In the aftermath of the 2023 funding winter, there have been debates about whether the venture capital (VC) funding model remains viable in Africa. One side of the argument is that African startups do not necessarily justify their lofty valuations in light of scant exits, scanter IPOs, and a less sophisticated capital market than North America, Europe, and Asia. One analysis notes that the expected value of exits between 2015 and 2023 should hover around the $20 billion mark. The reality is more humbling, with only around $2 billion-$3 billion in realised gains.

Data from Briter Bridges reveals an exit-to-deal ratio of 20 to 1, doubling that of India and almost five times that of Latin America. The nature of the exits also shows a disparity: The countries that tend to lead in terms of funding volume, like Nigeria and Kenya, lag countries like Zambia, Tanzania, and South Africa in terms of exits.

The argument’s flip side is that the African tech ecosystem is still nascent. For this group of enthusiasts, investing in African tech is akin to playing the long game. Rather than abandon the model, repurposing it away from the Silicon Valley style —which often emphasises supernormal returns— towards a localised context that takes into account the institutional and regulatory nuances of operating in Africa while harnessing value that translates into steady long-term profits is the way to go.

More investors are moving towards debt-funded deals and away from equity to hedge risk. In return, founders are doing more due diligence, pivoting where necessary, and becoming more prudent and transparent with lean resources as they seek to extend their runway. Combined with improved capital efficiency and a longer time horizon, they hope the big exits will eventually happen.

Here are three charts that explain the state of African tech exits.

Mergers and acquisitions still retain their value proposition

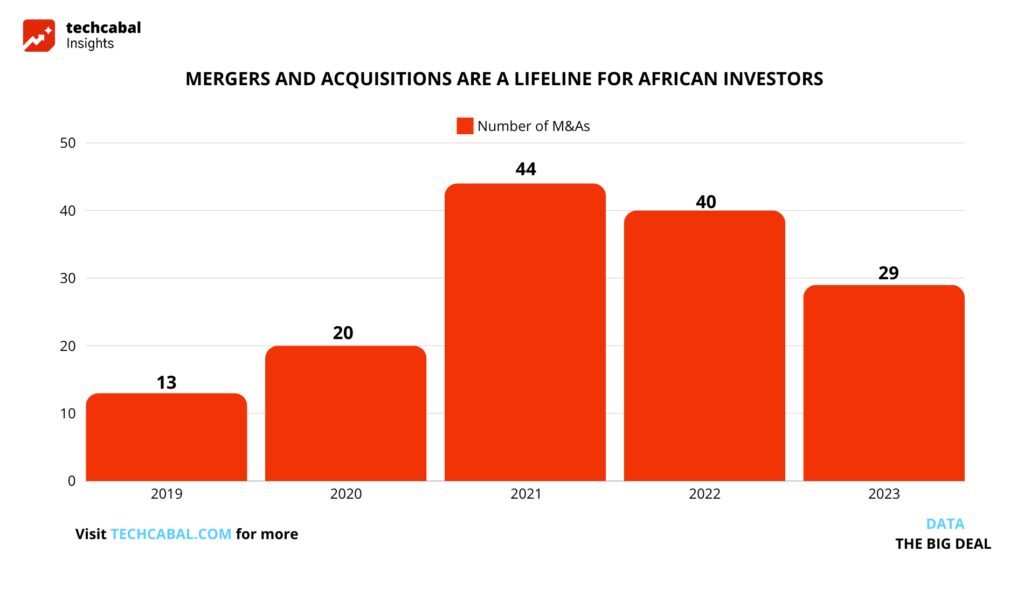

In the last five years, exits in African tech have followed a bell curve, peaking in 2021 with a record 44 disclosed merger and acquisition (M&A) deals. Although there has been a drop-off, recent trends suggest that M&As may be picking up steam again as investors look to lifelines in a stringent macroeconomic and funding climate.

