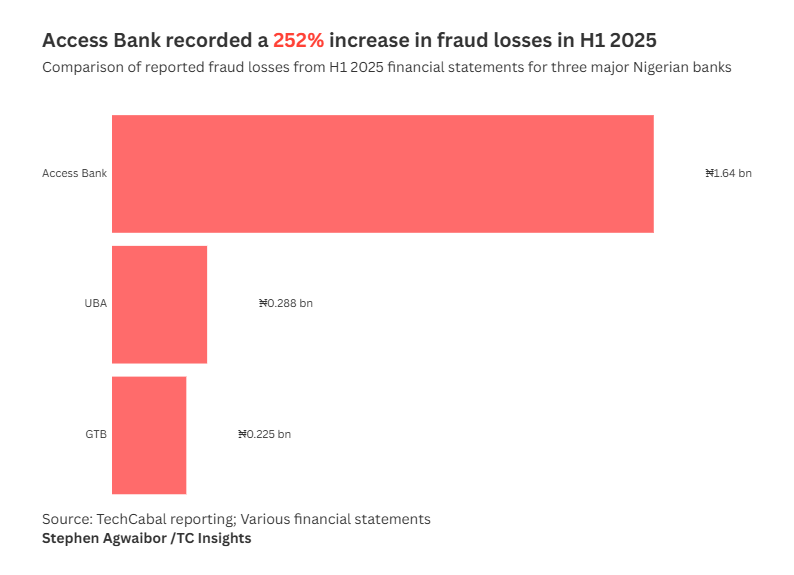

Macroeconomic challenges

Currency fluctuations present a particular challenge for investors seeking outsize returns. As Tokunboh noted, “With the macro backdrop, particularly in a country like Nigeria, it’s not great. You have a significant influx of foreign currency, yet local currency is depreciating. These funds have their denomination in dollars.”

Regional fragmentation

The fractured nature of African markets creates additional complexity for companies looking to scale. This was a salient point Tokunboh raised in explaining why the African market has yet to match the strides seen in places like India: “Our companies do have to think about regional expansions because they don’t have a single language or a single, stable currency.”

ALSO READ: Three charts that explain the state of African tech exits

Emerging solutions and opportunities

Despite these challenges, the discussion identified several promising paths forward:

Secondaries as an exit path

One increasingly important exit mechanism is secondary transactions. TechCabal recently highlighted how data might be valuable in exploring them as a viable alternative. As Babacar explained, “If we just look at transactions above $25 million since 2019, we have had 125 transactions, which generally include secondaries… That’s about 8 billion in deals. If you take 10 to 50% in secondaries, that’s a billion to 4 billion of capital that has been returned.”

Building strong fundamentals

There was an emphasis on African tech companies needing to focus on building businesses with solid financial foundations. “The financial fundamentals are EBITDA (earnings before interest, taxes, depreciation, and amortisation), cash flow, and growth. Those are what matter. The non-financial fundamentals are governance, the quality of your teams, and the quality of your process and operations,” Babacar said.

Unlocking regional integration

Tokunboh made the case for regional integration to make deals seamless: “One thing that has not been done yet in the African tech is building true regional layers… especially across West Africa, where we have very strong pre-existing economic links.”

Patient capital, realistic expectations

The discussants elaborated that venture returns in Africa may take longer to materialise and that recognising this fact and recalibrating expectations can be helpful in the long term. As Chirantan put it, “If you look at the data—and I’m talking about the top decile VC funds—they take around 15 years to make returns.”

