On Friday, April 12, 2024, TechCabal Insights launched its State of Tech in Africa (SOTIA) report for Q1 2024 via a virtual event featuring Dayvee Ngugi, founder of Paytree, and Uwem Uwemakpan, Head of Investments at Launch Africa VC Fund II.

The SOTIA report, themed “Charting a Path to Profitability,” sheds light on the challenges and opportunities African tech startups face in achieving financial sustainability. Here are four key takeaways from the session:

Macroeconomic headwinds have made profitability an imperative

The discussion highlighted the pressure African tech startups face to maintain profitability amidst economic challenges. Uwem pointed out that VCs now prioritize profitability, a shift from the pre-pandemic era when rapid growth was the primary focus. “We’re beginning to slow down on blitzscaling as VCs are now looking to build sustainably,” he said. This shift reflects a more cautious investment climate and the need for startups to demonstrate a sustainable business model. While the pre-pandemic era saw an abundance of “free cash” fueling rapid expansion, the current economic climate demands a more disciplined approach to growth.

There’s a shift in how VCs are rethinking investment strategizing

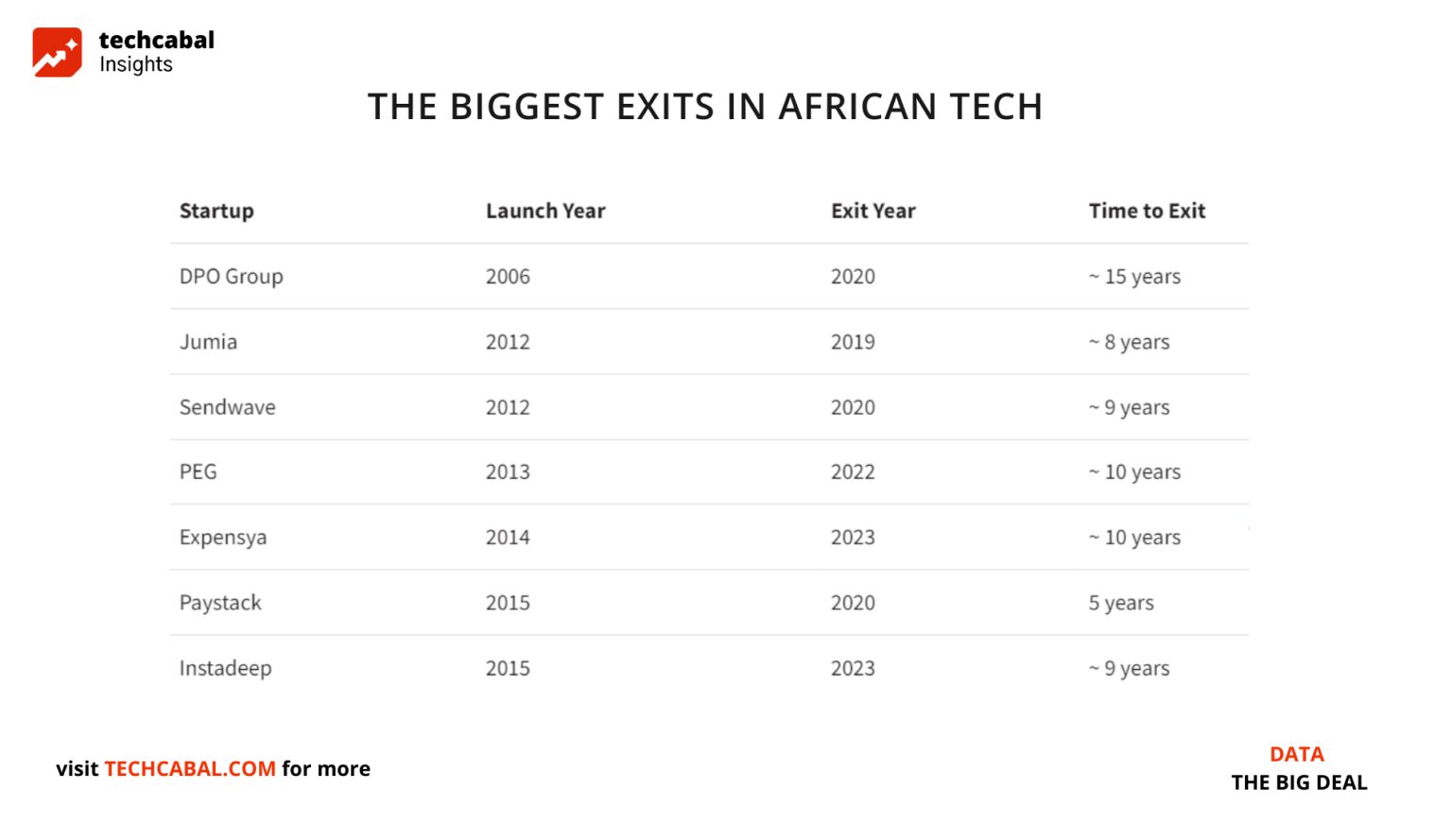

The session explored how the zero interest rate phenomenon contributed to the bubble that drove the African startup scene until its inevitable burst. The panelists discussed the changing startup investment landscape and concerns from VCs regarding the need for more successful exits. Investors are now more selective, demanding growth and a clear path to profitability. This has led to a decrease in “demo money” – funding provided primarily to validate an idea rather than for immediate financial returns. Startups must adapt their strategies to this new investment reality by prioritizing growth and profitability metrics.

Decisions are now being driven by data rather than sentiment

The importance of data-driven growth strategies for African startups was a recurring theme throughout the live event. Market research and validation before launching a business remains crucial. Swvl and Tymebank’s recent success was raised, highlighting how high-margin revenue streams and high-value customers were key to achieving profitability. Additionally, Uwem noted that companies might need to scale down on offering free services, which can create unrealistic customer expectations and hinder long-term financial sustainability. Regularly reviewing and adjusting growth strategies to ensure targets remain essential for success.

Pivoting must come with a clear focus

The event acknowledged the need for African startups to adapt to a dynamic market. Pivoting a business strategy can be necessary, but, as Uwem and Dayvee emphasized, doing so must come with a clear vision and staying true to the core mission rather than pivoting for the sake of it. Genuine motivation and clear communication with stakeholders, including investors and customers, are necessary for navigating challenges and avoiding failure. Dayvee also highlighted the importance of authenticity and honesty in the entrepreneurial journey. The State of Tech in Africa Q1 2024 report offers a comprehensive analysis of major trends in Africa’s tech ecosystem with a laser focus on profitability. Download the full report here to learn more. You can also watch the entire event via this link.