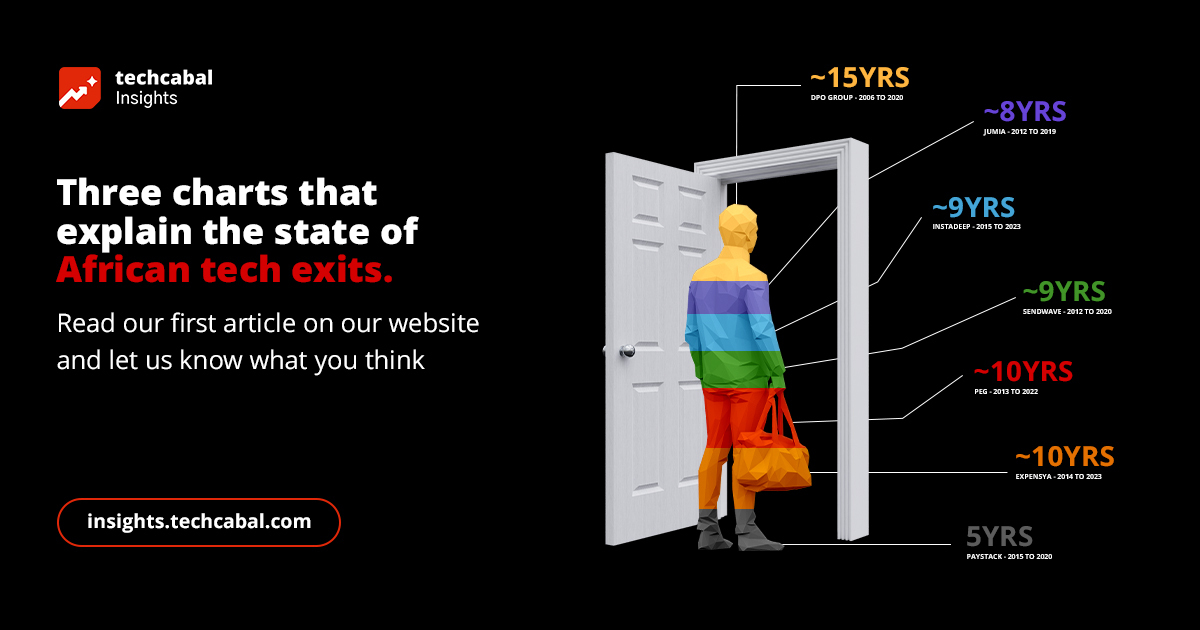

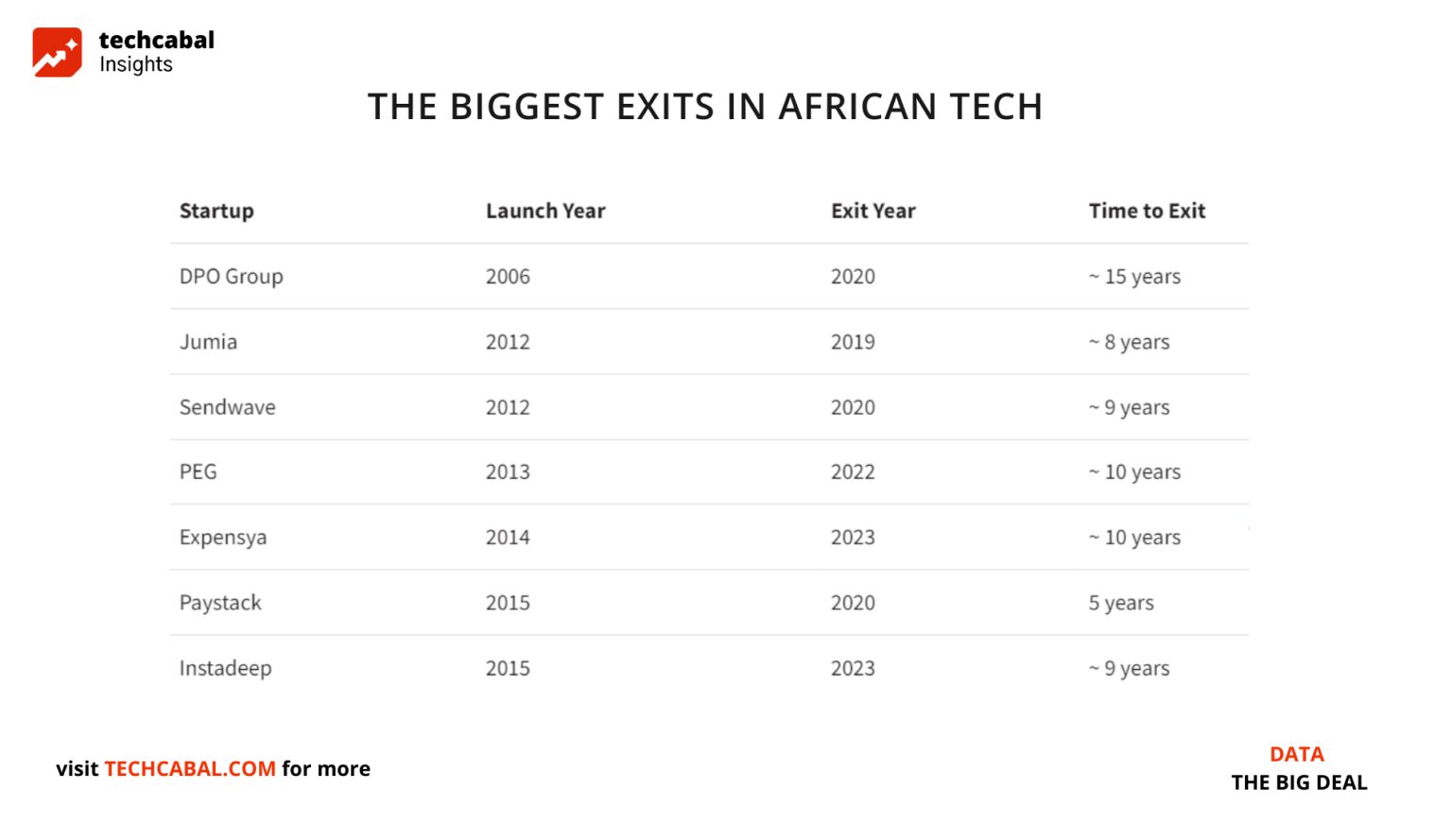

The most successful African exits take around 10 years on average

An understated but vital point about exits is that the larger they are, the more time they take to manifest. Paystack’s $200 million acquisition by Stripe in 2020 was an outlier and remains the only $200m exit that happened within six years. On average, the most successful exits take 10 years between launch and acquisition.

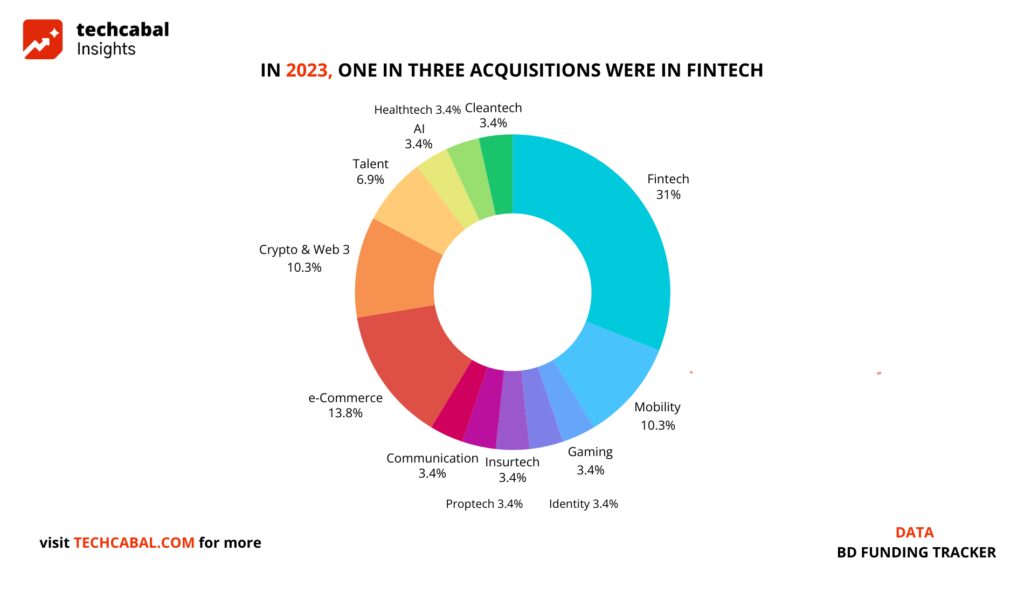

Fintech leads for now, but other sectors are catching up

In 2023, fintech took a sizable chunk of acquisitions in terms of the number of deals, accounting for 31% of the 29 acquisitions. Artificial intelligence (AI) proved to be the runaway winner in terms of value with the sale of Tunisia’s Biontech to Instadeep for $680 million. However, African fintech looks set for the challenge. Scroll, the Seychelles-based company building a platform for Ethereum raised $50 million in 2023 and has been tipped by Ionanalytics, along with Nigeria’s Sabi, which raised $38 million in a Series B round, and Kenya’s Cellulant as being likely for a VC exit.

Recently, there has been a move towards renewable energy and climatech. In 2023, climate tech startups racked up $1 billion in investment, accounting for around one-third of African tech funding. One might explain it as a strategic shift from the heavily saturated fintech sector to sectors with a more expansive frontier for innovation. In the coming years, these startups may become ripe for acquisition by global players, making climatech well-placed to cash in should the moment arise.