The future of African tech exits

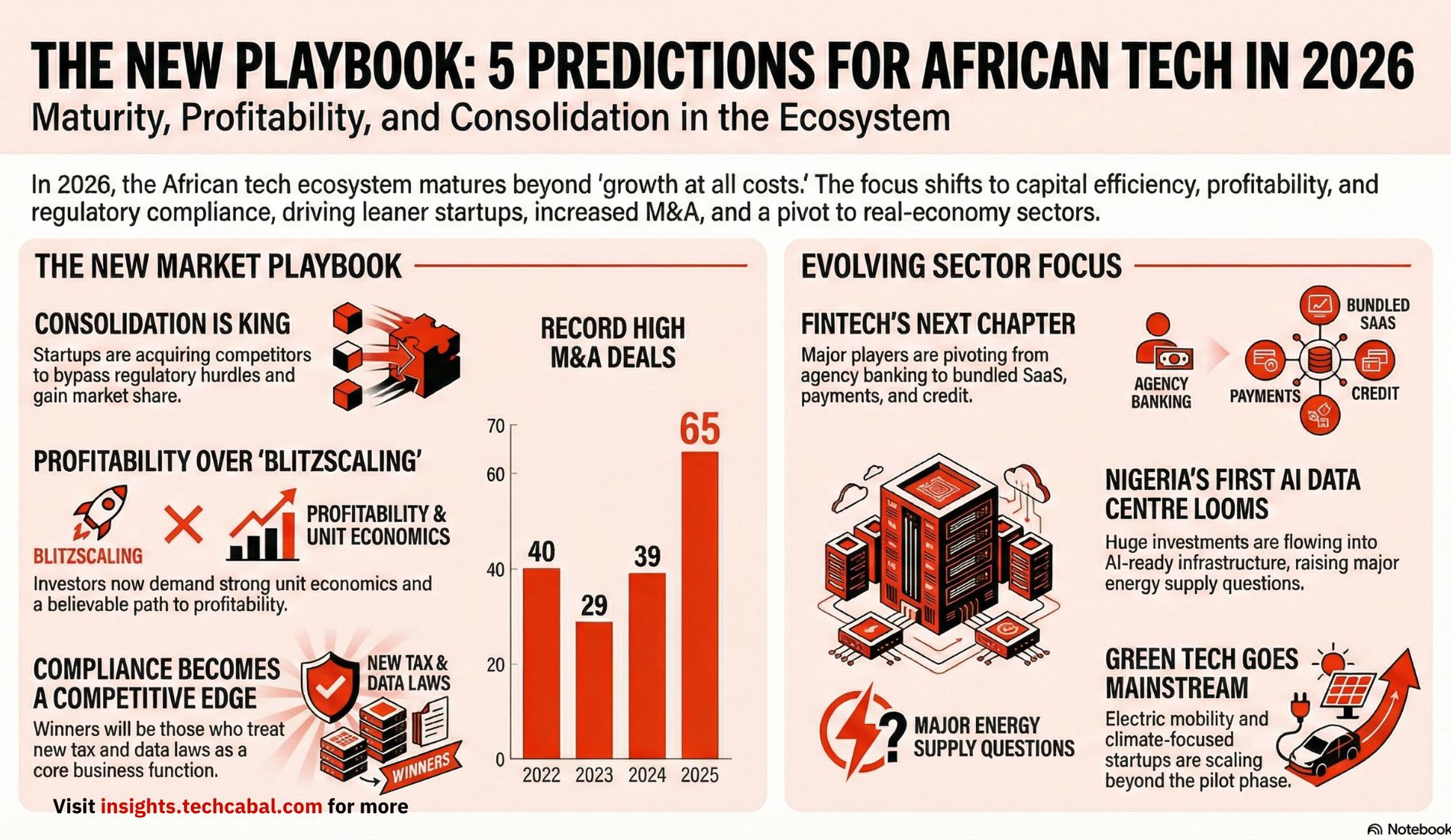

Looking ahead, the conversation identified several key trends that will shape African exits:

Tech companies as acquirers: As the ecosystem matures, today’s well-funded tech companies will become tomorrow’s acquirers, creating a virtuous cycle of innovation and exits.

Moats as value creators: The dearth of infrastructure often means that companies must fill the gaps that governments fail to address, making investing a laborious venture. Those who take on that risk and build their moat will solidify their market positions, becoming the foundation that others build on, thus making them valuable.

Domestic capital activation: Unlocking local pools of capital will be crucial for success. “A big missing part is domestic capital… if we had more depth in our local capital with the domestic capital, that could help release some of the strain investors carry.”

Evolving regulation: Continued improvement in regulatory frameworks, particularly in areas such as capital markets and business combinations, will facilitate increased exit activity.

The discussion made clear that while African tech has made remarkable progress in just a decade, patience remains essential. The continent has completed its first venture capital cycle, demonstrating that significant returns are possible and establishing the foundation for a sustainable ecosystem.

Patience, however, doesn’t mean passivity. To accelerate meaningful exits, a coordinated multi-stakeholder approach is essential: regulators must create tailored capital market structures and streamlined listing requirements; investors should adopt realistic timelines and support domestic capital development; founders need to build businesses with strong fundamentals and clear equity stories; while industry organisations and traditional corporations must respectively strengthen advocacy efforts and embrace acquisition strategies.

To drive this forward, stakeholders should form collaborative working groups focusing on specific initiatives: establishing specialised tech company listing frameworks on local exchanges; developing regional growth strategies that leverage cross-border economic connections; creating structured mentor programs pairing successful founders with emerging companies; and implementing incentive programs for domestic capital participation in tech investments. By addressing these priorities with coordination, the long-awaited exits may finally become a reality.

To watch the session, click here.

Explore our dashboard: Track African tech exits and acquisition trends in real-time